When you have an emergency and need to settle quickly with money, the first thing you may think of is going to the ATM, since it is the safest and most convenient way by which you can withdraw cash and transfer the money into your account, depending on the requirement.

Currently, there are approximately 400,000 ATMs, and almost 20,000 belong to the Bank of America domain and are spread all over the country. Whenever you need one, there will surely be one very close to you.

However, we know that there are situations that warrant a higher-than-usual withdrawal or cash deposit, and ATMs usually have a limit – even Bank of America atm deposit limit.

If you’ve been doing research on what returns are like at Bank of America, which bank is better between Chase or Bank of America, or how to transfer money from Bank of America to Chase, you’d better know about the Bank of America deposit limit.

What is the limit of cash I can deposit at the Bank of America ATM?

Many people wonder how much can I deposit at Bank of America atm. Although it is not the most used company or bank in the country, since that position belongs to JPMorgan Chase, they have more than 50,000 customers subscribed. This portfolio of users includes individuals, personal firms, and small and large businesses.

The main characteristics attributed to it are its transparency and efficiency. Since its foundation in 1998, it has earned the trust and loyalty of the American people, not only because of the warmth and friendliness of its employees along of the efficiency of its customer service systems.

They also offer multiple benefits to their customers, starting with a higher interest rate on savings accounts but much lower for maintenance, retention, and cash withdrawal, i.e., their commissions are not so significant.

This brings us precisely to the question that concerns us about what is the maximum amount that we can deposit or withdraw at an ATM. In the case of BoA, there is no Bank of America atm check deposit limit ceiling for money that enters or leaves your account.

However, there are certain conditions or restrictions regarding the movements you can make in a day, week, or month. That is how they manage their security policies that include the amounts of money you can send or receive.

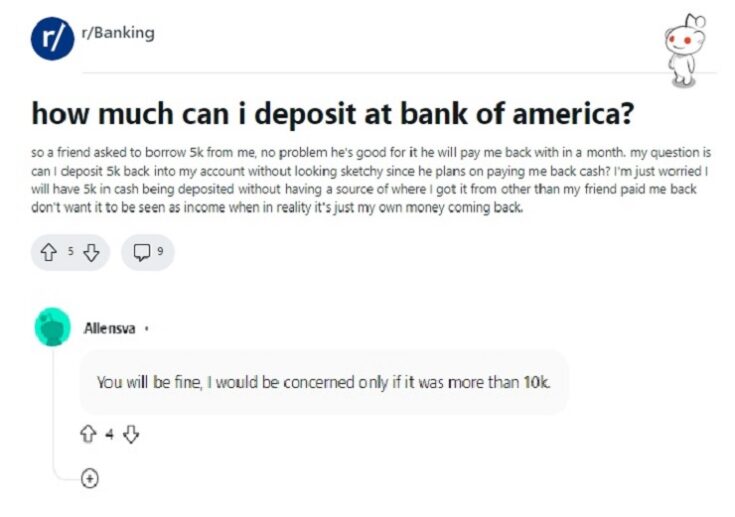

And in that aspect, we could say that the daily quantity you can send or receive in your account without any inconvenience is $1000 or $2000. But, if we want to discuss an extreme case or what would be the maximum to deposit, we could say that you can mobilize up to $10,000.

How much cash can you deposit at once?

First, we must state that there are 3 ways in which you can make deposits or withdrawals at Bank of America. These include:

- Branch deposits by check or cash

- Online transfers

- ATM deposit

Although they themselves state that there is no problem with the amounts that are mobilized in a personal or business account, they do apply certain rules. That is, if you do not choose the right method to deposit your money, it could be returned, blocked, or even suspended. Of course, the suspension of your account may be an extreme case, however, we still recommend that large deposits be issued by one of the official depositories since there are more risks of this nature when using mobile or online banking or ATM. Much less do we recommend trying to “cheat” the rules of the system by trying to transfer or split these large amounts into several movements or transactions since they will still be monitored and considered by the trackers programmed by the bank. Therefore, we suggest that if you are going to receive or transfer an amount close to or greater than $10,000, please notify the Bank of America head office closest to your home. In case you will receive or send more than $1000, you may only be asked for a verification code by SMS. Although checks are considered an outdated or archaic method of payment, they are still used and accepted by many banking units or companies., since it is a way to pay large amounts of money and withdraw them without the need to have the holder present. The Bank of America still implements check deposits or remittances because it is still a secure way to manage payroll or personal transfers especially when the amounts are extremely high, as in the case of $10,000. First, we must be clear that, as mentioned above, if you want to deposit a check with that monetary value, it is best to do it in person. That way the bank can ensure that it is not a strange or fraudulent movement. If you were to deposit $10,000 through Bank of America’s online banking or application, this money would most likely be frozen, reported, or placed under review. This is in case your account was personal, and you did not have the opportunity to prove its origin. This does not happen frequently in corporate or business accounts, however, the same procedure is suggested for a personal account, by a personal deposit in the official offices or branches of Bank of America. On the other hand, if you have any inconvenience with sending or receiving a check for $10,000 or more, you can also justify its origin by sending an e-mail. Bank of America has also provided a space suitable for the receipt of checks through online banking. Again, though, if you’re expecting a large deposit, pick it up at branches. Bank of America’s cash deposit-taking policy has significantly changed in recent years, marking a milestone as of September 2024. In that month, Bank of America decided to stop taking cash deposits into its bank accounts, which means that there’s no more atm deposit limit Bank of America. This change implies that you can no longer deposit cash directly into your Bank of America account, as there is no Bank of America cash deposit limit. However, it is essential to note that several alternatives are still available to manage your financial resources efficiently. Among the options available are the ability to make transfers between accounts, deposit checks, monitor your account balances, make payments related to your Bank of America credit card, and a wide range of other services. If you have specific questions or require additional assistance related to cash deposit limit Bank of America, such as obtaining routing numbers, SWIFT codes, or direct deposit information, you are strongly encouraged to contact the Bank of America team directly. Bank of America’s knowledgeable staff can assist you and address any concerns. Bank of America’s deposit policies and services have evolved to provide customers with a dynamic and convenient banking experience. Here’s a breakdown of some key aspects: Bank of America offers the convenience of depositing checks through their mobile app. It’s important to note that there is a monthly Bank of America check deposit limit, and certain statements may not be eligible for mobile deposits. For example, checks from foreign banks or U.S. savings bonds are not accepted. When you deposit a check, a portion or the entire amount may not immediately be available in your account. This temporary hold is implemented to ensure the check’s validity and the collection of funds from the check issuer. The duration of deposit holds can vary, typically from 2 to 7 business days, depending on the reason for the delay. Bank of America has significantly revised its overdraft services to reduce clients’ reliance on overdraft protection . They now offer resources to help clients responsibly manage their deposit accounts and overall finances. Because of these changes, Bank of America has eliminated non-sufficient funds fees and reduced overdraft fees. Bank of America has encountered regulatory actions by the Consumer Financial Protection Bureau (CFPB) in recent years. These actions have included mandates to reimburse customers for instances of double-charging fees and withholding rewards. Furthermore, there have been orders to cease the unauthorized opening of accounts and remove any entries that may appear on credit reports for individuals who had accounts opened without their consent. References María Laura Landino is a journalist who graduated from Boston University with more than four years of experience in the financial sector. He has been responsible for several research papers published by major universities. Content Manager of allaboutgroup company. You will find me in job and Finance sections.What happens if you deposit a check over 10000?

Do these sanctions also apply to corporate accounts?

Bank of America cash deposit policy 2024

Conclusion