Varo Bank is a banking institution that provides support through a cash advance service. Varo advance gets those who cannot stretch a check out of trouble. Knowing how to get Varo advance will enable you to meet the requirements for this type of help.

A Varo advance is a short-term loan that gives immediate access to a certain amount of money when you need it most. This advance is produced through the various advanced products that exist. In most cases, they are issued by credit card companies.

This type of service comes with high fees and interest rates. Therefore, customers must opt for their application in case of a financial emergency or meet an unexpected expense. But with Varo Advance, you have the best interest-free alternative.

How Varo’s cash advance works

With a cash advance through your credit card, you can request a certain amount that you will later pay back with interest. The easiest way to do this is at the ATM, as the advance is added to the balance. Once it is approved and deposited, it starts earning interest.

Institutions set very high-interest rates for cash advances, even higher than the interest rate on a regular credit card purchase. Varo Bank offers a short-term loan, a smart alternative when you need extra cash.

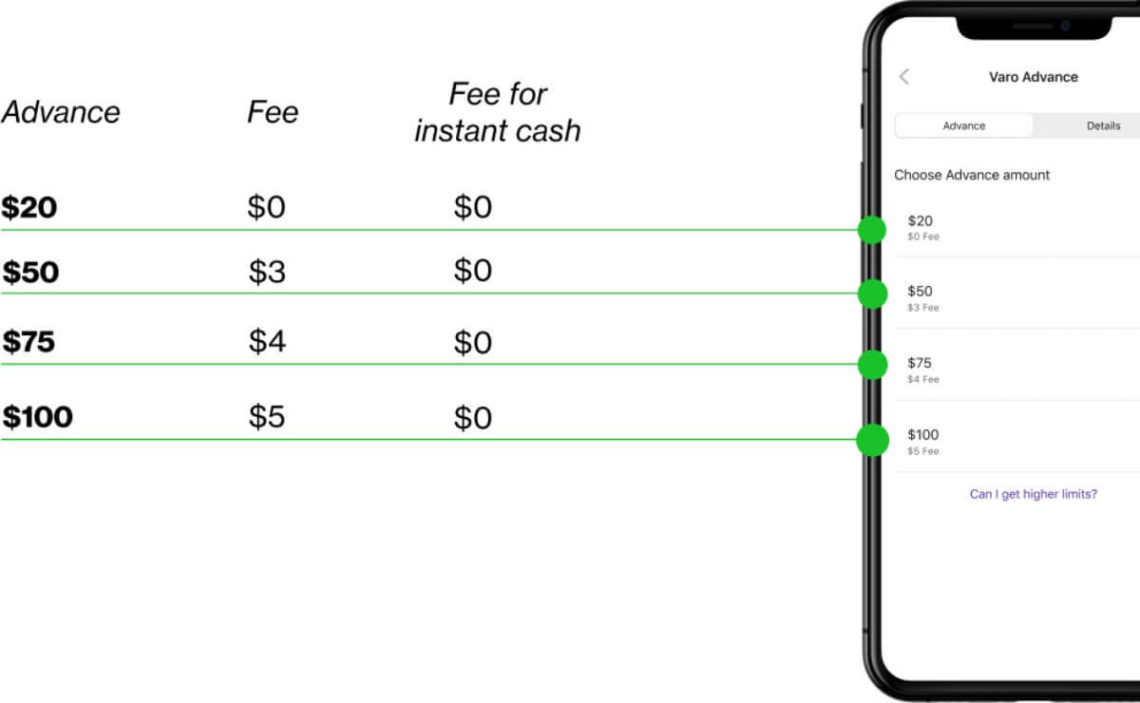

The Varo advance allows you to get up to $100 directly from the Varo Bank app as soon as you qualify. There is no interest rate but a simple fee, depending on the advance amount.

The advantage is that you can make payments however you want, whenever you want, and for whatever amount you wish to pay. The important thing is to pay it back within 30 days. Before you think about that, you should know how to get Varo advance.

Requirements to qualify for an advance

If you want to get out of a financial bind, Varo Bank is one of the best options to apply for an advance. You can complete the process through the application as long as you meet the requirements to qualify for this service.

- Have an activated Varo Bank debit card.

- The account must be active, not suspended or closed. In addition, have a positive balance, that is, equal to or greater than $0.00 in the Varo Bank Account or Savings Account.

- The account must be at least 30 days old.

- Requires at least $1,000 in qualifying direct deposits (including payroll, pension, or government benefit payments) into the Varo Bank Account, Savings Account, or both combined within the last 31-day period .

Will verify eligibility for a free $20 initial advance. Upon eligibility, you can get an advance the next day. Will then demonstrate monthly eligibility to qualify for higher limits.

Please note that by having the first advance, you can apply for another one if you do not have any previous late or missed Varo advance payments. The customer can see the available amounts by logging into the Varo Bank app and selecting Varo Advance. The pieces will go up or down based on direct deposit and advance payment history.

What to Consider When Getting a Loan Advance

When applying for an advance, it is important to be clear about the consequences of getting a loan and how it affects your credit history. As you already know, the Varo advance does not generate interest, only a simple fee. However, there are aspects to consider when receiving an advance.

Speed

Compared to borrowing cash in person at the bank or through the ATM, it is a fairly fast process if you do it with Varo Bank. Thanks to the Varo app, you get the advance just by pressing the screen on your mobile device, wherever you are.

Rate

Most cash advances include a fairly high fee for the amount of the passage, as well as a high annual percentage rate. When you carefully read the terms and conditions, you’ll see that many advanced products charge 5% of the advance in interest.

It is not the case when you opt for Varo’s cash advance, which charges no more than a $5 fee. So, you can forget about paying interest. The only condition is to return the cash advance within 30 days.

Credit

Suppose you are worried about directly damaging your credit score. With the Varo advance, you won’t have that problem because it has no impact on your credit score. But if you get the passage on the credit card, it will be added to your balance. It means you could increase your credit utilization by more than 30%, affecting your credit history.

Varo Advance offers cash advances directly to your bank account through the Varo Bank app whenever you qualify. Compared to other cash advance products, the fees are usually high, with a high APR. Varo has no APR facilitating the qualification of its customers.

Are a transfer and a cash advance the same thing?

Although credit card cash advances and balance transfers generally allow cardholders to access their credit lines to receive cash, they do not have the same meaning.

A cash advance is a short-term loan that must repay with interest. It is the easiest way to obtain immediate cash; however, it is a very expensive option. In that sense, it is recommended to request it only in cases of emergency or at the time of an unforeseen purchase.

A balance transfer, however, moves your money from one card to another. This alternative is valid when you want to save money on interest. When the credit card company completes the transfer, it makes the payments on the balance transfer card.

Varo Bank has made it a point to help its customers in this regard. The advance starts with a low amount of $20 to check the readiness of the beneficiary. In other words, it does not commit the person beyond their capabilities. As direct transfers improve, so will the amount of the advance available.

Salesforce Certified SALES & SERVICE Cloud Consultant in February 2020, Salesforce Certified Administrator (ADM-201), and Master degree in “Business Analytics & Big Data Strategy” with more than 13 years of experience in IT consulting.