Attending university is a significant part of a student’s life. It doesn’t only prepare the student academically but also for his professional life. If you have decided to get admission to the University of Utah, you must know your overall educational expenses and ways to afford them. Fortunately, there is financial aid to help you.

Planning can help you avoid a difficult financial situation. Therefore, you must look up what options you have and what financial aid the university can offer to pay dues.

Although it isn’t easy to estimate all the available financial aids, you can still learn about general categories of financial assistance provided by the University of Utah. In this way, you can calculate the receivable financial aid, the average cost you have to pay, and the final debt at the end of degree completion.

Here are the details of financial aid by the University of Utah to help you manage your expenses effortlessly.

Cost of attendance at University of Utah

It is the total amount payable by the student to the university without any financial aid. It includes tuition, room, board, textbooks, and personal expenses. This is the breakdown of the cost of attendance at the University of Utah:

- In-state cost of attendance = $8,615

- Out-of-state = $27,220

- On-Campus Room and Board charges = $10,684

- Off-Campus Room and Board charges = $10,782

Certainly, the costs mentioned above are intimidating. But not every student has to pay the total amount. Financial aids help many students pay their dues based on the average family income.

Types of Financial Aids

The university has the following types of financial aid:

- Need-based grants

- Merit-based scholarships

- Student loans

Breakdown of Financial Aid for full-time freshman

- 85% Grant or scholarship aid

- 24% Federal Grants

- 20% Pell grants

- 4% other federal grants

- 22% State/local government grant or scholarships

- 70% Institutional grants or scholarships

- 28% Student loan aid

- 27% Federal student loans

- 5% other student loans

At the University of Utah, 64% of students get financial aid which is 22% lower than public schools. This means there will be fewer numbers of students getting assistance.

➡LEARN MORE: How to Apply for a Student Loan

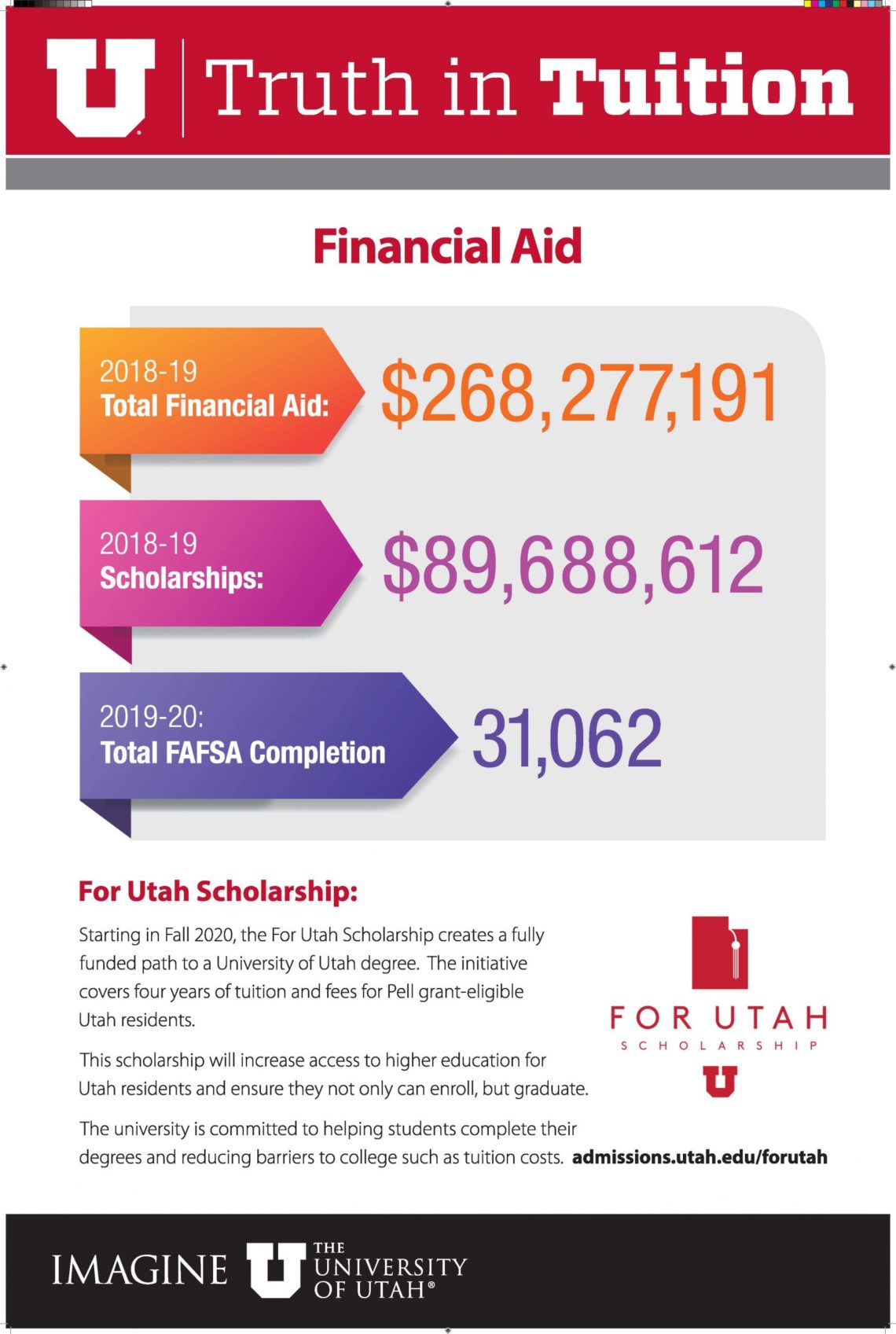

Scholarships and grants

Scholarships and grants are the most desired forms of financial aid for students as they are not payable. On the other hand, the loan has to be paid back. So, if students receive more scholarships and grants, managing educational dues becomes relatively easy.

The university offers online, need-based, and department scholarships for current, freshmen, and transfer students.

Students have to sign up for FSA ID at fsaid.ed.gov and complete the FAFSA to be eligible for it. After that, students can search and apply for scholarships. The financial aid status will be available at the CIS (campus information services).

Student Loans

Two types of loans are available for students:

- Federal loans

- Private loans

It’s common for graduating students to get loans to pay their educational expenses and end up with debt at degree completion. The ideal goal of every student is to have no debt at degree completion.

If a university has a lower percentage of students with loans, it shows its affordability. At the University of Utah, 27% of students take any loan, which is 31% lower than public schools i-e 58%.

Additionally, a university with more federal loans shows how strong the university’s financial aid program is. If students get more federal loans than private loans, it is a sign of affordability.

Federal loans

Federal loans are preferable as they come with low-interest rates and impose a less financial burden in the long run. In special conditions, students can also use subsidization and loan forgiveness options.

Private loans

Private loans are the last resort when no other option is left. Because of the highest interest rates, they are least preferred by students and cost a heavy debt in the long run.

Only 25 students at the University of Utah take private loans, which is 3% lower than public universities. This shows the affordability of expenses at the University of Utah.

The essential springboard into the job market for school leavers, students and graduates.

The AllAboutGroup have worked across more than 1000 campaigns with HR teams from over 250 firms over the last decade as their partners to help them solve problems across all parts of the recruitment process.