The Charles Schwab Company, or simply Schwab as it is often called, has over time become one of USAA’s investment providers. No wonder, considering the association’s 40-plus-year history in the market. So it is certainly one of those options you immediately think of when talking about USAA.

Such is the point, that in 2020 USAA closed one of the biggest deals in its history along with Schwab. Associating USAA’s accounts directly with Schwab’s, with all the benefits they offer. This is in an effort to provide a solution for military members looking to take their future into their hands with USAA.

USAA investing with Schwab

Undoubtedly the crown jewel of USAA’s collaboration with Schwab is the investment funds. USAA investing with Schwab is more than an alternative, it is a key for USAA users. A key to a future of investments guided by mutual funds in the way that you can save your money while generating passive income.

Giving users something that not many investment companies do, which is the ability to manage their portfolios. With a system of previous organization and basic teaching about investments searching for solidarity with the user.

USAA Charles Schwab easy investment

The main feature of USAA’s partnership with Schwab is the ease it provides for first-time investors. But non-first-time investors can take advantage of this as well. This is thanks to the linking of accounts on both platforms, taking advantage of user-friendly interfaces.

Something that together with the 24/7 customer service available 365 days a year becomes a total reward for those who seek to secure an economic future. Linking your accounts is both fast and secure, whether you are looking to log in from USAA or Schwab.

With the ability to access and interact with your investments from either the USAA website, its mobile application, or the Schwab app, This option is undoubtedly more than just for the economic facts, for ease of use it takes a lot of buzz as an incredible investment fund.

Are there any fees?

The answer is no. USAA Charles Schwab fees are non-existent compared to what you see in other companies. The investment accounts do not incur any online transaction fees nor do they require you to pay a monthly maintenance fee. So you can work with your eyes closed on keeping your savings afloat.

USAA Charles Schwab login or signup

One of the biggest questions about all this is “How do I start investing in Schwab?” The answer can be explained with a quick process.

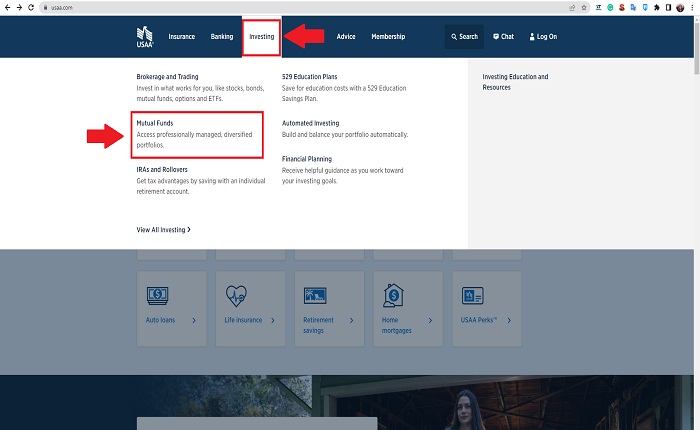

- Visit the USAA website, in its mutual funds section

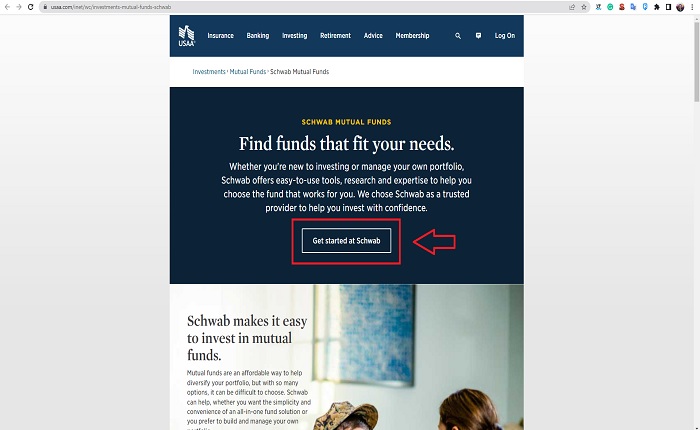

2. Go to “Get started with USAA Charles Schwab”

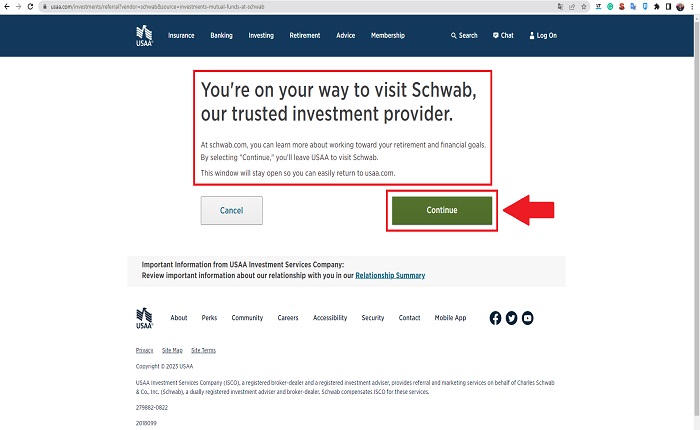

3. When you click, you will get a message telling you that you will be transferred to Schwab’s website. Click “Continue“.

