In the bustling world of digital finance, Cash App stands as a beacon of convenience, offering a seamless way to send and receive money.

But what if you want to use a credit card with Cash App?

Today, I will explain the details of adding a credit card to your Cash App account.

With a focus on clarity and practicality, I’ll guide you through the process, address common questions, and offer tips to make your Cash App experience smooth and hassle-free.

Key Highlights

- Linking a credit card to Cash App is straightforward but requires a prior link to a debit card.

- A 3% fee applies to transactions made with a credit card.

- Credit cards are for sending money only; receiving funds requires a bank account.

- Regular updates and monitoring of transactions enhance security and user experience.

The Basic Steps of Adding a Credit Card

Step 1: Accessing Account Settings

To start, open Cash App and tap on your profile image. This is your gateway to personalizing your Cash App experience.

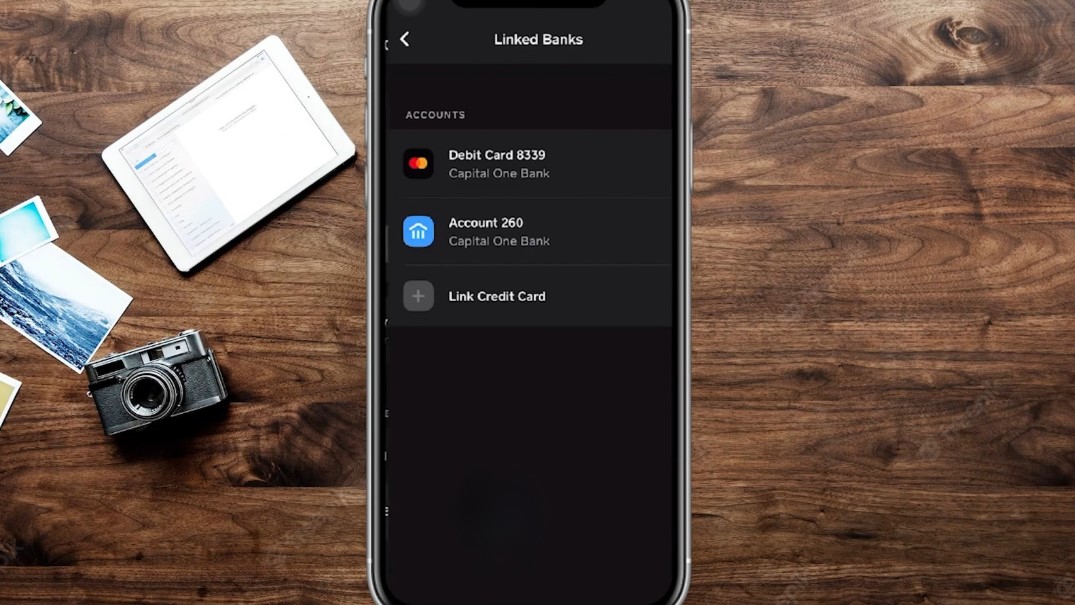

Step 2: Navigating to “Linked Banks”

Once in your account settings, locate and select the “Linked Banks” option. Think of this as the control center for managing your financial sources in the app.

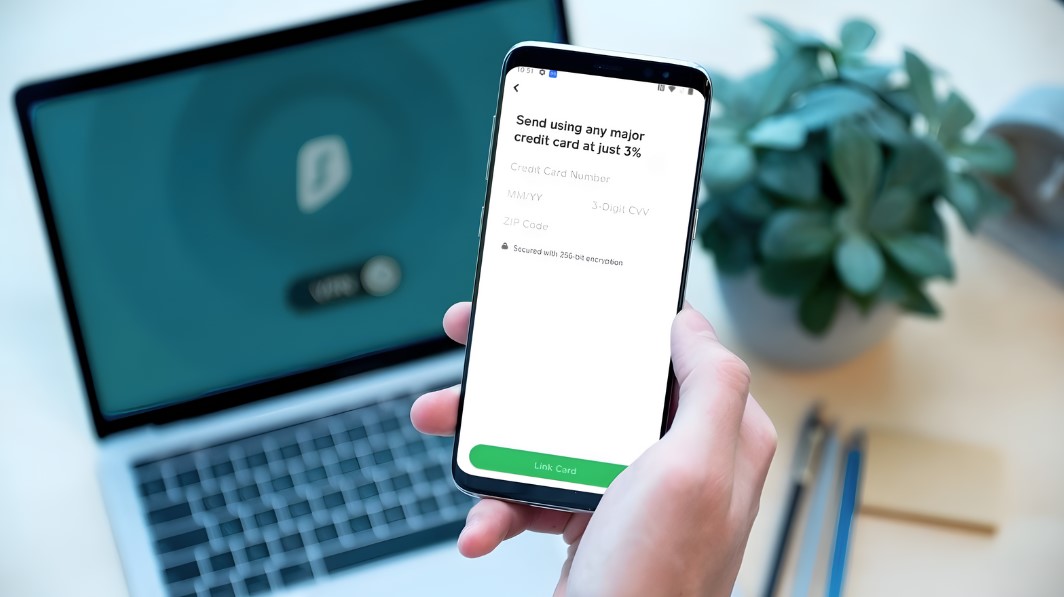

Step 3: Linking Your Credit Card

Here, you’ll find the option to “Link Credit Card”. It’s a straightforward process—like adding a new friend to your contact list, but in this case, it’s a financial ally.

