One of the most important things about getting a credit card or applying for a loan will be our credit score. It is good to know how to check our Chase Freedom credit score to learn our score and see if we can apply.

If our credit score is good, we will not have any problems. But if it is low, we will have to work to improve it before taking any credit line.

What tool does Chase offer us to check our credit score?

We will be able to use the free Chase Credit Journey tool, which allows us to always keep our credit history monitored and see our activity. In this application, we can check our score through TransUnion.

It will be different than the FICO score, but it is just as valid. There are different providers, and our credit score may vary across the three credit bureaus. It is normal, but we don’t have to worry about it because it will always be valid.

Verify our credit score at Chase

To verify our credit score, we must log into our Chase Online account. Looking on the left side, we can find the “Your credit score” option. There we will be able to select the option to get our free score which will be updated weekly.

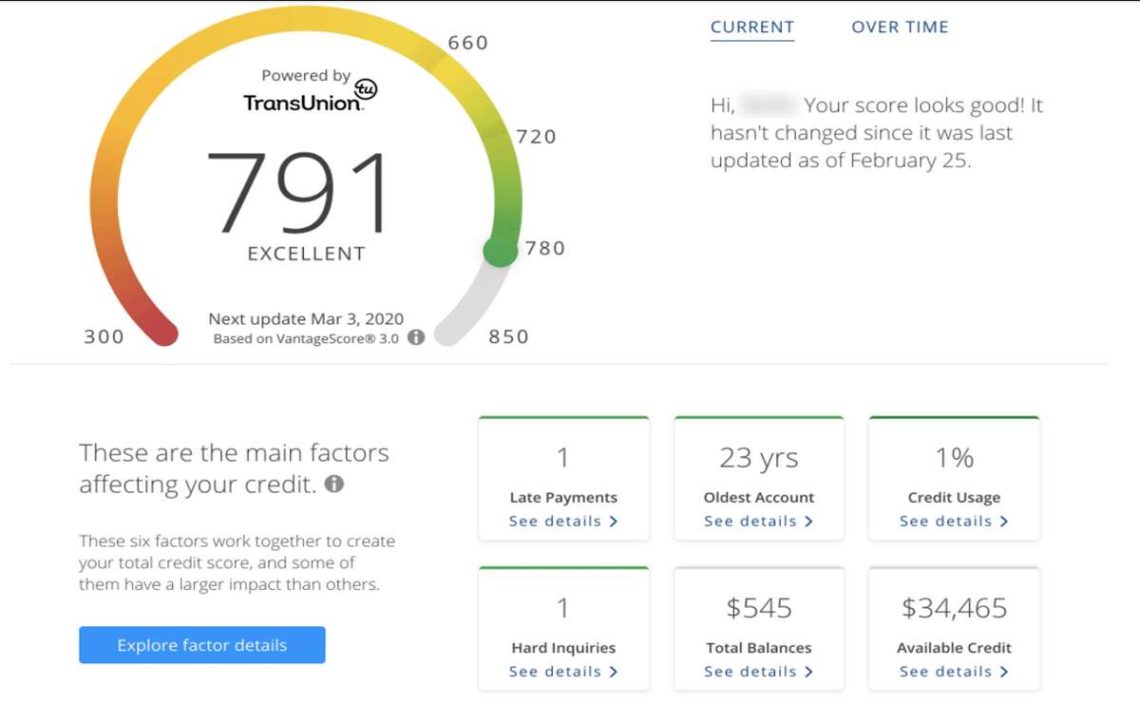

When we enter this tool, we can see our credit score on our screen immediately. It will automatically show us our current credit score, but if we want to see the credit history, we must click “Over Time.” We will then see a graph of the last six months of activity.

Note that if you scroll down the page a little further, you will see the six factors that influence the credit score. If you want to see any of them in more detail, we can click on the “Explore factor details” button, and there we can find the details of each of the factors.

Some points may be at zero, and we can see each aspect much simpler and faster.

Score simulator

It is another tool that Chase will offer us to understand the factors affecting our credit scores. This tool will be located at the bottom of the home page, and there we will have to select “Try our Score Simulator,” and there, we will be able to simulate our score.

We can use the factors at the bottom of the page to see how credit scores are affected. In this way, we can see how each factor will affect our credit score and simulate what happens if we make late payments or any other factor.

How to check credit score on Chase app?

We can access our credit score history easily through the Chase mobile app. However, those with business bank accounts cannot access this part of the mobile app, so we will have to do it online.

First, we must access our Chase account through the mobile app. Next, we can select the “Credit score” option. From there, we will be able to see the credit and everything related to the features of the Chase Credit Journey tool.

This app can be used even if you are not a current Chase customer, and you will be able to sign up for the app in a really easy way. We have to log into the Chase website and look for the free tool.

What score do we need to qualify for a Chase Freedom Credit Card?

We should note that for either the Chase Freedom Unlimited or Flex cards, we will need to have a credit score above 670. Most applications with this score are successful, and many applicants have scores as high as 700.

However, it should be noted that a credit score of 670 or lower will not guarantee us approval for our credit card. It is because Chase looks at several other factors besides the credit score.

One of the most important factors that Chase will consider is the number of credit cards we have obtained in the past 24 months. Chase will most likely reject our application if we have five or more. For this reason, in these cases, it is best not to apply because we will not be able to pass the review.

Other factors to consider are:

- How long we have had credit.

- Our income.

- Our payment history.

- Our credit card debt.

- Whether we have a Chase bank account.

Based on this, we can have our credit card application approved or denied by this bank, so we must consider all the factors to know if we qualify for it.

Luis graduated from Boston 2004 in Northeastern University and Tulane University with a MBA in NYU Stern School of Business.

Since then, Luis O. has earned the CFA Institute Certificate in ESG Investing, the Chartered Financial Analyst® designation (CFA® charter), as well as having FRM Certification which makes him a high-level financial consultant.

Luis has been collaborating in writing finance-related content for allaboutcareers since February 2022.