Managing personal finances can be a challenging task, especially when it comes to timely payments and investments. The right timing can make all the difference in ensuring that bills are paid on time and unexpected expenses are covered. One of the primary challenges many individuals face is waiting for their paychecks to arrive, which can significantly impact their ability to manage their finances effectively.

To address this issue, the “Early Pay Day” concept has emerged as a way to offer individuals greater financial flexibility. With Early Pay Day, individuals can access their paychecks earlier than usual, allowing them to cover bills, make investments, and manage their finances more effectively. This concept benefits those who live paycheck to paycheck or have limited financial resources, as it offers a lifeline to improved financial stability and greater control over their finances.

What is Wells Fargo’s Early Pay Day?

“Early Pay Day” is an innovative financial feature that is reshaping how individuals approach and manage their income. It presents the unique advantage of granting pre-scheduled access to eligible direct deposits . It enables users to receive funds in their accounts up to two days before the designated pay date.

Understanding the intricacies of this feature is crucial. By enabling individuals to retrieve their funds in advance, Early Pay Day offers an empowering tool to address unforeseen financial challenges. This early access mitigates the need for seeking short-term loans or other forms of debt.

Such foresight and flexibility enhance the economic well-being of those using Wells Fargo’s Early Pay Day, embodying a broader transformation in financial services. This evolution underscores the importance of adaptability, customer-centric design, and responsiveness to each economic aspect.

Wells Fargo’s Early Pay Day Requirements

Specific eligibility criteria must be met to qualify for Wells Fargo’s Early Pay Day, which may vary based on your checking account and other factors. One of the primary requirements is to have an eligible Wells Fargo checking account. However, not all checking accounts may be eligible for Early Pay Day. You may need a specific type of account or meet certain criteria set by Wells Fargo to qualify.

Another requirement is to set up direct deposit for your paycheck or other electronic deposits. However, it’s essential to understand that early availability of direct deposits is not guaranteed and may vary from deposit to deposit.

While Wells Fargo offers this service, the timing of receiving your funds early may depend on various factors, such as the Wells Fargo direct deposit time and other account activities.

Pros and cons of Wells Fargo’s Early Pay Day

Wells Fargo’s Early payday access offers several benefits to individuals and employees, helping them manage their finances more effectively and navigate unexpected financial challenges.

Advantages of Wells Fargo’s Early Pay Day

- Financial Flexibility: Early wage access allows individuals to access their earned wages before the traditional payday. This can be particularly helpful when facing unexpected expenses or emergencies, as it ensures that funds are available when needed most.

- Avoiding late fees: By receiving your earnings a few days early, you can ensure you have enough money to cover bills, rent, or other financial obligations on time.

- Emergencies: Early payday access can be valuable during emergencies, such as medical expenses or urgent home repairs.

- Improved budgeting: With early payday access, you can plan your budget more effectively. Knowing when your funds will be available allows you to allocate more precisely for different expenses and savings goals.

- Reduced reliance on high-cost alternatives: Early payday access can be a lower-cost alternative for individuals who might otherwise turn to payday loans or high-interest credit cards to cover short-term expenses.

- Financial stability: Knowing you can access your earned wages when needed can provide peace of mind and reduce financial stress.

- Employee satisfaction: Employers that offer early payday access as a workplace benefit may see increased employee satisfaction and retention, and you would be able to have better financial planning.

- Adaptability: Early payday access can accommodate varying financial needs and schedules.

- Convenience: Accessing your earnings a few days early can be convenient, especially if your regular payday falls on a weekend or holiday.

https://www.youtube.com/watch?app=desktop&v=HIgP_lt7jTU

Disadvantages of Wells Fargo’s Early Pay Day

Not all direct deposits are eligible for Wells Fargo Early Pay Day, so you may be unable to access your funds early in some cases.

- Eligibility limitations: Not all direct deposits are eligible for Early Pay Day, so you may not always be able to access your funds early.

- Deposit holds: In some cases, a deposit hold may be placed on the funds, which could delay the availability of your funds for up to 7 business days. This could be problematic if you need the funds right away.

