We are all aware of how difficult it can be to start your own business from scratch. While the idea of being able to run the business you want yourself is an attractive goal, we recognize that coming up with the amount to invest is quite complex.

In fact, some entrepreneurs wonder about things like how to activate a USAA debit card, how to swipe a credit card properly for business purchases, or how long it takes for the money to settle in Fidelity, which is a pension fund that can benefit some employees.

Now, a great option for entrepreneurship would be to apply for a loan or credit from the bank you are affiliated with. But, when you do not have such a long credit history and you do not generate the necessary income and movements, these well-known banks may refuse to grant you a loan.

Faced with this problem, the company Blursoft has designed and implemented a system of advances or commercial loans.

Who can apply for the Merchant cash advance Blursoft?

The Blursoft company provides you with a tool or a practical way to start or maintain your business plans. By requesting an advance or credit to finance your venture which you can comfortably pay in installments of up to 2 years.

All applicants must register and fill out an online form to have their financing request processed in which they must specify and prove certain requirements established by this company to get the credit they offer, such as:

[wpdatatable id=299]Regardless of what your business or venture is about, you need to keep in mind that you must meet most of these requirements to be accepted. However, they are still much lower than those required by other banks in the United States.

How can I apply for Merchant cash advance Blursoft?

Once you have determined that your company meets the above-mentioned requirements to receive Blursoft financing, you can learn how to get it. Best of all, you can easily do it online.

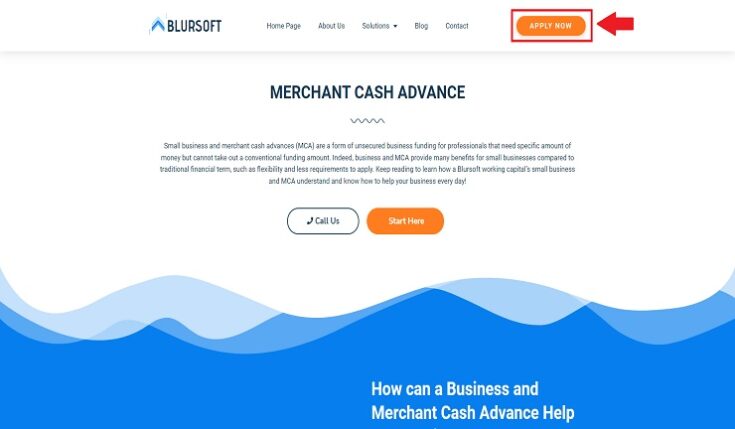

The first step is to access Blursoft’s official website, specifically the Merchant cash advance tab. There you will be able to see all the information concerning this Blursoft credit advance process, and you will have the direct access button to apply for it.

Enter your application

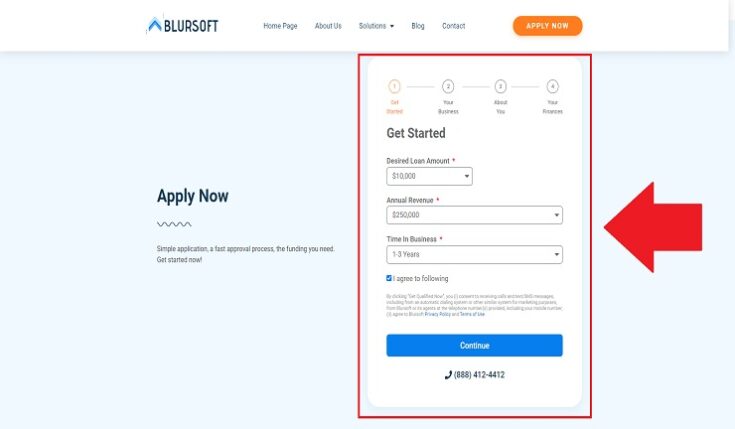

Immediately, when you click on the “apply now” button in this window, you will be redirected to the application form. Here, in the first instance, you will be asked how much you wish to apply for; remember that the figures start from $10,000 up to a maximum of $500,000.

