Homeownership is a profoundly cherished aspiration for many, symbolizing stability and independence and marking a significant life milestone. However, the journey towards this goal can be complicated, particularly in deciphering and managing mortgage payments. The actual cost of owning a home extends well beyond the fundamental principal and interest payments.

Prospective homeowners must also consider additional expenses such as property taxes and homeowners’ insurance. These crucial elements can significantly influence your monthly expenditures and overall financial planning. Therefore, it’s essential to use tools like a mortgage calculator with escrow to estimate the comprehensive cost of homeownership accurately.

What is a mortgage calculator with escrow?

An escrow mortgage calculator is a specialized online tool used to estimate the total monthly payment on a mortgage loan by considering additional expenses related to home ownership, such as property taxes and homeowner’s insurance.

Unlike a basic mortgage calculator, which typically only calculates the principal and interest on the loan, an escrow mortgage calculator provides a complete picture of the total costs of home ownership.

By incorporating escrow-related expenses into the calculation, this specialized calculator gives prospective homebuyers a more precise and realistic picture of their overall financial commitment when purchasing a property. It also helps current homeowners evaluate potential property tax or insurance cost changes, allowing for better economic and budgetary planning.

Where do the additional expenses go?

These extra expenses are usually deposited into an escrow account managed by the lender. When property taxes and insurance payments are due, the funds in the escrow account are used to make these payments on behalf of the homeowner.

How to use an escrow mortgage calculator?

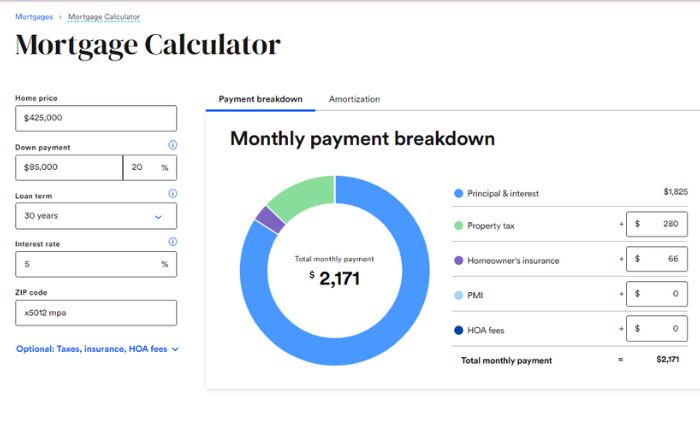

An escrow mortgage calculator is a valuable tool that combines various financial data to provide a more accurate estimate of the total monthly payment. This includes the principal and interest on the loan and the amounts needed for property taxes and insurance. Here’s a step-by-step guide on how to use an escrow mortgage calculator:

- Gather all the necessary financial details for input into the calculator. The components of a mortgage payment typically include the following:

- Homeowners Insurance Premium: The annual cost of your homeowner’s insurance policy.

- Interest Rate: The yearly interest rate for your loan.

- Loan Amount: The sum you plan to borrow for your mortgage.

- Loan Term: The duration (in years) for loan repayment.

- Property Taxes: The yearly property tax amount for your considering property.

- Find a reliable and user-friendly escrow mortgage calculator online. Many financial and mortgage-related platforms offer this tool for free.

- Input the collected financial data into the calculator’s respective fields. Ensure accuracy for a precise estimate.

- If your down payment is less than 20% of the home’s purchase price, you may need to pay Private Mortgage Insurance (PMI). Some calculators may require this information for a more accurate estimate.

- To process the information, Click the “Calculate” or “Estimate” button. The calculator will then provide an estimated monthly mortgage payment, which includes principal, interest, property taxes, and homeowners’ insurance.

- Review the estimated monthly payment breakdown to understand the allocation towards the principal, interest, property taxes, and insurance. This will help you assess your budget and make informed financial decisions.

- For further planning, experiment with different scenarios. Adjust the loan amount, interest rate, or property taxes to see how changes impact your monthly payments. This can be particularly useful in understanding how variations in property taxes or insurance costs might affect your future finances.

What is an escrow account?

An escrow account is a specialized account established by a lender to safeguard funds for a borrower. These funds are earmarked for property-related expenses such as property taxes and homeowners’ insurance. When a borrower makes a monthly mortgage payment, a portion is allocated to the escrow account.

When the due dates for property taxes and insurance premiums arrive, the lender utilizes the funds in the escrow account to settle these payments. This system ensures that these crucial expenses are promptly taken care of.

How does an escrow account work?

For example, imagine you’re buying a house. The seller might require you to put down a portion of the purchase price into an escrow account, which will only be released when certain conditions are met, such as when the sale is finalized, and the title is transferred. This ensures that the seller receives payment only after completing their end of the deal.

