Zelle has arrived to make people’s life easier when it comes to payments. Today it is one of the most used payment methods, just like PayPal. Every day more and more payment methods are created, and this has caused people to want to transfer money from one application to another, but does PayPal accept Zelle? can Zelle send to PayPal?

So it would be the case of knowing if does Zelle work with PayPal (or if does PayPal work with Zelle) and how to transfer money from Zelle to PayPal. Since perhaps not everyone will have both accounts, but most people will have at least one, we may need to learn how to work between these two widely popular platforms. So, let’s see if can Zelle send money to PayPal and if can you use Zelle with PayPal .

Can I send money from PayPal to Zelle?

If you were wondering if does PayPal have Zelle or if does PayPal use Zelle and if, indeed, can you send money from PayPal to Zelle, here we have the answer. Actually, you cannot transfer directly from PayPal Zelle. To transfer money from PayPal to Zelle, you need to link your bank account to PayPal and transfer the funds to your bank account. Once the funds are in your bank account, you can accept money from Zelle.

Can I directly transfer money from Zelle to PayPal?

The same goes for those who wonder “can I use Zelle with PayPal?” or “Can I send money from Zelle to PayPal?” which means that the answer to “can you Zelle to PayPal” is no. There is no direct way so can you transfer money from Zelle to PayPal, which means that there’s no way that can PayPal send money to Zelle.

Unfortunately, no. The PayPal and Zelle platforms are incompatible, so sending money directly from Zelle to PayPal is impossible, or vice versa, as we said before. Now that you know if can you send money from Zelle to PayPal, remember that these platforms are not connected, but this does not mean there are no other ways to send money.

How would I transfer to a PayPal account if Zelle and PayPal are incompatible?

Zelle has no wallet, so you cannot transfer directly to PayPal. However, remember that Zelle is a way to make instant payments from your card, so it is possible to make instant payments with the bank linked to your Zelle.

There are other ways to carry out the transaction from Zelle to PayPal, for which certain steps must be followed.

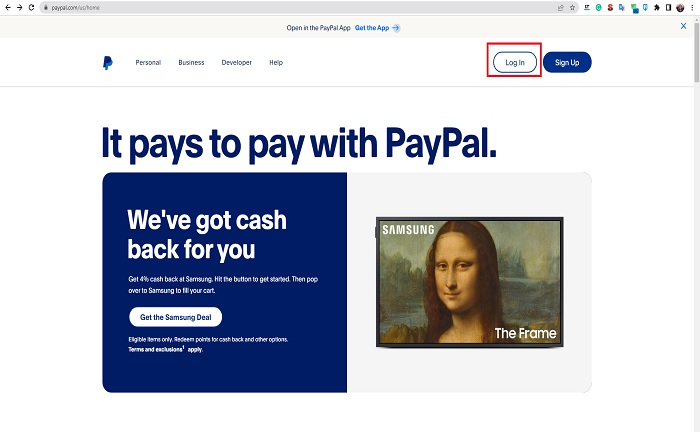

If you do not have a bank account linked to PayPal, you must first add the bank account through which you want to make the Paypal to Zelle transfer. To complete this, log in to the official PayPal website or mobile application.

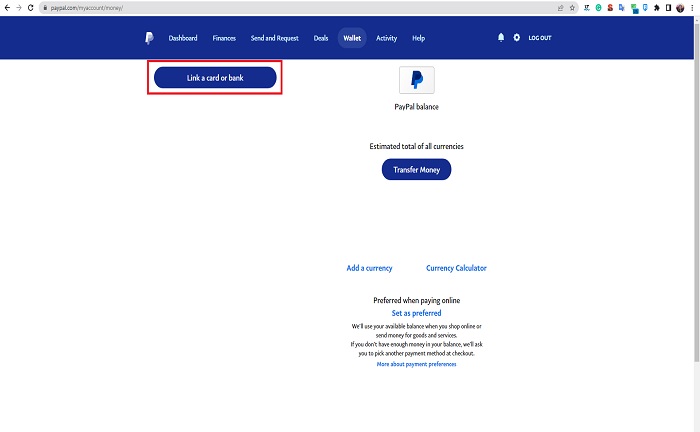

Once inside, go to the “Wallet” section. If browsing from the website, click on “link a bank.” If you are in the app, tap the menu and select “banks and cards.”

