For every university student, managing the cost of attendance is a crucial matter. If you have decided to get admission to the University of California-San Diego, you may get comprehensive financial aid.

UCSD supports its students by providing a comprehensive need-based financial aid program for eligible students. The program helps students financially so that they can get admission and attend classes.

This program ensures that every student admitted has enough financial resources to complete the degree with a successful and positive experience at the institution.

Types of Financial Aid at UCSD

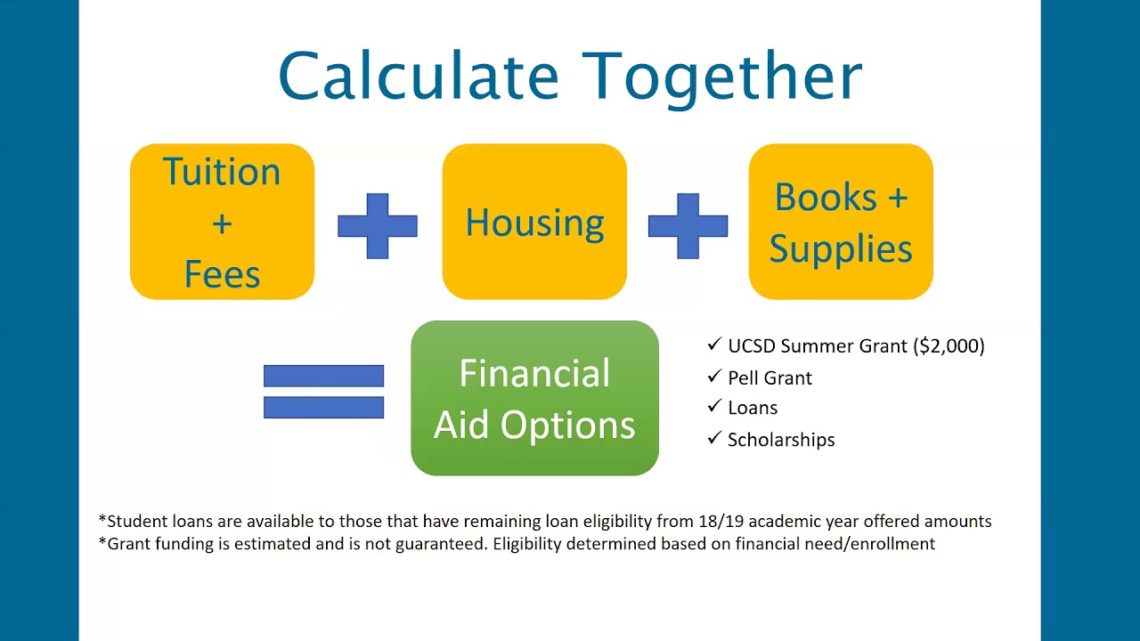

The University of California-San Diego offers different types of financial aid, which include:

- Grants: They are awarded to graduate and undergraduate students based on their financial needs, and one may get qualified for federal, state, or university grants.

- Loans: UCSD offers loans that you have to pay back. Federal loans have low-interest rates, and private loans have high-interest rates. So, if you need any loan, first go for federal loans and opt for the private loan only if no other options are available.

- Scholarships: Scholarships can be considered as gift aid, and students don’t need to pay back. They may be awarded on merit base, financial base, majors opted, etc.

- Work-study: The University’s work-study program helps students earn some extra money while in school. If a student is awarded work-study, he has to accept it to use the chance.

After that, the student can search for jobs at the Career Services Website. Once they get a job, the funds are transferred via paper check or direct deposit every two weeks. Work-study allows the students to work up to 20 hours/week.

Other types of financial aid that the UCSD offers are:

- Military tuition assistance

- ROTC funds

- Study abroad / exchange programs

- Summer Session

- Tuition benefit plans

- Prepaid savings plans & trusts

- Vocational rehabilitation funds

Financial aid is available for students under various categories. Those who can avail of these are:

- Prospective undergraduate students

- Current students

- Graduate students

- Military affiliated students

- Hope Scholars

- International students

- Undocumented students

- Parents and families of students

How to apply for UCSD financial aids

To apply for it, you must know the following points:

- UC San Diego establishes an account for every admitted student identified with a personal ID number. This account holds all the information related to registration fees, housing, parking, and other miscellaneous fees

- After setting up the account, students can fill out the Free Application for Federal Student Aid (FAFSA) to apply for financial aid that opens every year on 1st October. US citizens and eligible non-citizens can apply on FAFSA and require information about the previous year’s tax return

- UCSD school code for FAFSA is 001317

- All types of financial aid (such as Federal, State, and Institution-based grants, loans, work-study) are awarded based on students’ eligibility.

- If you want priority funding, you must submit your FAFSA application before March 2 of every year.

- After submitting your FAFSA application, the financial aid and scholarship office may ask you for additional documents. Therefore, you must check your UC San Diego Email account now and then to stay alert on your application’s current status and make sure that you have submitted all needed documents before March 2.

- Students awarded with financial aid primarily receive their aid in their student account. Once selected for aid, money is disbursed at the start of each quarter. Students whose financial applications are complete and are enrolled for the quarter can expect to receive their financial aid on the first day of each quarter.

Financial Aid estimator

Prospective students, current undergraduates, dependent students, and California resident students living in campus halls can use the estimator to estimate the 2020-2021 full-time cost of attendance and financial aid at UCSD.

Students also need to provide some important information to calculate the costs. The documents required are:

- Students and his parent’s Federal income tax returns from two years ago

- Students and his parent’s W-2 form or pay stubs from two years ago

- Bank statement, investment statements, and brokerage statements

The essential springboard into the job market for school leavers, students and graduates.

The AllAboutGroup have worked across more than 1000 campaigns with HR teams from over 250 firms over the last decade as their partners to help them solve problems across all parts of the recruitment process.