Today’s financial market offers a broad spectrum of banking institutions, including Capital One, This bank has become better-known due to its credit cards with many benefits for its users. The Capital One Venture Rewards Credit Card and Capital One Quicksilver Cash Rewards Credit Card are the most popular of their payment tools.

On the other hand, people are now familiar and comfortable with Zelle, a platform becoming increasingly popular for its instant payments. Some might wonder if Capital One accepts Zelle.

Does Capital One accept Zelle?

Capital One has decided to follow the steps of most banks, so it has decided to link up with the Zelle platform. This way, making faster payments from your Capital One account when using Zelle is possible.

How can I send money from Capital One 360 Zelle?

Users can send money through Zelle through the mobile application and the official Capital One website. To achieve this, they must first have registered accounts within Zelle through the Capital One Mobile app.

To download the application, just text 80101 with the word “MOBILE.” Within seconds you will be sent a link to download the application.

How can I transfer money through the mobile application or the website?

You can use the mobile application if you have already linked your account to Zelle. Once inside, go to the account from which you will send funds and tap on the “Send money with zelle” option.

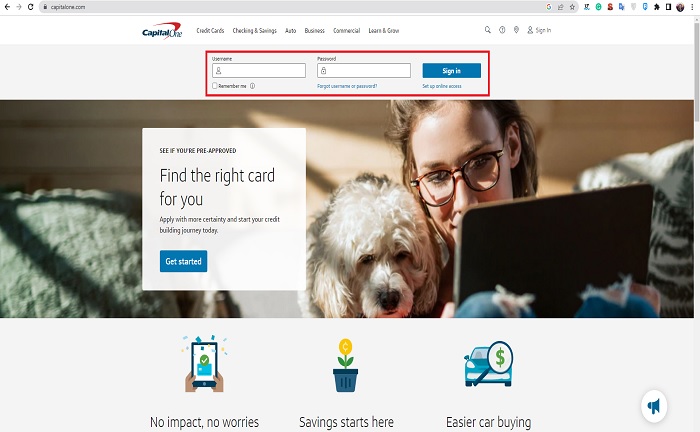

Through the website, the process is similar. Go to the website and log in.

Click on the checking account you will use, then select “send money with zelle.”

On the other hand, it is important to note that you will need to verify your identity through a unique access code to transfer. Without this code, you cannot send funds with Zelle.

What else should I know about Capital One 360 Zelle?

While using Zelle will make your payments easier, it is important to remember that the daily transfer limit is $2,500, and there is also a monthly limit. The latter may vary depending on the type of account the user has.

Transfers take only a few minutes to become effective if the recipient is already registered in Zelle. On the other hand, if the person is not registered, don’t worry about your money.

Just wait for the person to register; within minutes, it should be reflected in their account, which should not exceed one day.

Another important point to discuss is the service fees. Capital One does not charge commissions for using Zelle through its platform, so you will only get benefits by linking it to your account.

How can I ensure the money will be sent safely through Zelle?

It is paramount to make transfers to users you know and trust. Once a transaction has been made to a registered user, it cannot be canceled, and you cannot receive the money back.

Do not use Zelle for digital payments or to send money to strangers, as scams and frauds have become easy. Capital One and Zelle do not offer an authorized payment protection program, so they cannot help you in case of scams or fraud.

Check your email or phone number at least twice to avoid mistakes. That way, the money will go directly to the intended recipient. Also, confirm the name of the person you want to send the money.

References

-

“How to Set Up and Use Zelle | Capital One Help Center.” Capital One, https://www.capitalone.com/help-center/checking-savings/transfer-funds-with-zelle/.

-

“Zelle: Send Money to Family & Friends for Free | Capital One.” Capital One, https://www.capitalone.com/bank/zelle/.

María Laura Landino is a journalist who graduated from Boston University with more than four years of experience in the financial sector. He has been responsible for several research papers published by major universities.

Content Manager of allaboutgroup company. You will find me in job and Finance sections.