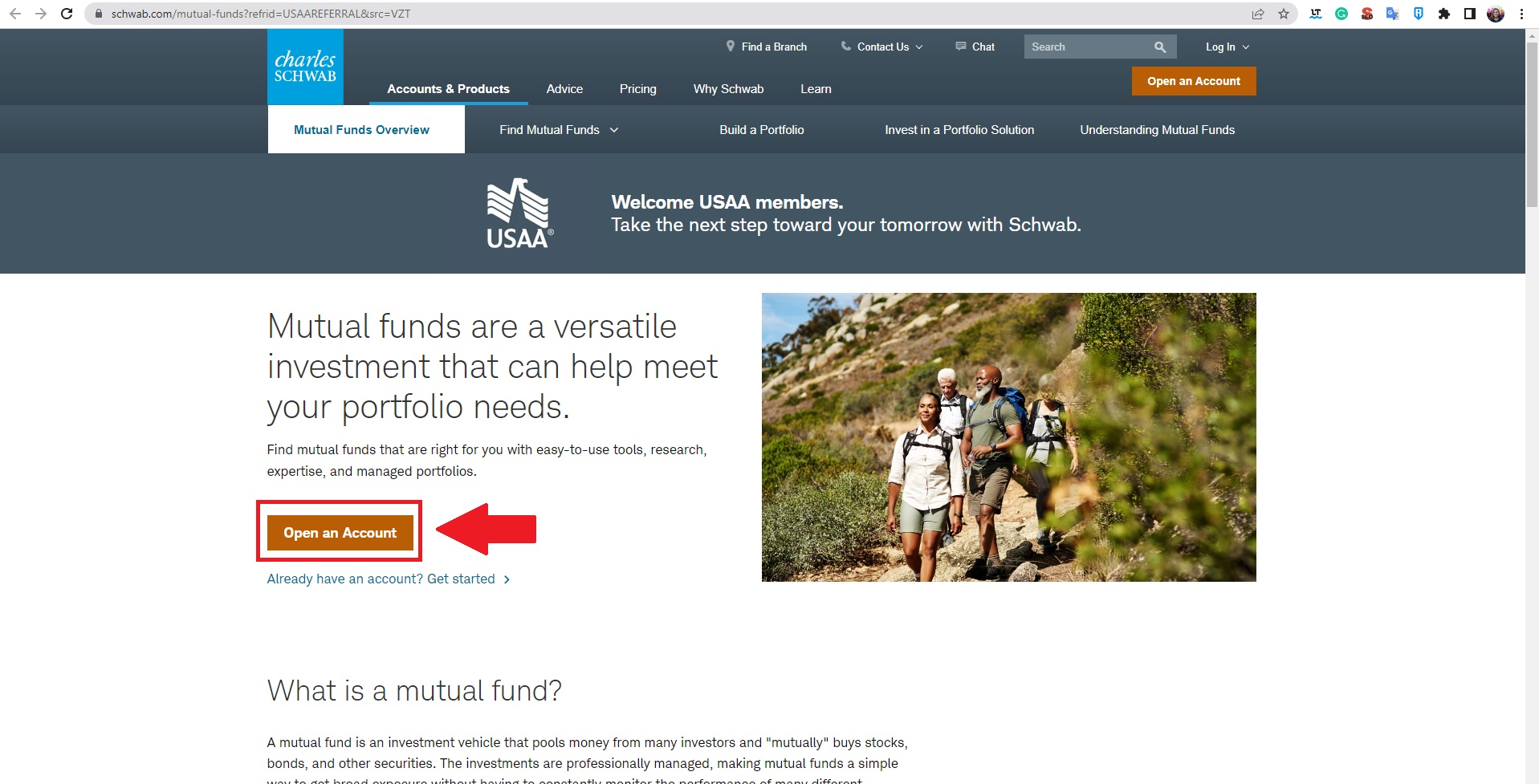

4. Start creating your account with Schwab as a USAA member

As you will see, this is a simple process, which once you get to the Schwab page will take about 10 minutes. Although it is recommended that you have thought about what type of investment account you want.

It should be clarified that although this process is quick and easy, it will always depend on what you are looking for. In any case, by contacting the Schwab team directly, you have the possibility to receive their customer service.

USAA Schwab, a Whole new world for investment

USAA’s investment accounts partnership with Schwab is undoubtedly a door of opportunity for those who want to make the most of their retirement. With the ability to learn to invest from scratch or explore a world of funds with your investment portfolio, you will always have a way to save or generate money.

Because another feature of investing with Schwab is the high level of support you can receive from team members. People who are ready for you to take a step with your account starting at $0 within the mutual funds available.

Individual retirement insurance in USAA with Schwab

Another point to highlight is the availability of USAA Schwab IRAs; They allow the option of investing in your future with no minimum monthly amounts. Making retirement something more digestible, at least financially speaking. These are thanks to their plans, either with USAA Charles Schwab IRA or USAA Charles Schwab ROTH IRA.

[wpdatatable id=30]Each one with different features to suit your basic needs and plans. Without a doubt a great way to continue producing money once you retire or at least have a secure income. In fact, more and more people are opening these accounts and taking the leap into the investment world once they leave the military.

Also taking advantage of the aforementioned advantages such as the availability of help services, 24 hours a day, 365 days a year. Along with the possibility of checking and interacting with your account at any time thanks to the USAA and Schwab applications. All in safe, fast, and secure access that will solve your doubts about investments.

References

- “Enable Cookies | USAA | USAA.” Enable Cookies | USAA | USAA, https://www.usaa.com/inet/wc/investments-iras-schwab?akredirect=true.

-

“Enable Cookies | USAA | USAA.” Enable Cookies | USAA | USAA, https://www.usaa.com/inet/wc/investments-link-accounts.

-

“Enable Cookies | USAA | USAA.” Enable Cookies | USAA | USAA, https://www.usaa.com/inet/wc/investments-mutual-funds-schwab.