With the growing popularity of Cash App and other digital platforms, scams targeting its users have also become more prevalent. Cash App scams can come in many forms, and it is crucial to understand the most common ones to protect your hard-earned money. In this article, we will delve into some of the most frequently encountered Cash App scams.

These include fake offers of free money, phishing attempts, and scams involving supposedly failed transactions, among others. We will provide you with practical tips and insights on how to recognize these scams and avoid becoming a victim. By being aware and vigilant, you can ensure your Cash App experience is safe and secure.

The 10 most frequent Cash App scams

Financial transactions have evolved to be more convenient and accessible than ever before. Cash App is a platform that has gained immense popularity for its ease of use. With its simple interface and quick ability to transfer money, Cash App has become a trusted choice for millions of users. However, this convenience has also attracted the attention of scammers looking to take advantage of unsuspecting people.

Below, let’s take a look at what the most common Cash App scams are, how the scammers’ deceptive tactics are used, and how you can protect yourself from falling victim to Cash App scams.

1. #CashAppFridays

#CashAppFridays is a social media trend on platforms like Twitter, associated with Cash Apps promotions and sweepstakes. Individuals, companies, or influencers use it to give away cash or prizes, and participants follow specific instructions to participate. Fraudsters create fake accounts imitating well-known characters and pose as hosts of these events.

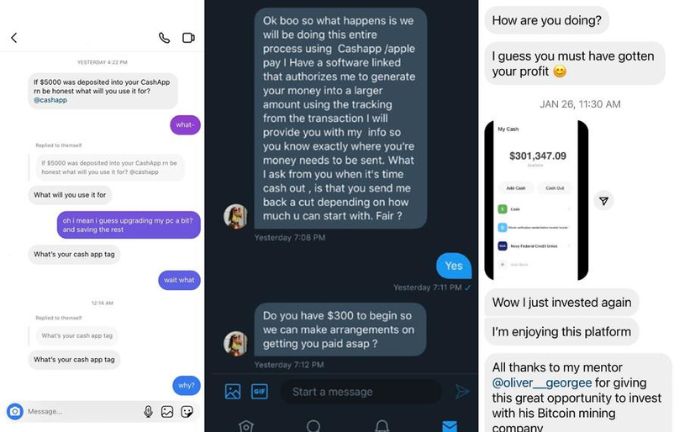

2. Cash flipping

Fraudsters promise to double your money quickly. They use social media to attract victims and may impersonate trusted figures. After gaining trust, they ask victims to send money, promising to multiply it, asking for a “clearance fee.

To prevent falling for this scam, be skeptical of offers that seem too good to be true, verify identities, and avoid sending money to unknown sources. Use reputable payment platforms, educate yourself about common scams, and report suspicious activity. Remember, legitimate investments involve risk, and there are no guarantees of quick, easy profits.

3. Fake Cash App receipts

These are fake transaction records that fraudsters use to trick users into believing they have received payments or made successful transactions through Cash App. Scammers use this trick to deceive victims differently, such as fraudulent sales, payment reversals, commissions, or phishing attacks.

Always verify receipts and refund notifications, use official payment channels, and confirm funds before checking out goods or services. Also, avoid sharing personal information or making payments. Be careful when clicking on receipt links, and report any suspicious activity.

4. Fake support

Fake Cash App support refers to fraudulent customer support services that fraudsters create to impersonate official Cash App support. Scammers trick users by creating fake websites, phone numbers, or social media profiles that appear legitimate. They exploit users’ problems or concerns by asking for confidential information, fees, or payments or performing malicious activities.

As a protective measure, always use official Cash App support channels, be wary of unsolicited help, avoid sharing personal information, verify the source of support, and report any suspicious activity.

5. Romance scams

That happens when scammers create fake romantic connections with individuals (Cash App users), typically online, to exploit their emotions and trust for financial gain. Scammers build confidence, make emotional connections, and then fabricate financial crises or emergencies to request money through Cash App.

You must be cautious with online relationships, verify identities, never send money to strangers met online, protect personal information, and report suspicious activity to authorities and the platform used for communication.

6. SSN request

Scammers seek an individual’s Social Security Number (SSN) to commit identity theft or fraud. Scammers often impersonate legitimate entities, use threats or urgency, and direct victims to fake websites or forms to obtain SSNs.