- Technical issues: Some users on Reddit have reported problems with Early Pay Day, such as the early deposit disappearing from their account and causing confusion. While this may not be a common issue, it’s something to remember.

- Unpredictable timing: The timing of deposited funds can be unpredictable and depends on various factors, such as the time and amount of the deposit. Deposited funds become available on the first business day after Wells Fargo receives them.

TIP: Other banks may offer similar features to Early Pay Day, so it may be worth comparing options to find the best fit for your needs.

What time does Wells Fargo direct deposit hit?

If you were wondering, “When do Wells Fargo direct deposits hit?” this depends on several factors. As we mentioned earlier, when funds are deposited, it is sometimes unpredictable because Wells Fargo Direct Deposit may vary depending on the transaction and cut-off time of the specific bank branch or ATM.

If you deposit funds using the Wells Fargo Mobile app, the cut-off time is 9 p.m. (PST). Typically, Wells Fargo makes the deposited funds available on the first business day after receiving the deposit. If we talk about Early Pay Day, you may be able to access your eligible direct deposits up to two days early.

If you deposit on a business day before the displayed cut-off time at the Wells Fargo Mobile app, the ATM, bank branch, or the deposit amount will usually be credited to your account on the same business day .

FAQs

What electronic direct deposits are available for Wells Fargo’s Early Pay Day?

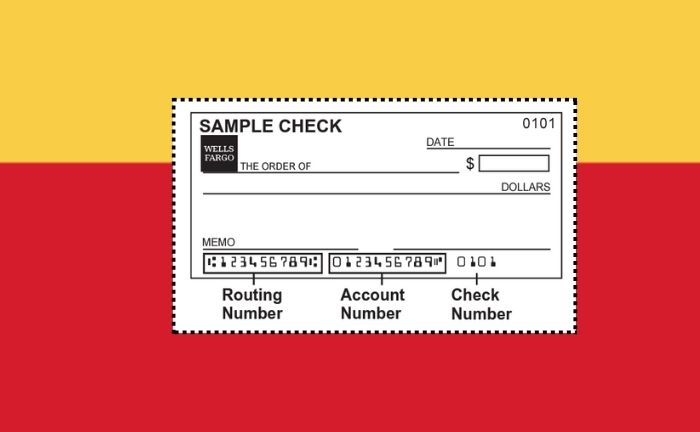

Early Pay Day access is available exclusively for certain electronic direct deposits, which include payments like your salary, retirement pension, and government benefits. To qualify, these payments must be processed through the Automated Clearing House (ACH) network.

What services are not available for Early Pay Day?

Other types of deposits or credits that do not meet the criteria for Early Pay Day access are funds received from instant payments made through the FedNowSM service or RTP® network, check or mobile deposits, person-to-person payment services like Venmo, Zelle®, or PayPal, among other online transactions.

References

- “Checking and Savings Help.” Wells Fargo, https://www.wellsfargo.com/help/checking-savings/.

- “Wells Fargo Early Pay Day.” Wells Fargo, https://www.wellsfargo.com/checking/early-pay-day/.

- “Wells Fargo’ glitch’ Affects Tons of D-FW Customers | Wfaa.Com.” Com, 2AD, https://www.wfaa.com/article/money/wells-fargo-direct-deposit-glitch-frustrating-customers-nationwide-wfaa/287-e57bbb47-f85a-4212-aa96-41a85eaa562e.

She has a degree in Social Communication (graduated in 2010). Arianna has experience in research and writing about universities, credit cards, procedures and insurance, among other topics related to finance in general.

With more than ten years of experience, she has worked in different local and digital media, writing on various issues related to the economy and international politics. She has also coordinated teams of editors, gaining experience in managing groups.

She was born in Merida, Venezuela. She lived in Wausau, Wisconsin, for 5 years, allowing her to learn English. Being bilingual, she also does research and writing in Spanish.

She has taken TOEFL exams and English proficiency tests (passed), so she is qualified to write texts in English.