Among the most prominent wholesale chains is Sam’s Club, a wholesale distribution supermarket that has become increasingly popular in the United States and countries such as Mexico, Canada, Brazil, and China.

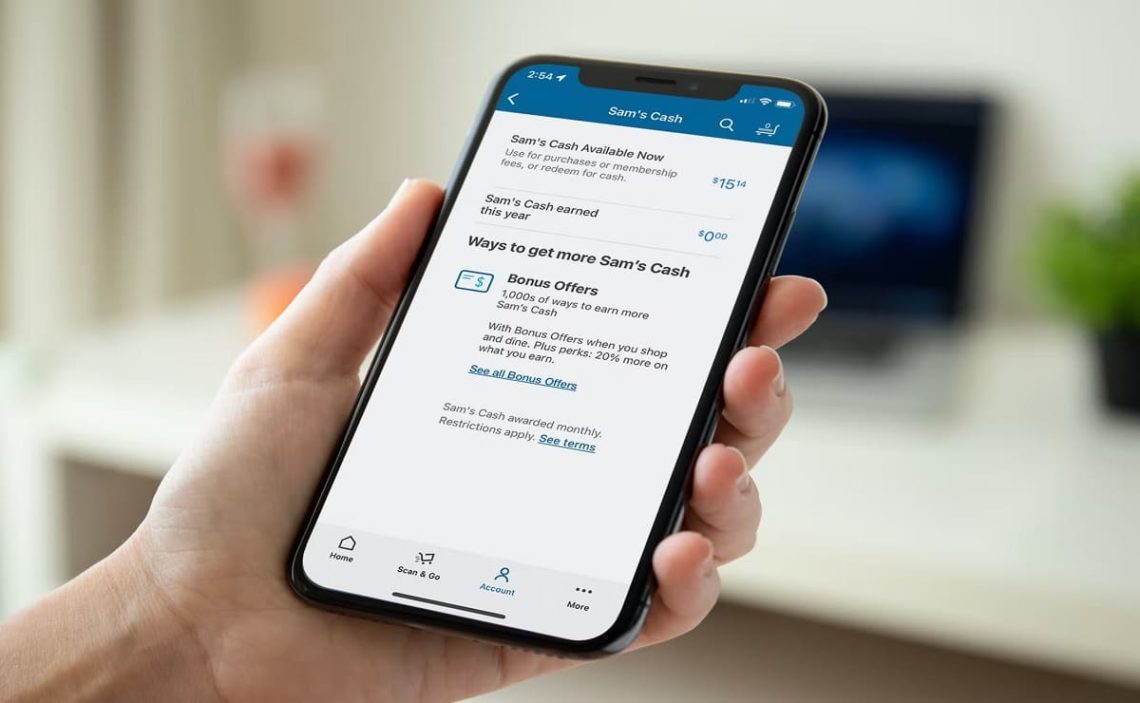

Sam’s Club has a program called Sam’s Cash, which, although very beneficial, can be confusing to use and understand.

What is Sam’s Cash, and how does it work?

Sam’s Cash is a cash rewards program launched this 2022 to replace the previous Sam’s club rewards system. Although it works similarly to the previous programs, it has certain differences.

The Sam’s Cash program replaces Cash Rewards and Cash, with the former being specific to Sam’s Club Plus members and the latter to Sam’s Club MasterCard holders.

In a way, the Sam’s Cash program works for the members above and cardholders in a single program and offers them new benefits.

Enrolling in the program is unnecessary to start enjoying its benefits. Any Sam’s Club membership is automatically enrolled in Sam’s Cash.

Sam’s Club Plus members and Sam’s club MasterCard holders get many more benefits than users of any other member and holders of any other card.

Those who join and receive the benefits of Sam’s Cash cannot opt out of the service and will always be able to see the available cashback balance in their account.

However, the balance will remain in their account until they wish to redeem it at a store or with any purchase that qualifies for cash back rewards. They should not cash it in if they do not wish to use the balance.

Why did you upgrade to Sam’s Cash?

Sam’s Club has long stood out as one of the few stores where they pay special attention to the requests, complaints, and recommendations of their customers, members, and users.

Customers often complained about having to keep separate accounts for cash back rewards programs for both MasterCard and Sam’s Club Plus members.

So, after listening to the needs of their users, they saw a great need to put Sam’s Club Plus members and Sam’s Club MasterCard holders into one program. Where they can carry and track their accounts in just one program.

Although the rewards and the conditions applied to the rewards are still slightly different depending on whether you are Sam’s Club Plus member or a MasterCard cardholder, the processing is now done with just one account.

Another major change made with the creation of Sam’s Cash is the monthly receipt of cash accumulation.

Previously, we could only change the cash rewards balance once a year. Now, we can do it every month. Although many stores make daily changes, it represents a great advance for Sam’s Club and its members.

What are the terms and conditions of Sam’s Cash?

As mentioned earlier, there are still differences between the rewards earned by Sam’s Club members and those earned by Sam’s Club MasterCard holders.

Sam’s Club Plus Membership

Sam’s Club Plus members earn 2% cash back on qualifying purchases. You must have made these purchases at one of the store’s clubs or Curbside Pickup.

This 2% does not apply when purchases are made online or are ordered with home delivery. You have to go to one of the clubs to earn it. The maximum rewards are $500 per year on qualifying purchases; the membership holder must be active.

Sam’s Club MasterCard Ownership

Sam’s Club MasterCard holders can receive a 5% cash back percentage of the total value of fuel refills.

This 5% on eligible purchases applies up to a maximum spend of $6,000; when this maximum of $6,000 is exceeded, you stop earning 5% cash back and start earning 1%.

Those who make purchases with their Sam’s Club MasterCard and are a Plus member at Sam’s Club affiliated stores earn 3% cash back.

When you make purchases with this card at restaurants, you get 3% cashback. To find out whether the restaurant applies to this reward, you should review the list of exclusions by logging into your Sam’s club account.

Finally, cardholders who are not Sam’s Club Plus members receive 1% cash back on qualifying purchases.

The maximum earning margin for Sam’s Club MasterCard holders is significantly higher than that of Plus members. The card offers rewards to a maximum of $5,000 per year on qualifying purchases.