The Pottery Barn credit card has a wide variety of benefits for all its customers. Pottery Barn is a well-known home furnishing’s retailer in the United States.

It is also a company dedicated to luxury e-commerce. You can find their stores in different states in the United States, Mexico, Australia, and Canada. They have an extensive catalog and at least 200 locations in the USA to offer the best furniture to the population.

Pay Pottery Barn credit card

Once the credit card is acquired, it is essential to comply with all the corresponding payments each month to be able to enjoy again the limit offered. The best-known option is to go to the nearest store and make payments at the customer service counter.

But the recommendation is to register at Pottery Barn’s online page to make the card payment. Another alternative is:

Online Payments

If the card has just been obtained, it is necessary to register on the Pottery Barn website. To register the credit card, you must first call the activation number 844 – 217 – 6923 to start using the card.

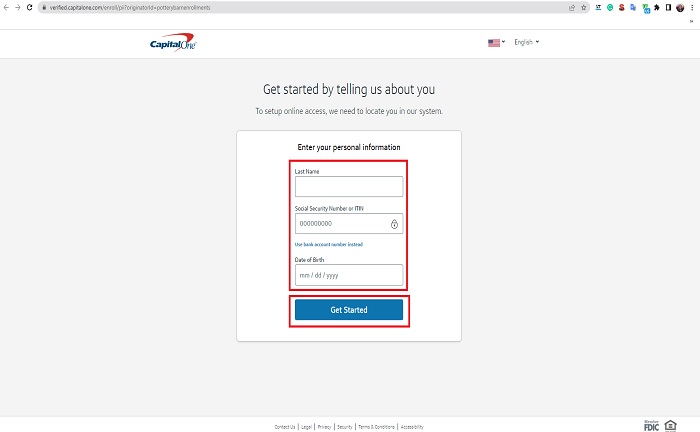

You must go to the registration page and fill out the form with personal information such as full name, social security number or ITIN, and date of birth.

You will notice that the registration is through the Capital One website because it is the card issuing bank.

Once you finish the registration, you must log in through the same page and add the Pottery Barn credit card to make online payments and check the balance, account statements, and transactions made.

In your account, you will find the option “payments” and the option to add a checking account to make payments. You also have the option to pay online through Comenity’s Easy Pay.

Payment by mail

If you prefer to complete your payment by check or money order, it should be sent to Pottery Barn Credit Card, PO Box 659705, San Antonio, TX 78265 – 9705. On the check should be your brand account number; you will see this on your statement.

It is not the preferred payment choice because they tend to be late. In addition, if any of the added data is not correct, the company will refund your payment. Ideally, you should send it at least five business days before the debt due date.

Payments through a phone call

By calling 1 – 866 – 234 – 2029, you will find the operator available to complete the payments and guide you if you have any inconvenience. These calls are not free; usually, per-call fees can be as high as $15.

Why apply for a Pottery Barn credit card?

With the Pottery Barn credit card, one can earn one point for every $1 spent at one of their stores, PBteen or Pottery Barn Kids. When you accumulate 250 points, the company will send a $25 gift card that you can use at any of Pottery Barn’s stores.

For investments, there are also some benefits, you can choose between two options when it is a large investment, and they will be able to take advantage when investing $750 or more. On the other hand, you can choose the interest-free option for credit payments, which grants 12 months interest-free on purchases made with the card.

Pay within the stipulated term is essential because the interest rate will be 19% when the debt is due. If you are sure you can meet all the payments, it is best to stay with the points scheme.

The company offers its cardholders exclusive offers in its stores throughout the year. Its APR is 19%, and no balance transfers or cash advances are available because it is a closed-loop card.

It has no annual fee; late fees are capped at $35, and returned payments up to $25. You have the option to pay no interest when the amount due is fully settled within five days after the last billing cycle.