USAA is one of the market leaders when it comes to providing savings, investment, and insurance services for military members and their families. So any kind of news about a financial failure or its impact is worrisome, to say the least. Such is the case that many are asking, “Is USAA in financial trouble?”

As much as USAA gives its users a service that is considered excellent, the mere fact that so many rumors regarding the entity are spreading is worrisome. Even more so considering the number of people who have their funds here. Besides the fact that it is generally understood as a brilliant option.

is USAA really in financial trouble?

Undoubtedly this is a situation to analyze as a whole. This is given that in March 2022 USAA received a big hit which was a fine of $140 million for poor money laundering control. This after not following the warnings of the federal law of the U.S. Banking regulators.

This not only affected the lender’s economy but also its reputation according to society, receiving a significant number of criticisms for its almost null attention to users who used this means to launder money, thus tarnishing a company that has been working for the U.S. military and their families for more than a century.

Is USAA losing money?

In a world where all companies suffer in the face of competition, it is normal for this one to do so as well. Especially after the aforementioned crisis and the fine they received in 2022. However, we are talking about USAA and USAA BANK, a company whose net income is around $3.3 billion.

Between criticism for service failures, state fines for anti-money laundering laws, and the turnaround, USAA is certainly not in its golden age. But it continues to position itself as one of the best and safest options in the market. This is due to the strength that comes from being a company of more than 100 years and the number of customers they still have.

What does USAA do?

It’s no secret that joining USAA is a must if you are in the military or have a family member in the military. The company itself presents you with a field of beneficial banking possibilities. So even if the company isn’t going through its best times, you should keep an eye on it.

Especially if you plan to improve your financial possibilities in the future or start a savings plan, USAA is certainly an option to at least consider thanks to its fees and wonderful customer service.

While in 1922 the company was launched as a defense mechanism for the military in San Antonio, today you have the possibility to make use of a varied list of benefits and possibilities such as:

- All types of loans to fit your needs.

- Life insurance plans

Savings cards - All types of personal, auto, and home insurance plans

- Retirement and investment plans

- Long-term care

- Annuities

- Banking services

- Introduction to Trading

- Mutual fund investment plans

Is USAA going downhill?

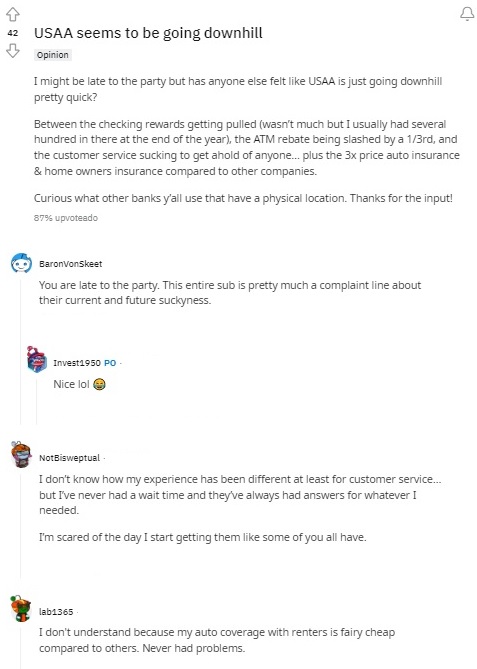

Like any large company, USAA has many haters, who claim that USAA has gone downhill. A term that sounds a bit strong for the banking company considering how it has gone about its business.

This is nothing more than one of the internet’s own responses to the various policy changes that have taken place within USAA. Changes such as the elimination of check rewards and ATM policies.

Something that is not good for the public relations of the company that has been involved in constant accusations of fraud. USAA is certainly not going through a golden age in terms of what the public thinks of them. But they continue to offer great services with brilliant fees that make them always a valid option.

The members are still there – How many customers does USAA have?

As criticism of USAA grows over time and more and more people join the movement, the company has not had a significant loss of members. Currently, USAA has around 13 million members who take advantage of its services without any problem.

Despite complaints about its different signature services, the company continues to offer large fees that fight toe-to-toe with other market giants and adjust to the needs of users.

So, if USAA is down a mountain, this is something that at least does not yet begin to affect active users directly. Although it could well be said that many with the ability to approach the company might have a second opinion about it.

Complaints to USAA

If you are wondering why did USAA get in trouble, it is undoubtedly because of the constant complaints to the company. Complaints both by governmental bodies that encouraged verification of the scams and by the users themselves.

On the other hand, the mere fact that USAA has become trending for its lack of attention to safety has made a line in its life as a company. A serious line that has already caused them several fines and could lead them to a final decline.

References

-

Bushatz, Amy. “USAA Bank Fined $85 Million by Federal Regulators for ‘Violations of Law’ | Military.Com.” Military.Com, https://www.military.com/daily-news/2020/10/21/usaa-bank-fined-85-million-federal-regulators-violations-of-law.html.

-

“Enable Cookies | USAA | USAA.” Enable Cookies | USAA | USAA, https://www.usaa.com/?akredirect=true.

-

“FinCEN Announces $140 Million Civil Money Penalty against USAA Federal Savings Bank for Violations of the Bank Secrecy Act | FinCEN.Gov.” United States Department of the Treasury Financial Crimes Enforcement Network | FinCEN.Gov, https://www.fincen.gov/news/news-releases/fincen-announces-140-million-civil-money-penalty-against-usaa-federal-savings.

-

Garage, TK’s. USAA Is A Disaster! Thousands Screwed at One Time. YouTube, https://www.youtube.com/watch?v=-DsbtVMYRBI.

-

Insurance, Think. Is USAA Insurance Good Anymore? Full Company Review. YouTube, https://www.youtube.com/watch?v=ILJSO79BwQ0.

-

“USAA Fine Money Laundering.” NY Times, https://www.nytimes.com/2022/03/17/business/usaa-fine-money-laundering.html.