When you get your Chase credit card, you must know the payment days you must meet to avoid damaging your credit history and ending up paying late fees. Through Chase’s online page, you can make your credit card payment. However, there are other ways to complete this application.

MyChase Schedule App

Once you acquire your Chase credit card, you can sign up for the My chase Schedule app; through your device, look for the App in the appropriate store according to the operating system you use.

Once installed on your mobile, it is time to proceed with the registration; enter the App and look for the “create account” option. You must enter personal information such as your name, ID number, email, and the number you affiliate with the application.

Once this is done, it is time to create your username and password. Once done, you can log in to the application and make transactions from your cell phone. Now, you can pay for your Chase credit card from your mobile device by adding a checking account that will take the funds.

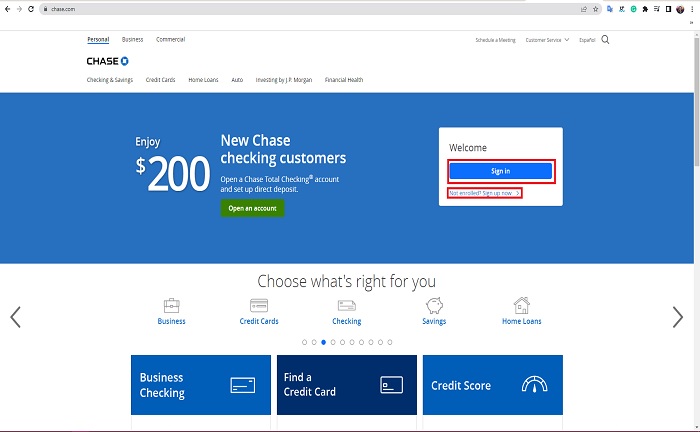

Online payments through the website

Through Chase, you will find the option to create an account. On the online page, you will find a box where you welcome customers and a blue “Sign In” button underneath. If you don’t have an account, you need to click on “not enrolled? Sign up now.”

On the next page will be the information you must provide; consisting of the social security or tax ID number, the account or application number, and the code sent to the phone number or email affiliated with the account.

It will also ask about the type of account you want to access, whether personal, business, or commercial. There will be spaces to put the card, account or application number and social security number.

The next step is creating a username and password and clicking “next“. Complete the rest of the form, and you will be able to access the chase credit card-affiliated account.

Once accessed, you have different options; you can make a one-time payment for a specific amount or schedule automatic payments so that the minimum amount of the credit card is deducted from your account each month.

For the automatic payment option, you need a valid checking account. The first thing to do is find your most recent account information and view your outstanding debt. Here you can choose the amount to be paid, select the account from which the payment will be debited and process the request.

You can also request a credit limit increase within the Chase account and add other bank accounts to make your payments.

Payments via postal mail

If you are not proficient with digital methods, you can opt for traditional check mailing through the U.S. Postal Service. You can send a personal check or money order to complete the payment, but you should check the account at the top for the correct account number.

Payments by regular mail should be addressed to Chase Card Service PO Box 94014 Patine, IL 60094 – 4014. Overnight payments are postage due and should be addressed to Chase Card Services 201 N. Walnut Street De1 – 0153 Wilmington, DE 19801.

You can also send your payments through Western Union Quick Collect; go to the nearest one with cash and use Code City WALNUT.

Other payment methods

To offer all the necessary convenience to customers, you can also make bank transfers. However, you will be charged a fee for this option. The transaction details are JP Morgan Chase Bank, NA 201 North Walnut Street Wilmington, DE 19801 ABA Number 021000021.

The last option is by phone; you must have a savings or checking account available to withdraw funds and pay by phone. The telephone number will connect you to a customer service representative at 800 – 432 – 3117.

If you are outside the U.S., you can call 1 – 302 – 594 – 8200 or schedule a payment through the automated phone line at 800 – 436 – 7958.

The time it takes to process your payment

Online payments made before 8:00 a.m. are processed immediately except on Saturdays. After that time, payments will be processed the next day, except on Fridays. The mobile application works the same way.

Mailed payments have varying processing times depending on when the check arrives at the office. Western Union pickups can take up to 7 days, and wire transfers rely on the institution you use to make the transfer. Finally, telephone payments up to 8 p.m. are posted the same day; payments made after hours are sent the next day.

María Laura Landino is a journalist who graduated from Boston University with more than four years of experience in the financial sector. He has been responsible for several research papers published by major universities.

Content Manager of allaboutgroup company. You will find me in job and Finance sections.