Chime is one of the most popular digital financial companies in the United States for its banking services. It specializes in personal spending and savings accounts. A great benefit of Chime is that it does not have a large list of bank accounts, making it difficult for you to choose from.

Instead, it has only three options capable of perfectly fitting any of your needs. You can decide between its savings account, checking account or secured credit card.

How to open an account at Chime?

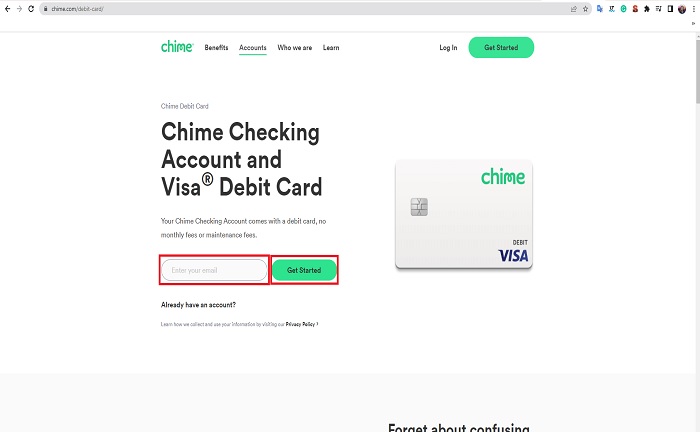

The best alternative is to open a checking account at Chime; it will give you the quality and confidence you want from this product. The process is completely online, and the steps are easy to complete in the best possible time.

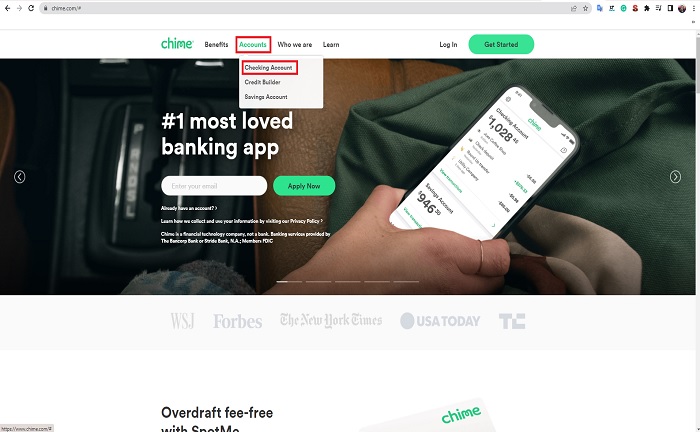

Log in to the Chime website, and in the top menu, click on “Accounts” and select “Checking Account“.

The special form to apply for the account will appear. In the form, you must provide information such as first and last name, social security number, email address and password. The data is requested to verify the veracity of the account.

Moreover, you must provide a photograph and other personal information as indicated on the application form. Be sure to add the only correct information to avoid complications.

Your account is already created, and you must download the mobile application on your phone. Click on “log in” and add the corresponding data, email and password you created earlier. After all, your account is ready, and you can start depositing your money, apply for a debit card and save.

If you wish to have benefits such as direct deposits, go to the settings and select the option. You will be prompted for your account number and routing number under the “account information” menu option. Now you can start moving your money from this platform!

Types of accounts you find with Chime

When it comes to accounts, with Chime, you can only choose between two options. Both are fully beneficial and offer different features and benefits to suit your needs.

It should be noted that there is no Business account with Chime, but either of these options can be beneficial:

Checking Account

With this checking account, you don’t have to worry about monthly account maintenance fees. It doesn’t either have a minimum balance requirement to have the account. It is a good choice when you first start using Chime; among its features, you will find:

- It has free overdraft protection with SpotMe. Furthermore, it has $200 or more in direct deposits per month.

- You can receive payments two days in advance with a direct deposit

- Good automated savings features

- It gives you access to free debit card replacement

- You can send money to your family or friends with no additional fees with a monthly limit of $2,000

- You will enjoy over 60,000 ATMs nationwide, where you can make your transactions without fees.

- Easy account disablement if your card is lost or stolen

- The mobile app is compatible with both Apple Pay and Google Pay

You are allowed up to a $20 overdraft on debit card purchases when you first sign up for Chime’s SpotMe service. None of the purchases will incur additional fees.

A one-time deposit of $200 and monthly direct deposits are required to be eligible for the SpotMe feature. Another benefit of this account is that there will be no credit check to open the account or receive the Chime debit card.

Savings Account

The annual percentage yield on this account is 0.50%, which is very competitive with other high-yield savings accounts offered by online banks. Some features of this savings account stand out:

- No minimum balance requirements.

- No monthly fees.

- No minimum deposit is required to open an account.

- No limit on the amount of interest you can earn.

However, you must have a Chime checking account to get your savings account. You can set it up when you get it by following the online page steps, allowing you to use Chime’s rounding feature.

This feature is a special automatic saving feature, meaning that it will round up the transaction to the nearest dollar whenever you use your Chime debit card. The difference will be transferred directly to your savings account.

It also has a “Save When I Get Paid” feature that allows you to set up a constant transfer of 10% of your $500 direct deposit check from your checking account to your savings account whenever you receive payment.

Credit Builder Card

Although it is not an account, it is one of the services available at Chime, and no credit check is required to obtain it. It is a product specially designed for users looking to build good credit.

It allows you to move your money from your checking account to the Credit Builder account. In addition, you can choose the amount you want to make your purchases or to pay your expenses on time and improve your credit history.

Payments you make with the card will be reported to the three major credit bureaus. It is a secured card with no interest, annual fee, or security deposit.

Which of the two account types to choose?

The decision is very personal. However, we can give you an idea. To know which is the most convenient for you, you have to evaluate the advantages offered and consider which fits your needs.

Either way, Chime is a financial institution that offers multiple benefits to any of its users. It doesn’t matter which one you have because you will have the best of the company with both.

María Laura Landino is a journalist who graduated from Boston University with more than four years of experience in the financial sector. He has been responsible for several research papers published by major universities.

Content Manager of allaboutgroup company. You will find me in job and Finance sections.