Know the Costs: The 3% Fee

When sending money from your credit card via Cash App, a 3% fee is applied. Picture this like a convenience fee at an ATM—it’s the price for the ease and speed of the transaction.

Limitations and Capabilities

Receiving Money: Why Your Bank Account is Necessary

It’s important to note that you can’t receive money on a credit card through Cash App.

For receiving (and sending) cash without fees, link a bank account, much like having a direct route for your funds.

Supported Credit Cards: A Wide Range

Cash App supports a variety of credit cards—Visa, MasterCard, American Express, and Discover.

It’s like having different keys for the same lock, offering flexibility in your choice.

Selecting Funding Sources for Transactions

For each transaction, you can choose between your credit card, debit card, or bank account.

Each has its own benefit depending on your needs at the moment.

The Debit Card Prerequisite

Before you can use a credit card, adding a debit card to your Cash App account is necessary.

Think of it as laying the foundation before building the house.

Funding Limitations

You cannot use a credit card to fund your Cash App balance, nor cash out to a credit card. It’s akin to a one-way street—credit cards are for sending only.

All of this is highly important info, as it can help you use the app more effectively and avoid any type of scams.

Troubleshooting: When Things Don’t Go as Planned

Network and Card Information Check

If you’re having trouble adding your credit card, ensure you’re connected to a network and double-check your card information, including the expiration date. It’s like proofreading a document before submission.

Updating Cash App

Still facing issues? Updating the Cash App might be your solution.

Removing a Credit Card: How and Why

To remove a credit card, follow these steps:

- Tap your Profile icon.

- Go to “Linked Banks.”

- Select the card.

- Tap “Remove Card”.

It’s as simple as unpinning a location on your map app.

Deleting Your Cash App Account: A Final Step

If you decide to close your Cash App account:

- Move all funds out.

- Navigate to: Profile icon > Support > Something Else > Account Settings > Close Your Cash App Account.

- Delete the app from your phone.

Maximizing Your Cash App Experience

Monitor Your Transactions

Regularly reviewing your transactions helps you stay on top of your finances.

Use Cash App for Budgeting

You can use Cash App to set aside money for specific purposes, much like using different envelopes for different expenses in traditional budgeting.

Stay Informed About Updates

Keeping your app updated ensures you have the latest features and security enhancements.

The Evolution of Digital Payments

The integration of credit cards into apps like Cash App marks a significant leap in the evolution of digital payments.

This shift is comparable to the transition from handwritten letters to emails. It’s about speed, convenience, and adapting to the digital age.

The Impact on Personal Finance

The ability to link a credit card to Cash App has a profound impact on personal finance management.

It’s a financial Swiss Army knife in your pocket, ready to tackle various monetary tasks efficiently.

FAQs

Why is a Debit Card Necessary Before Adding a Credit Card?

Adding a debit card first is a security measure. It establishes a primary, direct link to your funds, which is crucial for the app’s functioning.

Can I Use Multiple Credit Cards with Cash App?

Yes, Cash App allows you to add multiple credit cards. However, you can only use one at a time for each transaction.

It’s like having different shoes for different occasions; you can own many but wear only one pair at a time.

How Secure is Adding a Credit Card to Cash App?

Cash App employs advanced security measures, ensuring that adding and using your credit card is as secure as possible.

It’s akin to having a high-tech security system for your digital financial house.

What If My Credit Card Isn’t Accepted?

If your card isn’t accepted, check if it’s from a supported network (Visa, MasterCard, American Express, Discover).

If it is, verify your card details and try again. It’s like ensuring you’re dialing the right number when making an important call.

Final Words

Adding a credit card to Cash App, despite its nuances, is a straightforward process. Having knowledge about the fees, limitations, and troubleshooting methods ensures a smooth experience.

Whether you’re a frequent user or new to the platform, mastering these steps enhances your digital financial journey.

Keep in mind that each step in Cash App, like any financial tool, is about adding convenience and control to your monetary transactions.

With this guide, you’re well-equipped to navigate the world of Cash App with your credit card in tow. If you got the time, check out our guide that will inform you on how to get a new Cash App card for free. Free is always awesome, so don’t skip it!