One of the best features of the popular Cash App payment service is the ability to link directly to the user’s bank account. Thus, the mobile payment service makes it possible to send and receive money from friends, family, or anyone else seamlessly in a matter of minutes. Giving in the same way an opportunity when transferring funds between accounts and, therefore, expanding economic possibilities.

However, many Cash App users have been wondering if the service allows them to overdraft their accounts in case they need to pay that exceeds their available balance. A feature directly related to the company’s policies and the payment of “penalty” fees that are worth keeping in mind.

Certainly, just as there are questions such as: “What is Cash App $100 to $800?”, “Why is the Cash App unable to sign in on this device?” or “What is the Lincoln savings bank Cash App?” many want to know more about the company’s overdrafts.

How can I overdraft my Cash App account?

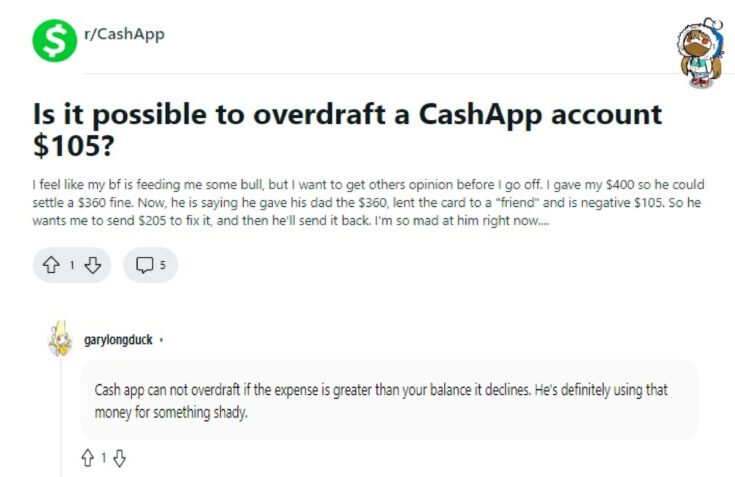

The answer, in a nutshell, is that no, Cash App does not allow overdrafts on its users’ accounts as you might find in a traditional bank. However, they do use the term “leaving a negative account,” which is generally allowed when making purchases at gas stations or leaving tips that exceed the balance.

This means that if you attempt to make a purchase or transfer that exceeds the available balance in your Cash App account, the transaction will be declined. It is important to note that Cash App is not a bank and therefore does not offer the same protections and features as a traditional bank.

If you need to make a purchase or transfer that exceeds your available Cash App balance, you will need to add additional funds to your account before making the transaction.

It is also important to note that Cash App may charge a fee if you attempt to make a transaction and do not have sufficient funds in your account. Therefore, it is advisable to maintain a sufficient balance in your Cash App account to avoid overdraft fees and other problems related to insufficient funds.

What happens when you leave an account negative on Cash App?

If you attempt to make a small transaction, such as a tip or gas station transaction, and you do not have sufficient funds in your account, Cash App may charge an insufficient funds fee. This fee may vary depending on the amount of money you are attempting to transfer and Cash App’s fee policy at the time. Therefore, it is essential to ensure that you have sufficient funds in your Cash App account before making any transactions.

If you find yourself in a situation where your Cash App account has a negative balance due to an insufficient funds fee, you will need to add funds to your account to cover the negative balance and avoid additional fees. You can do this by adding funds from your linked bank account or from a debit card linked to your Cash App account.

- California

- Iowa

- Kansas

- Massachusetts

- Missouri

- New Jersey

- New York

- New Hampshire

- Ohio

- Rhode Island

- Utah

- Vermont

- Washington, D.C.

How much can you overdraft on Cash App?

While Cash App does not generally allow overdrafts, if you attempt to make a Cash App transaction that exceeds your limits and sufficient funds in the account, an insufficient funds fee will be assessed; this fee may vary depending on the amount of money you are attempting to transfer and the policies Cash App has in place at the time. Therefore, it is always recommended to verify that there are sufficient funds in the account before making any transaction.

It is, therefore, that there is no specific amount you can overdraw on Cash App, as the service does not allow overdrafts on your account. If you try to spend more money than you have in your Cash App account, the transaction will either be declined, or a small additional portion will be covered in given cases. However, this will result in a direct penalty from the company.

The ”insufficient funds” fee at Cash App varies depending on the amount of money you are trying to transfer and Cash App’s fee policy at the time. Generally, the Cash App non-sufficient funds fee ranges from $0 to $10. It is important to note that Cash App may charge you an additional fee if you do not pay the non-sufficient funds fee within a specified period of time.

If your Cash App account continues to have a negative balance after a specified period of time, Cash App may close your account and send the outstanding debt to a collection agency.

Can you overdraft Cash App for gas?

In general, the answer to this question is a resounding no. As we have been seeing, Cash App does not allow overdrafts in any spending category. However, if you try to make a transaction that exceeds your balance, it can only be done if your bank has accepted it. But, if this happens, as mentioned above, Cash App will impose a penalty fee on your account.

If you are a CashApp user, you must be aware of the company’s transaction fee policies. So while to some degree you may overdraw your card to pay for gas, this does not directly mean that you are doing it like you would at a bank. Rather, you are putting your account at risk of possible penalties or total closure for non-payment.

It is, therefore, that Cash App wants users to be aware of their available balance in their Cash App account and make sure they have enough funds to make the transactions they want, avoiding any inconvenience with their accounts.

References

-

“How Much Can You Overdraft on Cash App? – Quora.” Quora, https://www.quora.com/How-much-can-you-overdraft-on-Cash-App.

-

“Negative Balance.” Cash App – Do More with Your Money, https://cash.app/help/us/en-us/11061-negative-balance.

María Laura Landino is a journalist who graduated from Boston University with more than four years of experience in the financial sector. He has been responsible for several research papers published by major universities.

Content Manager of allaboutgroup company. You will find me in job and Finance sections.