The Sears credit card is a type of card that offers many benefits and allows access to all the offers offered to those with it. When we already have this card, we will receive invitations to shopping events and have access to coupons that are not available to the general public.

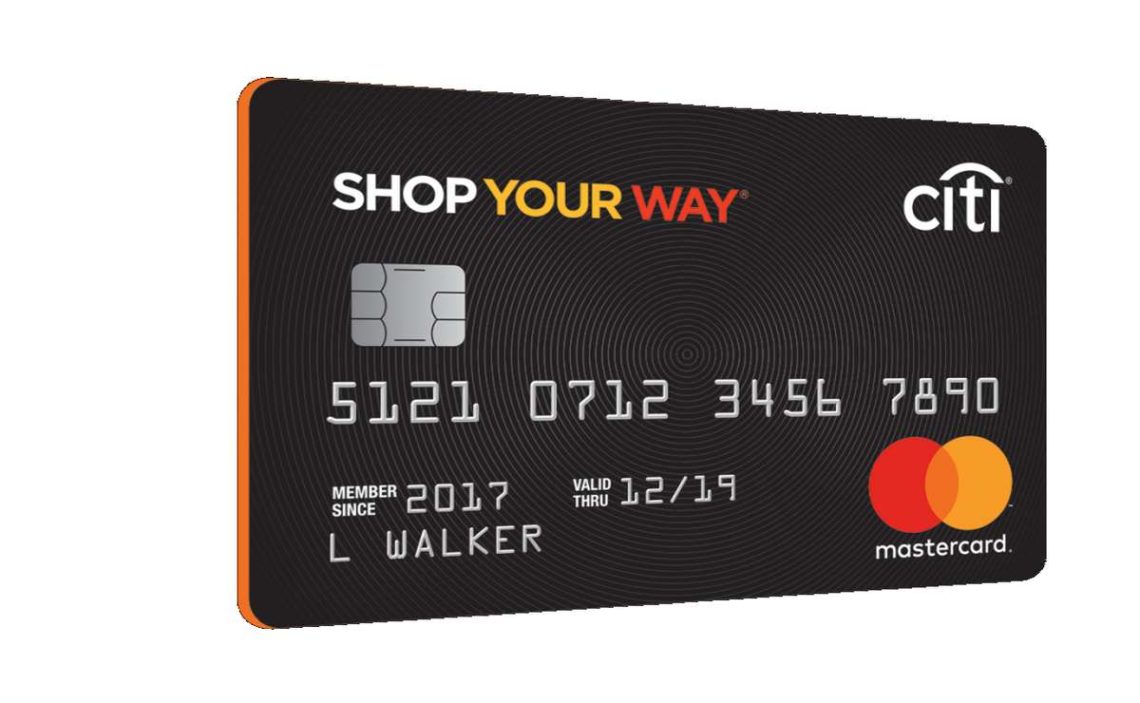

However, many users wonder what bank Sears credit card uses, especially on their Shop Your Way card.

Citi is the bank that uses the Sears card.

After the reorganization of Sears, priority has been given, especially to the Shop Your Way loyalty program and the benefits associated with this card. However, it’s worth knowing the two types of cards Sears offers, so we can decide which card best suits our needs:

Sears Card

It is a basic card that features the store’s branding and is not associated with any franchise. We can use it at Transformco stores and on the Shop Your Way platform.

It is a card that has few benefits, but among the main ones it includes will be:

- Financing: we will be able to access special financing for some products, which include electronics, fitness equipment, and tools, among others.

- Exclusive savings: with this card, customers can have access to special offers, discount coupons, as well as sales events. It also offers the possibility of earning points when using the cards through the Shop Your Way portal.

- Account protection: This card has the standard security that most cards use today.

Sears Shop Your Way Card

This card offers the same benefits as the Sears Card, plus the ability to make purchases anywhere MasterCard is accepted. This card is the one with the most benefits and is managed by Citi Bank.

Customers who have this card will be immediately enrolled in the Shop Your Way Rewards program and are eligible for different benefits such as:

- 5% in points on purchases at gas stations.

- 3% in points on purchases at grocery stores and restaurants.

- 2% in points on purchases made at Sears & Kmart.

- 1% in points on all other eligible purchases.

Please note that rewards will only apply for purchases up to $10,000 per year for the first two categories. Once this amount is reached, purchases will begin to accrue only 1% in points.

You can also access the sign-up bonus, a promotion that will allow you to earn up to $40 on our card statement. You must purchase over $50 in eligible products within 30 days of opening the account. It is a promotion that will apply only to online applications for the card.

Which are the fees on the Sears cards?

Regardless of which of the two cards is chosen, both will have an annuity of $0, and the Purchase APR will be a variable of 25.24% for both cards. On the other hand, the minimum interest payment will be $2, and the late fee will be up to $40 for both cards.

However, when talking about the Sears Shop Your Way Card, you also have a Balance Transfer Fee of $10 or 5% of each transaction. In addition, if you make a cash advance, you will have a 27.15% variable fee and a fee of $5 or 5% of the advance amount. When used for purchases at other establishments, this card will have a 3% fee for transactions outside Sears.

How to apply for Sears cards?

As Sears customers, we can choose between the two cards they offer to apply. We can apply online or directly at the store for both cards, as long as we fill out the application form.

It should note that neither Sears nor Citi specifies the credit score requirements for approval of these cards. However, the basic Sears card is much easier to obtain.

You would score better for the MasterCard version, although this is not always the case. Some customers have reported being approved for cards with poor scores. The qualification requirements for these cards are constantly being updated.

Shop Your Way credit card login

We can easily access MasterCard credit card status management through Shop Your Way credit card login. This platform is specially designed between Sears and Citibank to manage the account.

If our card approval has been done, you will first need to do the registration and create an account. After the initial registration, you can log in with your ID and password.

Through the platform, you can make different queries or procedures such as:

- View all account activity.

- View account statements.

- Make all types of payments.

- Receive exclusive offers.

- Activate alerts.

- Subscribe to digital statements.

These are just some things you can do from the Shop Your Way platform. Also, if you’re interested, Sears has a mobile app, although you won’t be able to manage your credit cards from there, so the only alternative is the Shop Your Way platform.

How much are the reward points worth?

Normally Shop Your Way Rewards members can earn 10 points for every $1 spent unless it is a special promotion. Regarding spending points, every 1,000 points is equivalent to $1.

The points earned for purchases will appear immediately in the account and can be consulted through the platform. The available points can be applied in online shopping or stores by providing your member number, email, or phone number.

Do earned points expire?

According to Shop Your Way program policies, points will have different validity periods based on how they have been received. The programs terms and conditions will indicate the points’ expiration dates.

Typically, points earned with credit cards are valid for 12 months from receiving them. For this reason, it is best to keep checking the status of our points because there, we will find information on the points that are about to expire so that we can redeem them before they expire.