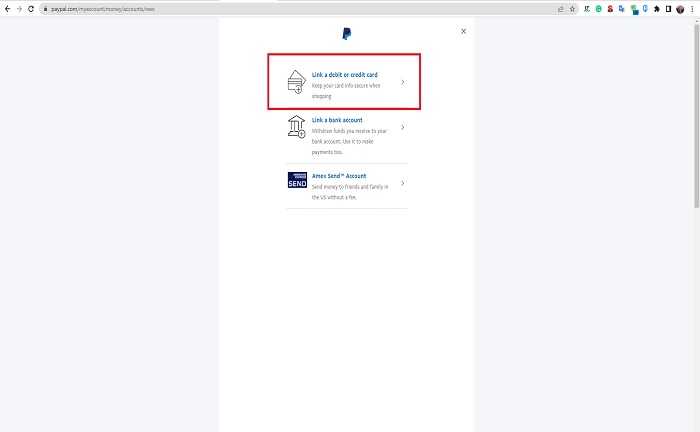

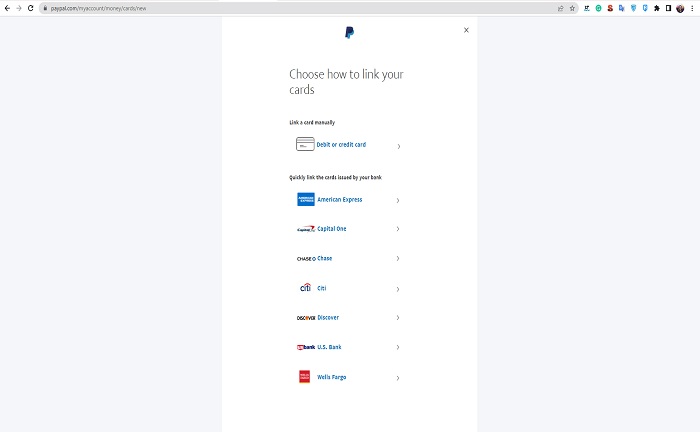

Then, select the option “Link a debit or Credit card.”

That’s it! You have now linked your card and PayPal account. Click on the “send and request” section to send money. Then choose the type of payment, whether it is a commercial or personal payment.

Here you will need to enter the email address or the number of the recipients of the money. Enter the amount to transfer and select dollars as the currency. Finally, click “confirm.”

Amounts transferred to PayPal can take 3 to 5 business days to be effective and come with 5% fees or higher.

I don’t have a PayPal account; how can I create one?

The process of creating a PayPal account is also simple. Just go to PayPal.com and click on “sign up.” Choose the type of account you wish to open, whether a personal or business account.

You will then be asked to enter an email address and generate a password. You will need to add your personal information, such as name, address, and phone number. You have now created your account and can link the card of your choice, either credit or debit.

Which platform should I choose: Zelle or PayPal?

Each platform has its benefits, so it is recommended to have both. On the one hand, Zelle allows immediate transfers without commissions and is accepted in most online banking applications and portals.

PayPal is also a good option because it provides security for online purchases. In addition, it allows its users to send refund requests 180 days after their purchases. So, I would say that your best option will depend on what you are looking for.

Opting for Zelle is best if you want to send money quickly and frequently to family or friends. But if you love online shopping, you should stick with PayPal. Besides, it is easy to create a PayPal account. All you need is your data, the internet, and a smart computer.

Also, you can opt for another alternative to Zelle through PayPal. It is said that Cash App is an excellent virtual wallet and is a great option to send money from Zelle to Cash App.

Online banks that use Zelle

Zelle is part of the options of many banks, and you can affiliate it with almost every bank in the country to make your transactions quickly and securely. Below is a list of some of the major traditional banks and credit unions that accept the Zelle service to their customers.

- Bank of America

- Wells Fargo

- JPMorgan Chase (Chase Bank)

- Citibank

- S. Bank

- PNC Bank

- Capital One

- TD Bank

- Suntrust Bank (now part of Truist)

- BB&T (now part of Truist)

- Navy Federal Credit Union

- USAA (United Services Automobile Association)

References

- Baluch, Anna. “Which Banks Use Zelle? (Full List of Banks & Credit Unions).” Crediful, https://www.facebook.com/crediful/, 24 Nov. 2022, https://www.crediful.com/which-banks-use-zelle/.

- “Can PayPal Send Money to Zelle? Can They Work Together | Newz Todays.” Newz Todays, https://www.facebook.com/Newztodayspk, 5 Mar. 2024, https://newztodays.com/can-paypal-send-money-to-zelle/.

María Laura Landino is a journalist who graduated from Boston University with more than four years of experience in the financial sector. He has been responsible for several research papers published by major universities.

Content Manager of allaboutgroup company. You will find me in job and Finance sections.