Money transfer apps have revolutionized financial transactions, offering unparalleled convenience and ease. Among these apps, EarnIn stands out for its innovative and user-centric approach. They have become essential tools for modern living, enabling us to split bills, contribute to group gifts, and support loved ones effortlessly.

With just a few taps on our smartphones, traditional banking boundaries are a thing of the past. These apps provide various options like bank transfers, mobile wallets, and credit card transfers, making our lives more manageable. They prioritize user-friendly interfaces and security measures, ensuring quick, easy, and secure financial transactions.

What is the EarnIn app?

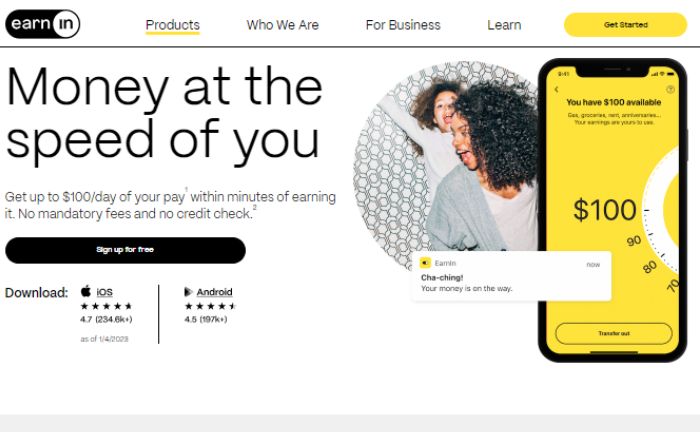

Living paycheck to paycheck can be challenging, mainly when unexpected expenses arise. Luckily, there’s a reliable solution for those seeking access to a portion of their earned wages before their scheduled payday – the EarnIn app. This app was created in 2013 under “Activehours” and launched as “EarnIn” in 2014.

EarnIn is not a bank itself, but it collaborates with Evolve Bank & Trust to provide essential banking services to its clients. EarnIn presents value-added features such as Lightning Speed, enabling swift access to funds, and Balance Shield, a protective shield against overdrafts.

By linking their bank account and payroll information, users can verify recent deposits and earnings to determine eligibility for an advance of up to $100 – $500 per pay period. What sets the EarnIn app apart is that it doesn’t function as a loan but rather as a means for users to access their hard-earned money before payday. The funds withdrawn are automatically deducted from the user’s next paycheck deposit.

How does EarnIn work with salary?

In order to use the EarnIn application, you’ll need a few things: a consistent payday, a checking account to receive your salary, and a smartphone. If you have those (among the abovementioned requirements), you can link your bank account and provide your employment information to enable the app to recognize your payment schedule.

To add your earnings, you have three options: submit an electronic or paper timesheet, use your work email provided by your company, or use the GPS earnings feature if your location is fixed. With this app, you can access the money you’ve earned before payday.

IMPORTANT: This isn’t a loan or credit application, and there are no fees or interest charges.

Does EarnIn charge fees for ATM withdrawals?

Users can download the EarnIn app for free. However, those who frequently withdraw funds a few times a month may incur a nominal $5-10 fee per withdrawal. The app aims to help users bridge the gap between pay periods and avoid financial stress by providing a reliable and safe way to access their earned wages early.

Requirements to have an EarnIn account

Some requirements must be met to use EarnIn and create an account. These conditions are as follows:

- Be over 18 years old.

- Must have a valid U.S. cell phone number.

- Be a U.S. bank account holder.

- Reside in the United States or any of its territories.

- Be an employee and have a direct debit payment schedule.

- Have a fixed work location, a company-provided email address, or an electronic or paper timesheet system (at least one will be requested).

Pros and cons of EarnIn App

Like any other application of this style, EarnIn has pros and cons. Let’s see below what each of them is so that, based on that, you can decide on the platform.

Pros of using EarnIn

- Early access to earnings: One of the main benefits of using EarnIn is its early access to payments. This feature allows users to access some of their earned wages before their official payday, which can be extremely helpful when unexpected expenses arise.

- No mandatory fees or interest: Another advantage of using EarnIn is that no mandatory fees or interest rates are involved. This starkly contrasts traditional payday loans and can save users much money in the long run.

- Simple and user-friendly: EarnIn is also known for its simplicity and user-friendly interface. The app makes it easy to request and receive funds, streamlining the process for users.

- Lightning Speed: EarnIn offers the Lightning Speed feature, which provides faster access to earnings, often within minutes.

- No credit checks: EarnIn doesn’t perform credit checks, making it accessible to individuals with various credit backgrounds.

- Helpful financial tools: The app also offers practical financial tools such as budgeting assistance and bill payment support, which can help users manage their finances more effectively.

- Community and support: EarnIn is a supportive community. Users can connect with others facing similar financial challenges and get the help and support they need.

- Privacy and security: The company prioritizes the privacy and security of users’ financial information, adhering to robust security measures.

- Better rates than payday loans: When compared to traditional payday loans, EarnIn offers better rates, making it a more affordable option for those needing financial assistance.

