The amount of federal withholding tax is influenced by various factors, such as the employee’s income, filing status, and number of allowances claimed on their W-4 form. Understanding how tax withholding works is essential as it can help individuals have greater control over their finances.

By knowing the percentage of taxes withheld from their paycheck, individuals can plan their expenses more accurately and allocate resources to their needs. This approach can help avoid any surprises when filing tax returns at the end of the tax year. So, it is crucial to make informed decisions about your finances and ensure that you are prepared for tax season.

What is the purpose of withholding?

The concept of withholding is a crucial aspect of tax management for employees. Its primary purpose is to ensure that employees pay their federal income taxes throughout the year rather than having to pay a lump sum at the end of the year.

This process helps ensure the government receives a steady revenue stream and taxpayers are not burdened with a large tax bill. Additionally, withholding helps ensure taxpayers do not underpay their taxes, which can lead to penalties or interest charges.

By withholding a portion of an employee’s income, the government can collect taxes in a more timely and efficient manner while also helping individuals to manage their tax obligations in a more manageable way.

Factors affecting changes in the federal withholding tax rate

The percentage subtracted from workers’ paychecks for federal taxes is not updated on a specific, regular basis. The tax system can change tax legislation enacted by Congress and signed by the President.

That is, changes in federal withholding tax rates generally occur when tax reform legislation is passed or adjustments are made to tax rates. Changes in government policies, economic conditions, budgetary needs, or changes in the tax structure, among others, may drive these modifications.

It is worth clarifying that changes in withholding tax rates will not occur automatically for all workers in case of any such adjustment. On the contrary, it may take some time after new tax legislation is passed for employers and payroll systems to implement the corresponding adjustments.

What is the Tax Withholding Estimator?

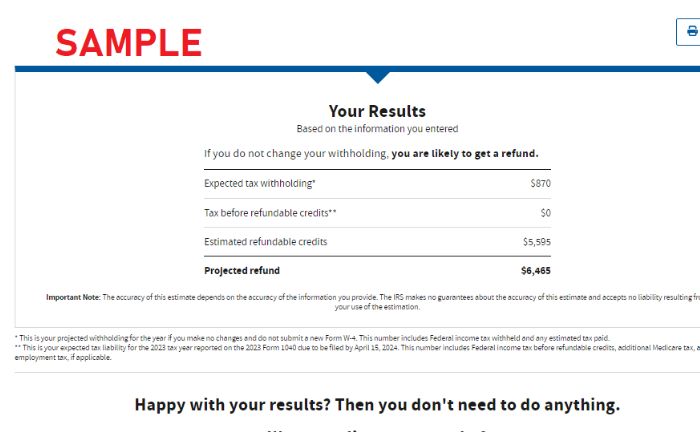

IRS Tax Withholding Estimator can be helpful for individuals who want to ensure that they are withholding the correct amount of federal income tax from their paycheck and avoid any surprises when filing their tax return at the end of the year.

The estimator provides recommendations to adjust the individual’s Form W-4, which determines the amount of federal income tax to withhold from their paycheck.

By submitting the recommended Form W-4 that includes all of the individual’s income, they would not need to submit a separate Form W-4P for pension or a different rate Form W-4V for Social Security income.

The recommendations provided by the estimator are designed to correct the individual’s withholding for the rest of the year based on whether they have had too much or too little federal income tax withheld to date.

NOTE: The adjustments may not be appropriate for a full year, so the estimator should be used again at the beginning of the next year.

How to calculate federal withholding tax: Step by step

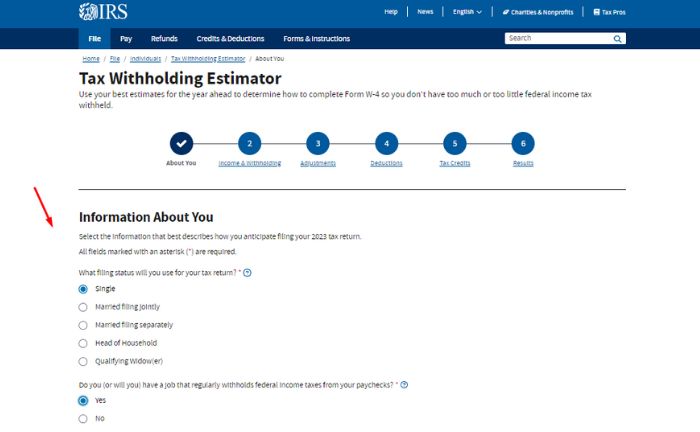

To calculate the federal taxes that are withheld annually, workers must log on to the IRS website and use the tool they provide to find out the percentage of their paycheck that will go to the IRS

- Go to the official IRS Tax Withholding Estimator website.

