Have you ever heard of Daily Pay? This is a financial service that allows employees to receive their earnings daily instead of waiting for their regular paycheck. This service is usually offered by employers who partner with outside companies that specialize in providing daily pay services.

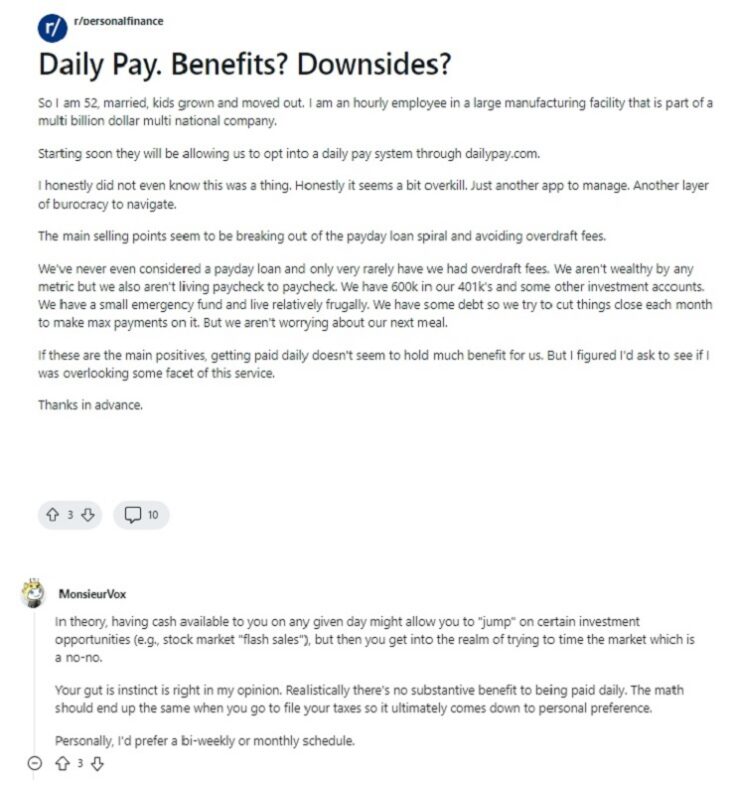

It can certainly be a useful option for workers who need to access their earnings earlier than their scheduled payday. But it is important to understand the fees and limitations associated with the service before signing up because its fees are affordably priced.

Currently, financial services are being much more scrutinized for good payment options and money management. Questions like “How to Check Netspend balance?”, “How to Transfer Money from Square to Bank Account: Step by step”, or “Is there a deposit limit at Bank of America ATM?” are being asked more and more every day.

The truth is that as long as you study your options, you will never lose out. Now, do you know if Daily Pay takes money from the check? Maybe yes, but it is up for debate since it acts as a platform that offers you an easy way to get your money.

First, you should know exactly how the platform works

Once the employer has registered, workers can access a portion of their salary through a mobile app or website. The amount they can withdraw is based on their salary and hours worked. The amount withdrawn is deducted from the worker’s next regular paycheck.

It should be noted that the Daily Pay service may have fees associated with it that vary by the service provider and employer. Some service providers may charge a flat fee per transaction, while others may charge a percentage of the amount withdrawn. Fees can range from $1.50 to $3.99 per transaction, or 0.5% to 2.99% of the amount withdrawn.

Furthermore, it is important to note that not all employers offer this service and there may be restrictions on the amount of money that can be withdrawn daily. Some employers may set a daily or weekly limit on the amount a worker can withdraw.

Now, is there a decrease in pay after using Daily Pay?

When a worker uses the Daily Pay service to withdraw a portion of their wage before their regular payday, the amount withdrawn will be deducted from the worker’s next regular paycheck. This means that the regular paycheck will be less than it would have been without using Daily Pay.

Always keep in mind that the amount of money that can be withdrawn using the Daily Pay service may be limited by the employer based on the worker’s salary, hours worked, and other factors. These limits may be designed to prevent workers from withdrawing more money than they can afford and to prevent them from becoming dependent on the Daily Pay service.

It is important to understand the policies and limitations associated with the service and consider the associated fees and charges before using the service. In addition, limits on the amount of money that can be withdrawn may be designed to protect both employees and employers, and it is essential to understand these limits before using the service.

Benefits that the Daily Pay service can offer

Well, it has several benefits for both employees and employers. These include the following:

Benefits for employees

- Greater financial flexibility by allowing them to access a portion of their salary daily instead of waiting for their regular payday

- Helps cover unforeseen expenses or financial emergencies without having to resort to loans or credit cards with high interest rates

- Helps avoid overdraft fees or payday loans, saving money on fees and interest rates associated with these financial services

Benefits to employers

- Increased employee satisfaction and retention by showing employers care about their financial well-being

- Reduced employee financial stress, which can improve the company’s long-term productivity and profitability

- Attracts and retains talent in an increasingly competitive job market

- Differentiation from the competition by offering innovative and attractive employee benefits

It is significant to understand the policies and limitations associated with the service before using it to ensure that you are making an informed financial decision.

Is Daily Pay secure when it comes to receiving payments?

The service is designed to help workers better manage their cash flow and avoid the need to resort to payday loans or other costly forms of financing. In terms of security, DailyPay uses advanced security measures to protect workers’ personal and financial information.

Note that the entire system uses bank-grade encryption to protect user data and has security measures in its network infrastructure and storage systems to protect against cyber attacks. In addition, this service is PCI DSS certified, which is a data security standard for companies that accept credit card payments.

However, it is essential to note that DailyPay is a third-party service that integrates with employers’ payroll systems. Therefore, the security of payments also depends on the security of the employer’s payroll systems. DailyPay takes steps to ensure the security of its platform, workers should be confident that their employer is also taking adequate measures to protect their financial data.

How can the Daily Pay service affect a worker’s personal financial management?

Frequent use of the Daily Pay service can have a significant impact on a worker’s personal financial management, especially regarding savings and financial planning

In terms of saving, using the Daily Pay service can hinder a worker’s ability to save money. With less money in their regular paycheck, workers may have difficulty reaching their long-term savings goals.

When talking about financial planning, frequent use of the Daily Pay service can also make it difficult eventually. Workers may have difficulty planning their budget and future expenses if they are using the Daily Pay service frequently. This is because constant use of the service may cause them to rely on advances to cover their expenses.

References

-

“$name.” Payroll, HR and Tax Services | ADP Official Site, https://www.adp.com/resources/articles-and-insights/articles.aspx.

-

“DailyPay – Ensign Benefits.” Ensign Benefits, https://www.ensignbenefits.com/home/dailypay#.

-

“Frequently Asked Questions – DailyPay.” DailyPay, https://www.dailypay.com/frequently-asked-questions/.

María Laura Landino is a journalist who graduated from Boston University with more than four years of experience in the financial sector. He has been responsible for several research papers published by major universities.

Content Manager of allaboutgroup company. You will find me in job and Finance sections.