- Costs less than overdraft fees: Using EarnIn can be more cost-effective than incurring overdraft fees.

- Low-balance alerts: Users of EarnIn also receive low-balance alerts, helping them manage their accounts more effectively.

- Overdraft protection with automatic advances: For those who wonder whether is EarnIn safe, the app also provides overdraft protection by giving mechanical advances to prevent overdrafts.

- Users can delete their information: People can delete their information from the system, giving them control over their data.

Disadvantages of EarnIn

Despite its many advantages, there are some drawbacks to using EarnIn.

- Earnings Cap: Users may be subject to daily and pay period limits on the amount they can withdraw, which may not cover all their financial needs.

- Employment Verification: Another disadvantage is that the app requires users to provide employment information, which may not be suitable for those with irregular or unconventional work arrangements.

- Tip-Based Model: While tipping is not mandatory, EarnIn encourages users to leave tips for their service, which can add to the overall cost.

- Bank Account Requirement: To use EarnIn, users must have an active checking account, which may exclude individuals without one. Additionally, EarnIn relies on employer-provided work email addresses or fixed-location GPS for automatic earnings tracking, which may not be available in all cases.

- Potential Overuse: Some users might become overly reliant on accessing their earnings early, disrupting long-term financial planning.

- Lack of investment features: It focuses on short-term financial assistance and doesn’t provide investment or savings features.

- EarnIn card activity not reported to credit bureaus: Activity with the EarnIn card is not reported to credit bureaus, which may be a downside for some users.

- Only available in the U.S.: The app’s availability may be limited to specific regions, and the services offered can vary by location.

- Does not accept unemployment payments: It may not accept unemployment payments as direct deposits.

- One employer at a time: Users can also only use one employer for income tracking at a time, which may be limiting for some users.

Remember, as we always recommend, to carefully weigh these pros and cons according to your financial situation and needs before deciding to use the EarnIn app (or any financial service).Principio del formulario

How does EarnIn verify employment?

To verify EarnIn employment, users must provide their employer’s name and give EarnIn access their payroll data. This allows the app to easily confirm critical details like salary, hire date, and payment amounts and dates. The good news is that EarnIn has partnerships with payroll and HR systems.

With direct access to payroll information, EarnIn can automatically verify employment status without requiring users to manually provide pay stubs or other documents. This helps streamline the verification process while ensuring accurate employment validation.

How to stop EarnIn from taking money?

To stop EarnIn from taking money, you must follow these steps:

- Log into your online EarnIn account through the mobile app or website.

- Navigate to the “Settings” section.

- Select “Linked Accounts” from the dropdown menu.

- Any bank accounts linked to your employer for salary deposits will be displayed here.

- Press the “Unlink” button next to the account you want removed.

- A pop-up will appear requesting confirmation. Tap “Confirm” to finalize the removal of the linked account.

Rewards will no longer deduct a percentage from each paycheck deposited in that account for cashback savings. However, you can still withdraw or spend any cashback balance already earned. New cashback won’t continue to accumulate. In the future, your total salary amount will be paid directly without the EarnIn deduction each pay period.

FAQs

Are there other payment methods?

No. For now, as they explain on their website, EarnIn cannot send money to prepaid and savings accounts or pay unemployment income, Supplemental Security Income (SSI), or disability pay.

How to trick EarnIn app?

To use the EarnIn app, it’s important to follow its terms and conditions and not attempt to access your earned wages before payday through deceptive means. Creating multiple accounts or submitting false payroll data are unacceptable ways to trick the app. If caught, you could face account suspension, legal action, and adverse effects on your credit score. It’s crucial to use the app responsibly to avoid any legal troubles.

How does EarnIn make money?

Earnin earns money through tips and refunds. Earnin offers cash rewards by linking users’ debit or credit cards to the app. Also, when users borrow money through EarnIn, they can tip the company as they feel is fair.

References

- “About Us | EarnIn.” EarnIn, https://www.earnin.com/about.

- “Bloomberg – Are You a Robot?” Bloomberg – Are You a Robot?, https://www.bloomberg.com/news/articles/2023-06-29/know-the-risks-before-using-cash-advance-apps-like-earnin-dailypay.

- Steiner, Erin. “2024 Earnin Review: Pros, Cons, Features, Ratings & More – Credit Summit.” Credit Summit, 12 Apr. 2024, https://mycreditsummit.com/earnin-review/.

She has a degree in Social Communication (graduated in 2010). Arianna has experience in research and writing about universities, credit cards, procedures and insurance, among other topics related to finance in general.

With more than ten years of experience, she has worked in different local and digital media, writing on various issues related to the economy and international politics. She has also coordinated teams of editors, gaining experience in managing groups.

She was born in Merida, Venezuela. She lived in Wausau, Wisconsin, for 5 years, allowing her to learn English. Being bilingual, she also does research and writing in Spanish.

She has taken TOEFL exams and English proficiency tests (passed), so she is qualified to write texts in English.