Advantages and disadvantages of an escrow account

Understanding the advantages and disadvantages of escrow accounts can empower you to make an informed decision about their use in your upcoming real estate transaction. Whether you’re a buyer, a seller, or simply seeking to comprehend the process better, this article will offer valuable insights into escrow accounts. So, let’s dive in and explore the benefits and drawbacks of using an escrow account.

Advantages of an escrow account

- An escrow account protects buyers by ensuring the seller completes their obligations before the buyer releases the payment.

- An escrow account also protects sellers by ensuring they receive payment only after fulfilling their obligations.

- y holding funds in an escrow account, the risk of fraud is reduced because the funds are not released directly to the seller.

- Setting up an escrow account is relatively easy.

- Thanks to their flexibility, escrow accounts can be customized to meet the parties’ specific needs.

- Many escrow services are provided by reputable financial institutions offering professional oversight and protection.

- An escrow account can help ensure compliance with applicable laws and regulations related to real estate transactions.

Disadvantages of an escrow account

- Opening and maintaining an escrow account may involve setup, maintenance, and administration fees.

- Once funds are placed in an escrow account, they cannot be easily accessed until the conditions specified in the agreement are met.

- Escrow accounts can take time to set up and administer, delaying the closing.

- Managing an escrow account can be complex, especially if multiple parties are involved, or the agreement terms are unclear.

- There is always a risk of human error when dealing with large amounts of money and complex transactions, which could result in delays or losses.

- Even with an escrow account, there is no guarantee that the transaction will be successful or that the parties will fulfill their obligations.

- If one party fails to fulfill its obligations, the other party may have limited legal remedies.

Where to find a mortgage calculator with escrow online?

Finding a reputable mortgage calculator with escrow online is relatively easy, as several reliable financial websites and mortgage-related platforms offer this type of calculator. You can implement the following tips to find online the perfect calculator with escrow.

- Use search engines like Google, Bing, or Yahoo to search for “mortgage calculator with escrow.” This will yield a list of websites that provide this specific calculator.

- Reputable financial websites such as Bankrate, NerdWallet, or Money often offer comprehensive mortgage calculators, including ones with escrow features.

- Many mortgage lenders have websites that offer various tools, including mortgage calculators with escrow, like Quicken Loans, GFL Capital Mortgage, or American Financial Network.

- Government housing websites like the S. Department of Housing and Urban Development (HUD) or the Federal Housing Administration (FHA) have helpful mortgage calculators with escrow for prospective homebuyers.

- Some reputable mortgage calculator apps are available for download on app stores for mobile devices, like Karl’s Mortgage Calculator, MortgageRepayment Calculator, or Mortgage Calculator By Zyablikon.

Mortgage calculator escrow formula

The mortgage calculation formula determines how much a lender will loan to a borrower based on the borrower’s income, debt, credit score, and other factors. Here is the basic formula used by most lenders:

Mortgage Calculation Formula = (Borrower’s Monthly Income x Debt-to-Income Ratio) / (1 – Mortgage Interest Rate), where:

- The borrower’s Monthly Income is the money the borrower earns every month.

- Debt-to-Income Ratio (DTI) is the percentage of the borrower’s monthly gross income that goes towards paying off existing debts, such as credit cards, car loans, and student loans. A higher DTI ratio indicates that the borrower has more debt than their income, making it harder to qualify for a mortgage.

- Mortgage Interest Rate is the rate at which the lender charges interest on the borrowed amount.

Example of mortgage escrow formula

Suppose a borrower has a monthly income of $5,000 and a DTI ratio of 35%. They want to buy a home worth $200,000 with a 30-year fixed-rate mortgage at an interest rate of 4%. Here’s how the mortgage calculation formula would work:

- Mortgage Calculation formula = ($5,000 x 35%) / (1 – 0.04)

- Mortgage Calculation formula = $19,250 / 0.96

- Mortgage Calculation Formula = $20,000

So, according to the mortgage formula, the borrower can afford a mortgage of $20,000. However, this is just an estimate, and other factors such as closing costs, private mortgage insurance, and the borrower’s credit history may affect the actual amount they can borrow.

FAQs

Does the law protect escrow accounts?

Yes, escrow accounts are governed by federal regulations, including the Real Estate Settlement Procedures Act (RESPA). These regulations ensure that lenders handle escrow funds properly and provide borrowers with annual statements for transparency and accountability.

Is an escrow account mandatory with a mortgage?

Sometimes. Depending on your lender and loan terms, an escrow account may or may not be mandatory. Some lenders insist on escrow accounts, particularly for specific loan types or borrowers deemed higher risk. In contrast, others may allow borrowers to independently manage their property taxes and insurance.

How does a mortgage calculator provide the estimates with escrow?

While a mortgage calculator with escrow provides a reasonable estimate, remember that it may not include all costs, such as homeowner association fees or other local expenses.