- Then click on the “Use the Tax Withholding Estimate” button.

- Then, you must check the corresponding boxes concerning your marital status (Single, Married filing jointly, Married filing separately, Head of Household, or Qualifying Widow(er)).

- Continue answering the questions about Income & Withholding, Adjustments, Deductions, and Tax Credits.

- You will get your tax results after completing the questionnaire in detail.

Make adjustments to the W-4 form.

People need to adjust the form to accurately reflect any personal, family, or employment status changes that may affect the amount of tax to be withheld.

Employees can ensure they are not overpaying or underpaying their taxes throughout the year by making these adjustments. Some specific situations that may require you to update your W-4 form are:

Changes in marital status

If you get married, divorced, or widowed, you must update your marital status on the W-4 form. You can file a joint or separate tax return if you get married. You must adjust your marital status if you get divorced or widowed. These changes can affect your tax withholding percentage.

Changes in the number of dependents

If you have a new child, adopt or take care of a dependent, or if your children are no longer eligible as dependents, you must adjust the number of dependents on the W-4 form. The number of dependents can influence your tax withholding rate.

Additional income or secondary jobs

If you have started an additional job or have income from sources other than your main job, you may want to adjust your W-4 form, which allows you to request additional withholding to cover taxes on those different income sources, thus avoiding a possible tax debt when filing your tax return.

Deductions and tax credits

If you have experienced changes in your itemized deductions or are eligible for new tax credits, such as the Child Tax Credit or the Earned Income Tax Credit (EITC), you may want to modify your W-4 form to reflect those changes. These deductions and credits can reduce your tax burden and affect your withholding.

Tax Brackets 2024 Percentage

The IRS has released new tax brackets for 2024, which will be used to calculate taxes due in April 2024 or October 2024 if an extension is filed. These brackets are adjusted annually to account for inflation. There are seven tax brackets for most ordinary income in 2024, ranging from 10% to 37%.

[wpdatatable id=392]How Do Tax Brackets Work?

To calculate federal income tax withholding for an individual with a gross annual income of $50,000, it is necessary to determine their taxable income and apply the appropriate tax rates. For the tax year 2024, the federal tax rates for individuals are as follows:

- 10% on the first $9,950 of taxable income

- 12% on taxable income between $9,951 and $40,525.

- 22% on taxable income between $40,526 and $86,375.

- 24% on taxable income between $86,376 and $164,925.

- 32% on taxable income between $164,926 and $209,425.

- 35% on taxable income between $209,426 and $523,600.

- 37% on taxable income over $523,600.

To determine taxable income, subtract the standard deduction applicable to the individual’s situation. Assuming a standard deduction of $12,550 for a single filer in 2024, the taxable income for someone with a gross income of $50,000 would be $37,450.

Next, apply the tax rates for different taxable income brackets. The first taxable income bracket is $9,950 and is taxed at 10%, resulting in a tax of $995. The next taxable income bracket is $27,500 ($37,450 – $9,950) and is taxed at 12%, resulting in a tax of $3,300.

The total federal income tax withholding for this individual would be the sum of the amounts calculated in each tax bracket, which is $4,295. Therefore, for a gross income of $50,000, the federal income tax withholding would be $4,295.

References

- Beattie, Andrew” “When Should You Adjust Your W-4 Withholding”?” Investopedia, Investopedia, 20 Apr. 2011, https://www.investopedia.com/articles/tax/11/signs-you-should-change-withholding.asp”

- “Tax Withholding Estimator | Internal Revenue Service”, Internal Revenue Service | An Official Website of the United States Government, https://www.irs.gov/individuals/tax-withholding-estimator.

She has a degree in Social Communication (graduated in 2010). Arianna has experience in research and writing about universities, credit cards, procedures and insurance, among other topics related to finance in general.

With more than ten years of experience, she has worked in different local and digital media, writing on various issues related to the economy and international politics. She has also coordinated teams of editors, gaining experience in managing groups.

She was born in Merida, Venezuela. She lived in Wausau, Wisconsin, for 5 years, allowing her to learn English. Being bilingual, she also does research and writing in Spanish.

She has taken TOEFL exams and English proficiency tests (passed), so she is qualified to write texts in English.