The Venmo platform for receiving and transferring payments has become one of the most popular among users. Among other reasons, for offering the possibility of receiving and sending money with payment methods that do not leave them tied to a traditional bank.

This is one of the new-generation payment technologies that have come to replace traditional methods in our daily lives.

Especially in the case of Venmo, thanks to the possibility of maintaining balance within the platform itself, differentiating itself from other payment platforms that associate money directly to the digital wallet of your bank account.

First… What is Venmo balance?

One of the main features that have led Venmo as a platform to become one of the options loved by users is Venmo balance or the option to pay with Venmo balance. Functioning similarly to PayPal (An application owned by the same company) it presents the possibility of keeping money in the account without linking it directly to another entity.

This gives users the possibility to choose their payment method according to their convenience. Either with a card linked to the account or with the balance left in the account according to the transactions made. A truly differentiating option compared to other payment applications.

This is one of the reasons that has led Venmo to become one of the most used payment applications worldwide. With around 80 million users who give the best use of the services offered by the application.

How can I pay with my Venmo balance?

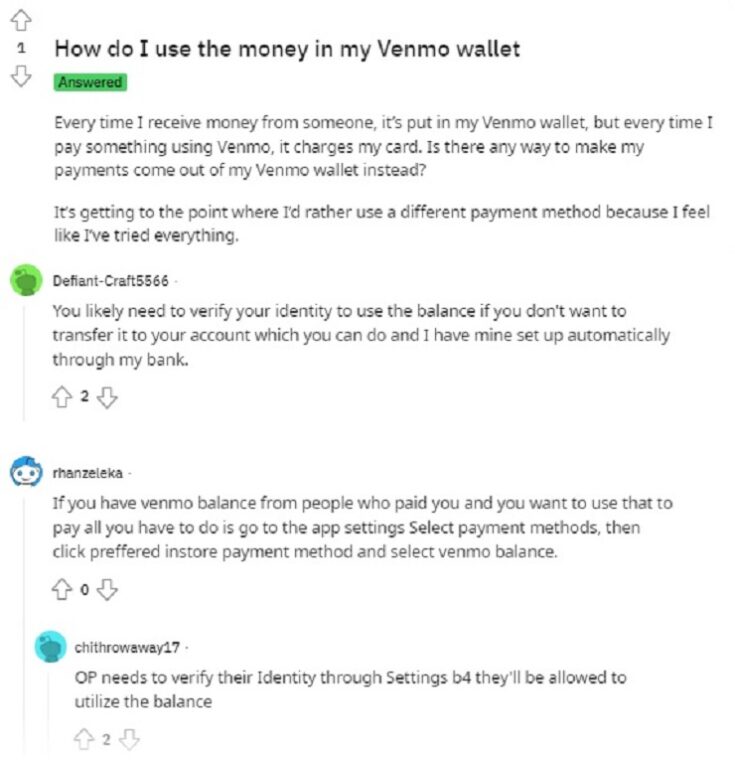

A feature that many users are usually unaware of is the possibility of making payments from their Venmo balance instead of the cards subscribed to the account. Something that can be really frustrating especially if there currently is money in our account. However, it is not a compelling reason to delete the Venmo account.

However, rather than the platform, it is typically a problem with the user, who does not have the ability to make transactions from their Venmo balance. This may sound strange if you don’t know how the platform works, but it is clearly explained in the terms of use.

To make payment transfers through your Venmo balance, you must have previously verified the identity of your account, which is the main reason why Venmo continues to make payments from linked bank accounts.

Verification Process

In other words, to make payments with the Venmo balance, you must have previously verified your identity within the account. A simple process, but one that many users tend to overlook when creating an account since Venmo is concerned about the user’s security above all else.

Thus, it blocks the money available in the account balance until the user verifies the identity in one way or another. It should be noted that this is a relatively new feature in Venmo, so it has generated some impact on many users who have been on the platform for some time.

The verification process is relatively simple and is based on the following steps:

- Log into the Venmo app

- Go to “settings” more specifically in the section “verify identity“

- Follow the process presented here

- Fill in the personal identification data to confirm the identity of the account

Confirmation in Venmo

Once this is done, Venmo’s automated system will verify the data entered comparing it to the data provided during the initial creation of the account. This follows the legal requirements for the verification of the user’s identity.

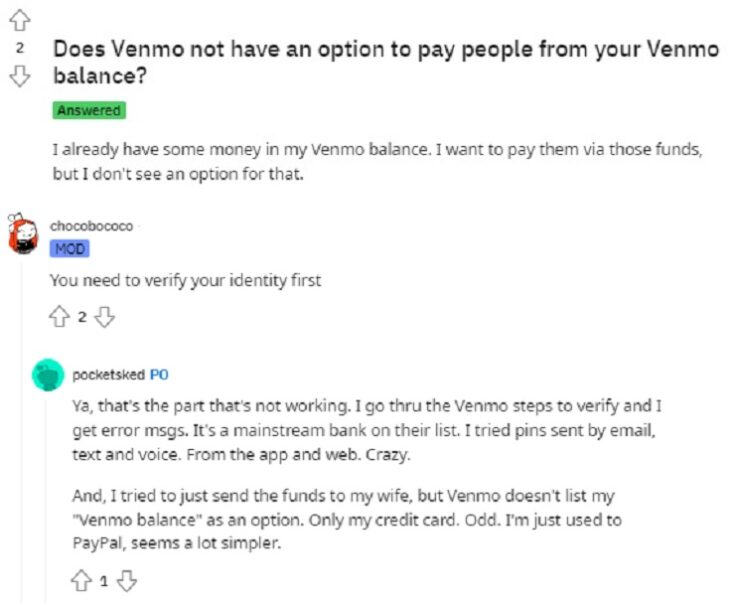

Once you have confirmed your identity, you will be able to find the Venmo balance payment among the payment methods available in your account. A feature that has always been available within the application, but since the imposition of identity verification at a certain point has been changed.

In fact, many users that have not yet verified their identity are still counting on this payment method. This is because they requested the Venmo debit card at some point before the imposition of this security measure.

Payment process with your Venmo balance

Once you have verified the identity in your account and checked that the total amount to be covered is available in your Venmo balance, it will be time for the transaction. This payment is relatively simple because it will be made just like any other payment with Venmo.

A point to clarify is that Venmo does not divide amounts between payment methods, so you will have to make sure that the chosen method has the full amount. This is due to the company’s own policy to protect the user’s economy when using Venmo as a payment method.

Choosing my payment method in Venmo

When making any payment it is simple to decide the method which you want the money transfer to come from. Among the possibilities, you can find either the banks that are linked or the money you have in your account.

Although it should be clarified that once you have made the transfer, the payment method cannot be changed. That is to say, this will be where all the money will be charged even if the transfer takes more than a day to be carried out. Likewise, this payment method will be the default for future transfers.

References

-

“Changing Your Payment Method.” Help Venmo, https://help.venmo.com/hc/en-us/articles/235174288-Changing-Your-Payment-Method. Accessed 2 Mar. 2024.

-

“Money in Your Venmo Account and Venmo Balance.” Help Venmo, https://help.venmo.com/hc/en-us/articles/217042588-Money-in-Your-Venmo-Account-and-Venmo-Balance. Accessed 2 Mar. 2024.

-

“Venmo – Share Payments.” Venmo – Share Payments, https://venmo.com/legal/us-payment-method-rights/. Accessed 2 Mar. 2024.

María Laura Landino is a journalist who graduated from Boston University with more than four years of experience in the financial sector. He has been responsible for several research papers published by major universities.

Content Manager of allaboutgroup company. You will find me in job and Finance sections.