Uplift’s buy now pay later loan service has gained fame and market dominance over time thanks to its excellent services. Since its emergence in the market in 2014 and after the pandemic roadblocks, this travel loan service has not stopped its journey.

Positioning itself as a lending structure that handles around $1 billion in loans annually. This is thanks to its incredible payment plans where you can go either alone or in a group to live a real experience. Likewise, uplift offers different buy now pay later packages to fit your plans.

But… does uplift report to credit bureaus?

One point to clarify is that not all buy-now-pay-later services report their results to the credit bureaus. It will depend on the service itself and the legal treatment that they handle in their structure. In the case of Uplift, they do. Indeed, Uplift does report to the credit bureaus.

Although this kind of travel loan could be considered “risky”, Uplift has a team that checks the history of each person who resorts to a loan. They also report to the different credit bureaus the treatment and payments of those who apply for their loans. Preventing in this way possible scams.

All types of loans are reported

One point to note is that Uplift reports each transaction to the credit bureaus. So regardless of what type of loan you have made, whether for a trip or a purchase, it will impact your credit history.

Likewise, in the case you apply for more than one loan at the same time, all of them will be reflected in your annual report. So you must be careful with the organization of payments if you want to maintain a good credit history.

In the same way, many users have come to state that at the moment of requesting a loan check, they usually move their history by one or two points. Although this will not mean a big change, it could catch you off guard. Even more so if we consider the fact that this typically lasts for 12 months on your history.

What does Uplift consider when determining loans?

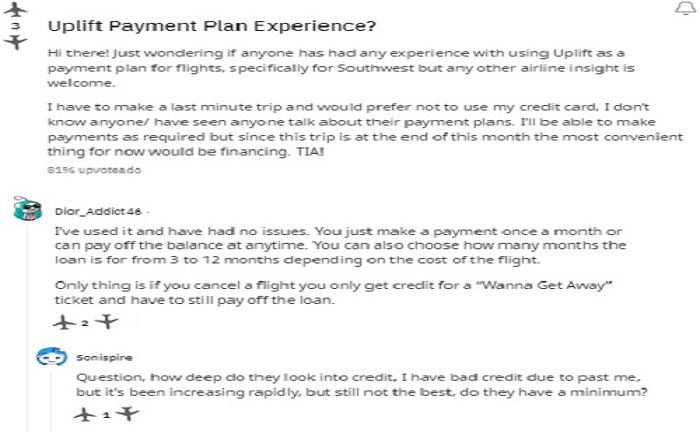

When applying for a loan from Uplift, whether for the purchase of a product or the organization of a trip, different aspects are considered. One of them, and the most important, is the credit history, which is recommended to be higher than 550 points to obtain a full loan.

In the same way, details of your purchase will be key at the time of direct application, especially if we are talking about a trip. For this, the payment package you are looking for and the organization that exists in your installments will be analyzed.

A simple application system

One point to highlight about Uplift is that the loan application system is simple and as we have said, the act of applying for one does not impact your history. This allows users to

- Organize their trips with time considering the economic possibilities that Uplift offers

- Travel, even if the travel loan has not been paid off in full

- Differentiate Uplift from other travel loan companies

- Avoid putting obstacles in your way when applying for loans, thinking you will be rejected

Uplift Annual APR – How does it work?

Uplift’s philosophy is to charge a simple interest rate that can vary between 0% and 36% depending on the loan request. While these figures may look a bit eye-catching, it is worth clarifying that the average is set at 15% APR.

How fees work on Uplift

Some transactions within Uplift may have a 2% fee for the use of the services. While this is not as common, it is normal for it to happen on some of your transactions as a charge from the company itself. It is worth noting that Uplift does not charge for late payments, but late payments could impact your credit bureaus and credit bureaus.

Set up your trip in minutes

One of the main features of Uplift that is often chosen for trip sponsorship is the ability to lock in prices. From the moment your application is accepted, the trip costs are locked in. So you have the possibility to organize a trip for a few months from now by paying comfortable rates based on today’s price.

Likewise, Uplift does not charge late fees for late payments or early repayment of your loan. So if you have a good credit history and are planning a trip ahead of time, Uplift could be the ideal choice for you. Especially if you’re looking to arrange your travel payments in convenient installments that work for you.

References

-

“Frequently Asked Questions – US – Uplift.” Uplift, https://www.facebook.com/upliftcorp, https://www.uplift.com/frequently-asked-questions/#how-uplift-works.

-

“Uplift Agent 2 Line.” BSTVacations, https://bstvacations.ca/wp-content/uploads/2020/05/Uplift-Agent-2-line-1.pdf.

María Laura Landino is a journalist who graduated from Boston University with more than four years of experience in the financial sector. He has been responsible for several research papers published by major universities.

Content Manager of allaboutgroup company. You will find me in job and Finance sections.