Then you need to select the approximate amount of income that your company produces each year, this point is essential because it will measure your ability to repay the loan. And finally, they ask for the length of time your business has been operating regularly, the minimum is one year.

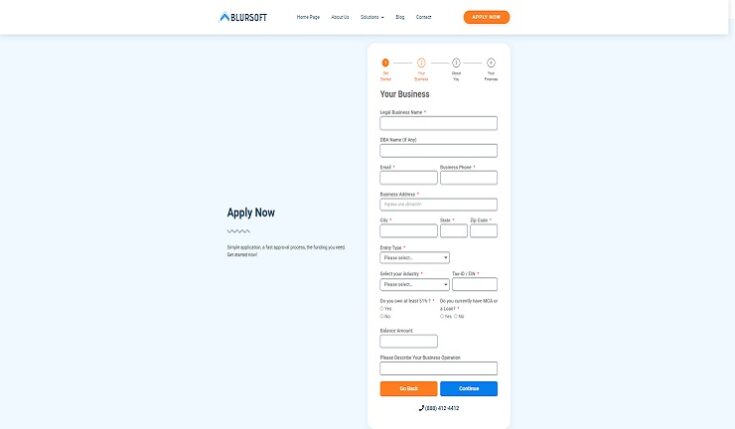

Fill out your business information

After you have completed the first section of the form, you are allowed to access the second phase of registration. This requires the data corresponding to the business you are seeking to finance, do not forget to complete the fields carefully to avoid typing errors.

You will be asked to input in this application form:

- Name of your business

- E-mail address

- Corporate or business phone number

- Business address and tax ID

- General address: city, state, zip code

- Account balance

- Type of entity

- Industry or field in which the enterprise operates. That is to say, to what activity the company is dedicated.

You will also be asked to clarify whether you are the majority owner of this company, your bank account balance, and whether you are currently subject to an MCA or bank loan.

Enter your personal information

The third phase of this Merchant cash advance Blursoft application is titled “about you,” and as you will see, it is the registration of your data. Here you will need to enter your: full name, email, address, phone number, credit score, ID number, and signature.

Last step: finances

Finally, the fourth section that constitutes this loan form concerns your financial status. Here you will proceed to connect your bank account through the PLAID banking application.

They will also request proof of your bank statement to verify the financial requirements you have previously filled out. So they can confirm that you and your company are eligible to receive the Blursoft financing you are requesting.

These receipts or requirements are requested in digital PDF format and will be verified in a period of approximately 24 hours. If all the requirements are met, you will be contacted at the phone numbers and email addresses you provided.

What can I do with Merchant cash advance Blursoft credit?

It is an undeniable fact that businesses constantly need to update themselves to stay current according to their target audience. Having financing such as the one offered by Blursoft can be highly beneficial to improve or complement any aspect.

For example, if you get your Merchant credit approved, you could consider purchasing new merchandise, products, or tools to vary your inventory. Or, perhaps, think about hiring more staff or upgrading any other space in your business.

Although, definitely a portion of those funds should be used for marketing or advertising your brand.

References

-

“Blursoft – Working Capital Loan Solutions USA.” Blursoft, https://blursoft.com/.

-

Blursoft, Bad. “Bad Credit Business Loan Blursoft – USA | about.Me.” About.Me, https://about.me/badcreditbusinessloanblursof.

-

“How Can a Business Cash Advance Blursoft Help with Your Hiring Needs? – Quora.” Quora, https://www.quora.com/How-can-a-business-cash-advance-Blursoft-help-with-your-hiring-needs.

-

“How Grow Your Business Cash Advance Blursoft.” Linkedin, https://www.linkedin.com/pulse/how-grow-your-business-cash-advance-blursoft-abubakar-saleemi/.

-

“Merchant Cash Advance Blursoft Reviews (2024) | SuperMoney.” SuperMoney, https://www.supermoney.com/reviews/merchant-cash-advance/merchant-cash-advance-blursoft.

-

“The Best Merchant Cash Advance | Business Cash Advance by Blursoft Financing.” Blursoft, https://blursoft.com/solutions/business-merchant-cash-advance/.