Chargeback is a process that allows consumers to dispute charges made on their credit or debit card by going through certain processes established by the bank. Following the fact that when a consumer files a dispute, the card issuer investigates the transaction and grants a chargeback.

In the case of a returned item chargeback, this is a dispute filed by a consumer after returning an item and not receiving a refund. This type of dispute can be complicated and may require additional documentation to support the consumer’s claim. So below, we will further explore the return item chargeback process at Bank of America and provide helpful tips for consumers facing this type of dispute.

Our interest in clearing up questions about disputes is not only based on the Bank of America. In fact, we have answered questions such as “How to dispute an AmEx chargeback?”, “How to dispute a chargeback on a Chase credit card?” and even “How to withdraw money from a permanently limited PayPal account?”.

How do I file a return item chargeback dispute at Bank of America?

To file a return item chargeback dispute at Bank of America, you must follow a process previously established by the bank.

Contact the merchant

The first thing you should do is try to resolve the problem directly with the merchant. If you have not received a refund for an item you have returned, contact the merchant to inquire about the status of the refund and provide any additional information that may be necessary.

Review your statements

Verify that the charge for the returned item still appears on your statement. If it does not appear, the refund may have already been processed, and you do not need to file a dispute.

File the dispute

If the merchant has not processed the refund and the charge still appears on your statement, you should file a return item chargeback dispute with Bank of America. You can do this online through your mobile account or by calling the customer service number on the back of your card.

Provide documentation

Bank of America may require additional documentation to support your claim. Make sure you have copies of any communications you’ve had with the merchant, such as emails or return receipts. You may also need to provide a copy of the original purchase receipt and return receipt.

Wait for resolution

Bank of America will investigate your dispute and decide on whether to issue a chargeback to the merchant. If your dispute is determined to be legitimate, you will receive a refund for the charge in question. If the dispute is resolved in favor of the merchant, the charge will remain on your statement, and no refund will be issued.

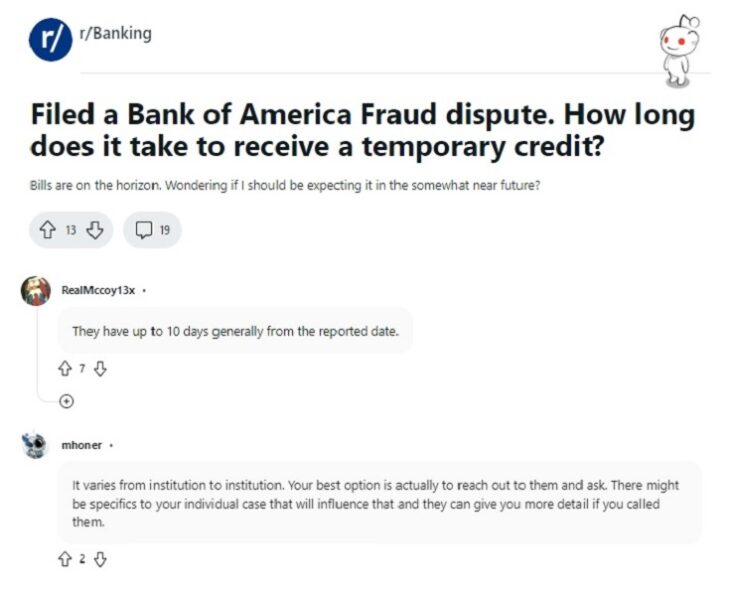

How long does it take Bank of America to resolve a dispute?

The time it takes Bank of America to resolve a dispute may vary depending on the complexity of the case and the availability of information and documentation. In general, the investigation process can take 30 to 90 business days. During this time, Bank of America will review the information provided and contact the merchant to obtain more details about the transaction in question.

While this, as mentioned, will depend on the specific case, your dispute may be resolved much more quickly. It is also important to note that throughout the investigation process, the disputed charge will continue to appear on your statement. However, if the dispute is legitimately determined, you will receive a refund for the charge.

This refund will include any chargeback fees that were applied to the case, so you will not have to worry about additional charges. Following this, you will be able to contact Bank of America’s customer service department at any time, and they will provide you with updates regarding the case.

What documents are required for a return item chargeback dispute?

The documents required for a return item chargeback dispute at Bank of America may vary depending on the nature of the claim and the information provided at the time of purchase and return of the item. However, some documents you may need to include:

- Proof of original purchase: You will need to provide a copy of the original receipt or invoice showing what you purchased and the amount that was charged to your credit or debit card

- Proof of item return: If you returned the item to the merchant, you will need to provide proof of the return, such as a receipt or shipping confirmation

- Communication with the merchant: If you have had contact with the merchant to resolve the problem, you should provide any written communication, such as emails or text messages, that supports your claim

- A detailed description of the problem: You should explain in detail the reason for your return item chargeback dispute, including any information that may be relevant to support your claim

It is significant to provide all relevant information and documentation in a clear and concise manner so that Bank of America can effectively investigate your dispute and make an informed decision. Similarly, Bank of America seeks to encourage communication with its customer service team in case there are any questions.

What other documents do I need?

In general, when filing a return item chargeback dispute with Bank of America, it’s important to provide all information and documentation to support your claim. This may include any communications you have had with the merchant, such as emails or return receipts, as well as any other documents that demonstrate that you have attempted to resolve the issue directly with the merchant.

Patience and cooperation will be key during this dispute process since, as long as you provide all relevant information and documentation, the Bank of America team will be able to help you. Thus, it is always recommended to be attentive to the case and try to solve any doubts you may have during this process.

References

-

“How to Dispute a Charge and Check the Status of Your Claim.” Bank of America, https://www.bankofamerica.com/help/how-to-dispute-a-charge/.

María Laura Landino is a journalist who graduated from Boston University with more than four years of experience in the financial sector. He has been responsible for several research papers published by major universities.

Content Manager of allaboutgroup company. You will find me in job and Finance sections.