When it comes to financial matters, many people are interested in knowing about the Wawa Cash Back, about the USAA identification code, or if you can use Venmo from Canada in the U.S.A. All this is useful, but there is something that goes much further.

There are times when we need a representative to manage our payments and manage selected finances. For that, there are representative bank accounts, which are managed by a representative for a social security administration (SSA) user.

At this point, the representative uses the account for the user’s expenses, which at some point makes it difficult for them to utilize this data or financial applications. Typically, these are checking accounts.

Who requires a representative payee for their funds?

The people who benefit from the representative payee’s service on your account are usually elderly people, people with few expenses, and those who can no longer take care of themselves. In this section, there are rules to consider, one of which is that the representative cannot take money from the beneficiary for their pleasure and use.

Social Security is responsible for the management and selection of representatives, and they take care of the expenses for food, clothing, and basic services of the elderly.

Likewise, the beneficiary can also have a say in the decision if they disagree with the SSA’s choice or believe that they do not need the care of this type.

Which banks can handle these types of representative accounts?

The major banks in the United States play a role in favor of representative accounts and play a big role in managing them, hand in hand with the SSA, the most important entities that we can see here are:

- Wells Fargo

- Bank of America

- Chase Bank

- River City Bank

These accounts to be opened are in all the cases of the current type because it is possible to verify the expenses made and the management of the representative, economically speaking.

Although the charges in these accounts are usually high, check how to lower the rates to have a better organization, it is always advisable that the accounts used are for the beneficiary.

As a representative, can I receive any payment for this?

As we emphasized before, the representatives do not receive any money for this, nor are they paid for this social work. If they are paid, it is because a qualified organization was contracted for this, and this is where the fee comes in.

Here, the competent organizations can be a governmental or social service agency, in charge of the medical treatment, transportation, and income maintenance of the beneficiary.

In these cases, it is always recommended to keep count and track invoices of the expenses generated because if you spend this on cabs or tolls for medical consultations, everything will be reimbursed to the amount selected and with a receipt.

