Taking out insurance, regardless of the insurance company, will be of great benefit to protect individuals, companies, and organizations against possible financial losses. Taking out insurance will act as a safety net, offering peace of mind and financial security. There are different types of insurance and insurers.

You can apply to protect your home, car, health, or business, as the insurer guarantees security and mitigates risks. The Federal Deposit Insurance Corporation (FDIC) and the National Credit Union Administration (NCUA) are two government organizations that play a significant role in the national insurance landscape. Before we begin, it is worth clarifying what is FDIC and NCUA.

Differences between FDIC and NCUA

The Federal Deposit Insurance Corporation (FDIC) and the National Credit Union Administration (NCUA) play pivotal roles in ensuring the stability of financial institutions and protecting your hard-earned money. Through their insurance programs and regulatory oversight, they provide a safety net for your savings.

Let’s see the characteristics and differences between these two entities to help you understand their roles and decide if you’re considering applying for insurance.

What is FDIC and how does it work?

The FDIC (Federal Deposit Insurance Corporation), created in 1933, is an agency of the United States government designed to maintain stability and public confidence in the country’s financial system. The FDIC insures bank deposits and thrifts up to $250,000 per depositor, per FDIC-insured bank, and per ownership class.

This insurance protects customer deposits even in the event of the failure of a bank or savings association. In addition to insuring deposits, the FDIC supervises the safety and soundness of more than 4,000 banks and thrifts to ensure that they operate safely and comply with consumer protection laws.

What is NCUA and how does it work?

The National Credit Union Administration (NCUA) is a vital government agency that regulates and insures credit unions in the United States. Established in 1970, it oversees federal credit unions, provides deposit insurance, and safeguards the interests of credit union members. Headquartered in Alexandria, Virginia, the NCUA is led by a three-member board appointed by the President.

Its primary responsibility is to ensure credit unions‘ safety and stability while protecting their members’ deposits. This includes conducting regular examinations, enforcing regulations, and promoting financial education. The NCUA has contributed to a stable and secure credit union system that benefits millions of Americans through its efforts.

Benefits of having a FDIC/NCUA insurance

The benefit of ensuring that your account is FDIC/NCUA insured is that it protects your deposits in case of a bank or credit union failure. The FDIC (Federal Deposit Insurance Corporation) and NCUA (National Credit Union Administration) offer insurance coverage to safeguard deposit accounts.

For banks, the FDIC insures deposits up to $250,000 per depositor, per ownership category, per insured bank. This means your deposits up to that amount are protected even if the bank fails. The same happens with the credit unions insured by the NCUA, which provide coverage up to $250,000 per member.

NOTE: The insurance coverage is per depositor and institution. So, if you have accounts in multiple banks or credit unions, each version is separately insured up to the respective limit.

How does FDIC and NCUA insurance protect my money in case of bank failure?

When a bank fails, the FDIC and the NCUA react similarly. First, the entity pays depositors up to the insurance limit as the insurer of the bank’s deposits. This is usually done on the next business day, within a few days of the bank’s closure.

The FDIC and NCUA provide each account holder with a new bank account at another insured financial institution in the same amount as the insured balance in their performance at the failed bank or issue a check to each account holder for the covered balance in their history.

Second, as an FDIC/NCUA receiver, the regulator sells or collects the failed bank’s assets and pays its obligations, including claims on deposits over the insured limit. Depositors with uninsured funds may recover some of their uninsured money from the sale of the failed bank’s assets. Depositors with uninsured funds usually receive regular payments on a pro-rata basis as the assets are sold. This process can take several years, so you must be patient.

As a result, depositors will not lose their insured funds up to the specified limit if a bank or credit union fails. The insurance coverage applies to different types of accounts, such as checking accounts, savings accounts, money market deposit accounts, and certificates of deposit.

IMPORTANT: Insurance coverage is per depositor and institution. If a depositor has accounts at several banks or credit unions, each account is insured separately up to the limit.

How do I find out if a bank is FDIC/NCUA-insured?

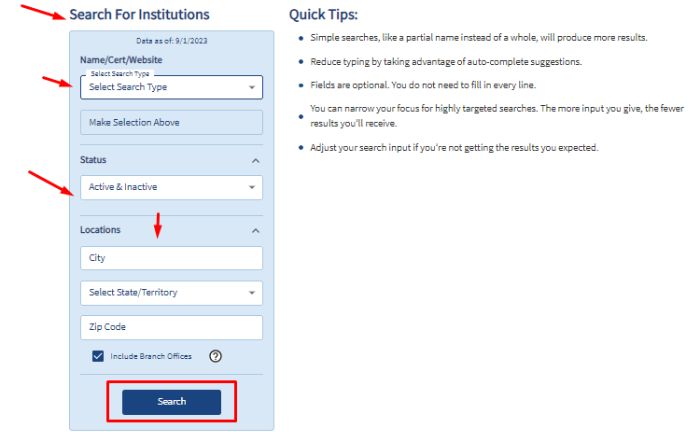

To determine if a bank is FDIC/NCUA-insured, there are several methods you can use. For FDIC-insured banks, you can call the FDIC toll-free at (877) 275-3342, utilize the FDIC’s “BankFind” tool on their website, or look for the FDIC sign displayed where deposits are received.

