TCF Bank is one of the best-known and most respected banks in the United States, having a significant representation of 430 branches distributed in several states of the American nation.

This bank started its operations in 1923, and by 1985 it was already listed and had significant participation in the stock market, looking for a more effective expansion and customers who would seek to associate their savings with these banks.

Now, some may wonder about Bank of America’s limit, how to withdraw $1000 from an ATM or how to deposit Money orders at the ATM. But, in this case, we will focus on TCF transactions.

TCF ATM Withdrawal Limits

This is controlled daily and with private debit cards. This modality changes with a withdrawal limit of $2020 and a total of 30 transactions per day. Each bank has a different withdrawal rate and some may establish advantages over others.

On certain occasions, ATMs are low on cash, in which case, the amount that is available is what you will be able to withdraw even if you have a better card.

Why do banks have a limit on their bank ATMs?

It is fundamental not to live in excess and to take care of our integrity if the income that presides over us is good. This is a task banks do not take lightly, and that is why there is a TCF ATM withdrawal limit.

This is executed to a greater extent for the safety of the customer, and in these cases, we must consider several factors that play in our favour:

- In case of theft or loss, the card can be blocked from use at ATMs and the limiting of these will allow no access to larger amounts

- If the card is insured, they do not allow more than 50 dollars to be taken in case it happens

- Large withdrawals at ATMs can attract thieves and become an easier method of committing a crime

Banks often do not keep an unlimited amount of money, so they reduce withdrawal amounts and manage your capital as best they can.

Withdrawal limit for TCF ATMs and things to consider

Many banks have considerations depending on what type of customer you are, this is the same for TCF Bank and the ATM withdrawal limit will vary depending on what card you have and your credit history.

How to increase ATM withdrawal limits?

If the customer is not satisfied with the limit established by their bank, the first thing to do is to approach or call the financial institution and request an increase in the line and withdrawals. In this process, the bank in charge will consider the following considerations:

- How long you have been a customer

- What types of accounts you have and how you manage them in the bank

- Your credit history and how much money you have in your account

This will define whether this withdrawal is granted on a permanent basis or for a fixed term and whether the person deserves a better debit or credit card depending on the need.

A major purchase or a summer vacation may be reason enough for your bank to be willing to increase your ATM withdrawal limit, for a set number of days and depending on the vacation period you take.

Argumentation plays a key role here, because limits are put in place as a protective measure for the user and carrying a lot of cash can sometimes be detrimental, depending on the country you are in.

Methods to get more cash

Did you reach your daily limit of withdrawals at TCF or other ATMs? If so, there are several ways to get more cash through banks.

One of these solutions is cashing back at the merchant, many have this measure and depending on the options your card has in terms of purchases and the merchant’s disposition. This way you will be able to redeem that cash back or extra balance in cash.

Another way is to go to the branch of the accredited bank. Here they can provide you with a much better service than at ATMs and depending on the urgency or need to use the capital, you can opt for a higher amount than that offered at ATMs.

Checks, despite not being widely used, also work as a means of obtaining cash in a legal and efficient manner. It is necessary to read the cashing rates for these checks or the amount to be cashed in cash for a single day.

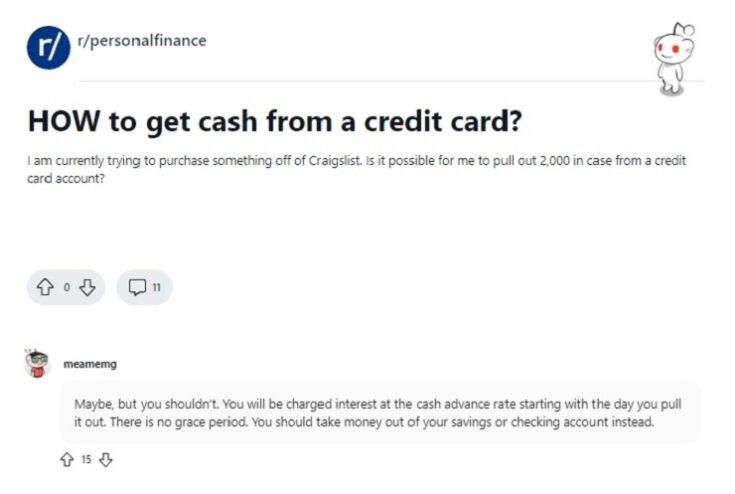

Can I use my credit card for cash withdrawals?

It is possible to use your credit card at ATMs or as a cash withdrawal measure through the application on your phone. This measure is usually used in exceptional cases, as the fee is often high.

Cash advances have an interest rate that begins to accrue immediately, there is no defined period for these commissions. This results in an unfeasible reason for cash withdrawals.

For this reason, it is advisable to first approach your bank to request a temporary increase in the ATM withdrawal limit or to withdraw cash at a branch so as not to generate interest in between.

How can I contact or locate the TCF banks?

To contact TCF staff and TCF banks, you can call 866-218-0520 Monday through Friday between 6 a.m. and 5 p.m. Furthermore, on weekends between 9 a.m. and 5 p.m.

Their email address is tcfbank.support@upstart.com, and they can also be reached at any of their U.S. locations. Located mostly in Illinois and Minnesota, one of which operates as a partnership with the University of Minnesota.

Also in Illinois, we have them in their metropolitan areas and inside Jewel-Osco stores, for the ease of customers.

References

-

“What Is the Cash Withdrawal Daily Limit at ATMs? | Neighborhood CU.” Online Checking, Savings, & Loans | Neighborhood Credit Union, Texas, https://www.myncu.com/explore/learn/cash-withdrawal-daily-limit-atm#:~:text=The%20daily%20limit%20to%20withdrawal,need%20for%20any%20special%20request.

-

“Tcfbank Support.” Tcfbank Support, https://tcfbank.helpjuice.com/.

-

Lake, Rebecca. “ATM Withdrawal Limits: What You Need To Know – Forbes Advisor.” Forbes Advisor, https://www.forbes.com/advisor/banking/atm-withdrawal-limits/.

María Laura Landino is a journalist who graduated from Boston University with more than four years of experience in the financial sector. He has been responsible for several research papers published by major universities.

Content Manager of allaboutgroup company. You will find me in job and Finance sections.