Once obtained, scammers can engage in identity theft and fraudulent activities. Be cautious of unsolicited requests, protect your personal information, and report suspicious activity to authorities and the legitimate organization being impersonated.

7. Claim your prize

“Claim your prize” scams involving Cash App are fraudulent schemes where scammers inform individuals that they’ve won a valuable prize and then deceive them to extract money or personal information. Scammers use unsolicited messages, create a sense of urgency, request sensitive data, and may ask for fees or charges.

In reality, there is no prize, and victims are left without their money and may be at risk of identity theft. Be aware of unsolicited prize notifications, verify the source, avoid paying fees upfront, protect personal information, and report suspicious activity.

8. Phishing emails

Cash App phishing emails are deceptive messages from scammers impersonating official Cash App communication. These emails contain urgent or alarming content and often include links to fake websites that mimic the Cash App login page.

The scammers aim to collect users’ login credentials and, in some cases, additional personal information or distribute malware. Verify the sender’s information, avoid clicking on suspicious links, be skeptical of email requests for sensitive information, enable two-factor authentication (2FA), and report suspicious emails to Cash App (like Zelle) and the relevant authorities.

9. Posing as cash app support

This is a scam in which fraudsters impersonate official Cash App customer service to deceive users. The scammers create fake profiles and contact users, often claiming urgent problems with their accounts.

They request sensitive information, such as login credentials or payment, to resolve the problems. After obtaining this information, the scammers disappear, and users receive no help. Don’t forget to verify the source of the service, be wary of unwanted messages, protect personal information, and report suspicious activity to Cash App and the authorities.

10. Selling items online

This is a legitimate practice, but fraudsters can exploit it through various schemes. They create fake ads, engage in overpayment scams, conduct fraudulent transactions, sell counterfeit products, and may fail to deliver items after receiving payment.

Don’t forget to verify buyers, check payments, use Cash App safely, avoid overpayment situations, be skeptical of unusual transactions, and report suspicious activity.

@elmerpage ⚠️BEWARE OF THIS TYPE OF SCAM!! scammers cashappscam exposingscammers greenscreen

Tips to avoid being scammed on Cash App

We have already mentioned in each point what you could do to avoid being scammed through this virtual wallet, but let’s clear the picture. To do this, we will put all the recommendations together in one text so that you can take the corresponding measures and have all these tips in mind when you notice suspicious activity in your Cash App account.

- Identity verification: Ensure you are dealing with legitimate people or companies. Verify the identity of the people you are doing business with, and if in doubt, investigate further.

- Don’t share personal data: Unless you are sure the request is legitimate, never give out sensitive information such as your Social Security number, passwords, or bank account information.

- Use official channels: Instead of relying on third-party links or applications, transact through the official Cash App application or website.

- Verify the transaction details: Before completing a transaction, verify the details, such as how much to pay and who to pay, to ensure they are correct.

- Activate two-factor authentication (2FA): For an extra layer of security, enable two-factor authentication for your account.

- Report any suspicious activity: If you see suspicious activity, such as fraudulent transactions, report it immediately to Cash App and, if necessary, to local authorities.

- Beware of offers that are too good to be true: If you receive an offer that seems too good, it could be a scam. Be cautious of offers that promise quick profits or unusual benefits.

- Check out the seller: If you are buying products or services from a seller you do not know, research the seller’s history and reputation before purchasing.

- Avoid advance payments: Be wary of requests for payment in advance of receiving goods or services, especially if they come from unfamiliar sources.

- Keep your app up to date: To take advantage of the latest security measures, ensure you have the latest version of the Cash App app.

Last but not least, it’s essential to educate your loved ones about security to help prevent scams from happening to you. Share these security tips with your family and friends.

The scams discussed, including impersonating Cash App support, sudden deposits, sales of expensive products, and a wide array of other deceptive methods, serve as a reminder that maintaining vigilance and skepticism is paramount.

While Cash App, like many other financial services, works diligently to enhance security measures, users play a pivotal role in protecting themselves. Remember to verify the legitimacy of offers, refrain from sharing sensitive information or sending money to unfamiliar sources, and promptly report any suspicious activity to the Cash App support authorities.