The BankFind Suite is a tool that allows users to find FDIC-insured banks and branches by name and location, with data available from the present day back to 1934. The search tool offers auto-complete suggestions and optional fields to help users narrow their search.

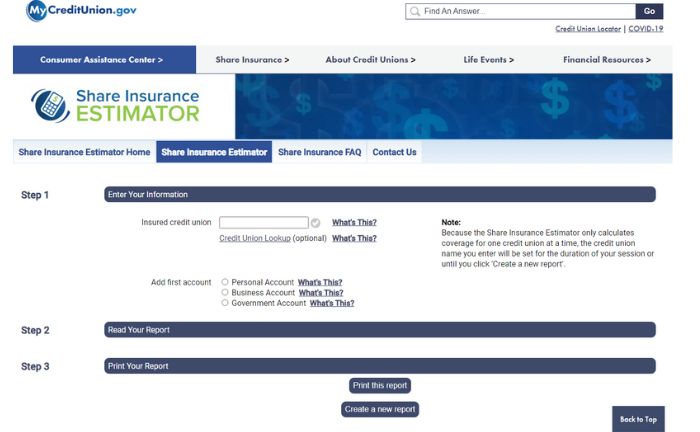

For NCUA-insured credit unions, ask a representative or look for the official NCUA insurance logo in their offices, by phone at (800) 755-1030, or on their website. Additionally, the NCUA provides a Share Insurance Estimator tool on its website that allows you to calculate the amount of insured funds at a federally insured credit union.

The Share Insurance Estimator calculates coverage so users can enter all share accounts for each credit union one at a time. You can access helpful information and resources, including a glossary and security information.

Are there any fees associated with FDIC/NCUA insurance?

No, there are no direct fees for NCUA/FDIC insurance. These agencies are funded by premiums paid by the banks and credit unions they insure, so depositors do not need to pay any additional costs to benefit from the deposit insurance coverage.

Pros and cons of FDIC and NCUA

The FDIC and NCUA provide deposit insurance for banks and credit unions, respectively. Understanding the pros and cons of FDIC/NCUA insurance can help individuals decide where to deposit their funds.

Advantages of FDIC and NCUA Insurance

- Deposit Protection: The primary advantage is that FDIC and NCUA insurance protect depositors’ funds in case of bank or credit union failure. This provides peace of mind and ensures that depositors will not lose their insured funds up to the specified limit.

- Stability and Confidence: Deposit insurance helps maintain stability in the financial system by instilling confidence in banks and credit unions. It assures individuals and businesses that their deposits are safe, even during economic uncertainty.

- Accessibility: FDIC and NCUA insurance coverage is widely accessible, as most banks and credit unions in the United States participate in these insurance programs. This allows individuals to find insured institutions to deposit their funds quickly.

Disadvantages of FDIC and NCUA Insurance

- Coverage Limit: One limitation is that FDIC and NCUA insurance have the same limits. The coverage limit is $250,000 per depositor, per ownership category, and insured bank or credit union. Deposits exceeding this limit may not be fully insured.

- Non-Deposit Products: FDIC and NCUA insurance typically cover only eligible deposits, such as savings accounts and certificates of deposit. Other financial products, such as investments in stocks or mutual funds, are not covered by deposit insurance.

- Limited Choice: While FDIC and NCUA insurance provide protection, it may limit individuals’ choices regarding where to deposit their funds. Some institutions may not be insured, and individuals may need to consider insurance coverage when selecting a bank or credit union.

Resources

- “FDIC: Deposit Insurance.” FDIC: Federal Deposit Insurance Corporation, https://www.fdic.gov/resources/deposit-insurance/.

- “Regulation and Supervision | NCUA.” NCUA, https://ncua.gov/regulation-supervision.

She has a degree in Social Communication (graduated in 2010). Arianna has experience in research and writing about universities, credit cards, procedures and insurance, among other topics related to finance in general.

With more than ten years of experience, she has worked in different local and digital media, writing on various issues related to the economy and international politics. She has also coordinated teams of editors, gaining experience in managing groups.

She was born in Merida, Venezuela. She lived in Wausau, Wisconsin, for 5 years, allowing her to learn English. Being bilingual, she also does research and writing in Spanish.

She has taken TOEFL exams and English proficiency tests (passed), so she is qualified to write texts in English.