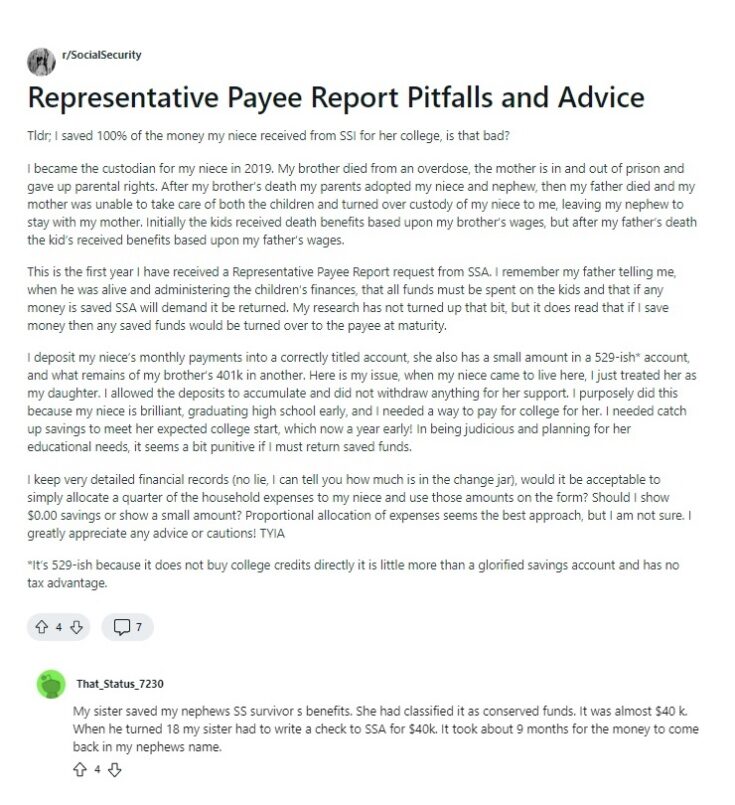

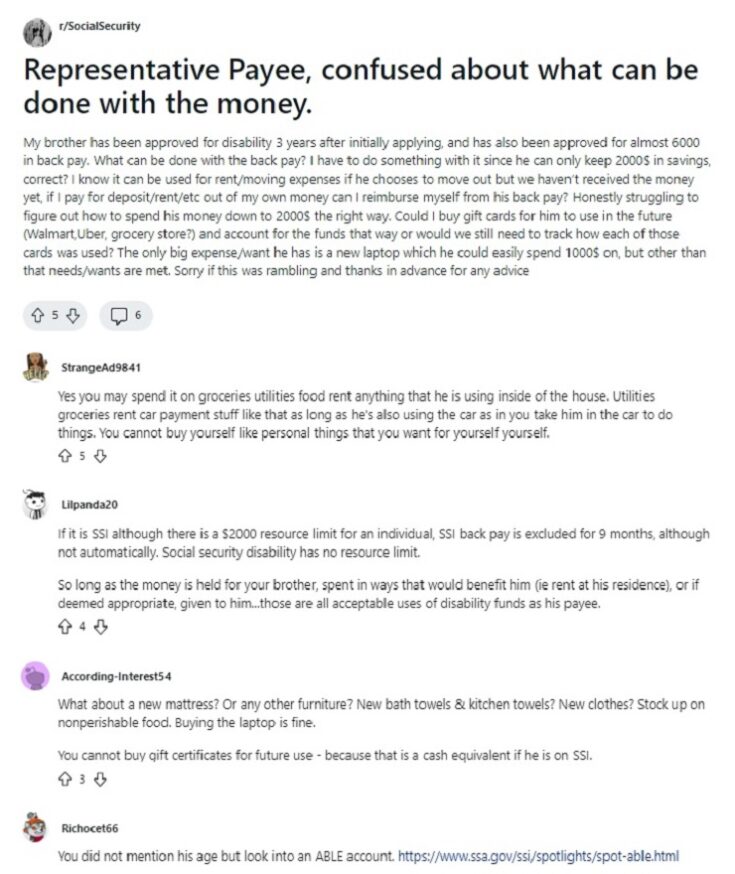

What activities are prohibited for a representative payee?

The beneficiary cannot perform certain activities, such as signing legal documents or signing documents related to a financial institution.

[wpdatatable id=355]If they have income outside of Social Security, it cannot be managed by that person, and the Social Security money is specified for their basic needs.

The beneficiaries cannot financially support each other and these funds must always be used for eventualities, a bank is not responsible for the fulfillment of these expenses, but the social security.

To be able to proceed with these activities without problems and despite your age, you can eliminate the option of having a representative.

Money management

A beneficiary may receive large sums of money corresponding to state resources and bonds. First of all, the needs of the benefited user must be covered with these sums, whatever the amount is.

After satisfying those services, they could spend the remaining amount on things that would improve their daily living conditions or provide better medical care. Here we are already referring to a more home comfort issue as well.

Likewise, you can use the leftover money to pay off your debts. However, if you are a creditor, they must approve your use of the money to pay any debts they owe you. Keep the remaining funds if necessary, this is approved under social security.

ABLE account as a resource for the beneficiary

These bank accounts represent a tax benefit for the beneficiary, although it is not granted to just anyone, to qualify for an ABLE account, the user must be blind or disabled by a condition that began before the age of 26.

Here it is necessary to have a representative in their care, and for these tasks, they choose the best ones, because these accounts are easy to use and to swindle the user owner.

This account along with social security helps pay for the beneficiary’s medical expenses, in these cases their condition is critical to cover, these expenses are known as “qualified disability expenses” or QDE for short.

A QDE is any expense incurred by the beneficiary related to their blindness or disability, including expenses to benefit themselves or to improve their health, independence, or quality of life.

These expenses are disbursed tax-free and these beneficiaries have a different and specialized care, even with credits granted and deductions in contributions.

The ABLE Act and its accounts are under the jurisdiction of the Internal Revenue Service (IRS). Section 529A of the Internal Revenue Code (26 USC 529A) authorizes the establishment of ABLE programs and accounts.

States establish and maintain individual ABLE programs for all who require them, and representatives who can provide for their primary needs for a better quality of life.

References

-

“Representative Payee Bank Account.” Investopedia, https://www.investopedia.com/representative-payee-bank-account5217784.

-

“Social Security.” NHLP Law Uiowa, https://nhlp.law.uiowa.edu/sites/nhlp.law.uiowa.edu/files/SocialSecurity.pdf.

-

“Social Security Administration – Representative Payee Program.” The United States Social Security Administration | SSA, https://www.ssa.gov/payee/faqrep.htm?tl=11%2C12%2C15%2C18%2C19%2C25%2C34.

María Laura Landino is a journalist who graduated from Boston University with more than four years of experience in the financial sector. He has been responsible for several research papers published by major universities.

Content Manager of allaboutgroup company. You will find me in job and Finance sections.