Peer-to-peer applications serve to ease the payment process between people, so normally, everyone uses them on a daily basis. However, do these apps succumb to taxes? Yes, the law specifies that there must be a report of any taxable income through forms, and you can find these on the IRS website.

If you are a user of this app and yours is a Business Account, the app would normally need to report this information. You will have to fill out a form that contains all the data regarding your gross income, and then Cash App will report it to the IRS. However, Cash App does not report Personal Accounts.

Note that most P2P apps must also report to the IRS because of The American Rescue Plan Act. But in this case, it is your priority to understand how to proceed with Cash App to report transactions.

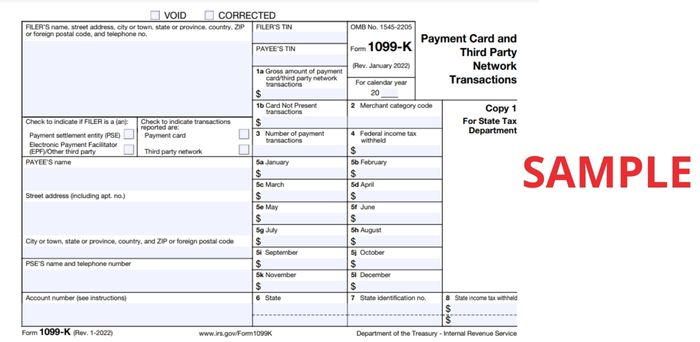

Receiving Form 1099-K

You can receive this form (Payment Card and Third-Party Network Transactions) on Cash App itself by login into your dashboard online. Prior to 2022, you would normally find it on your profile if any gross payment exceeds $20,000 and your account has more than 200 such transactions.

However, The American Rescue Plan Act of 2021 made some changes regarding whether you can receive this form for returns after 2021; it will only be possible in the following cases:

- For gross payments exceeding $600; it applies for any quantity of transactions. You must report any transactions that surpass this limit, even if you receive them in one go or are accumulated in various payments.

- For goods and services transactions; only if they have been made after March 11th, 2021. Any transaction between family and friends does not apply, and it must be clarified.

If you need it, here is what the 1099-K form looks like. You can also find it on the IRS website:

You will receive this form by January 31st, 2021 (only if you surpass the new regulations). Small businesses also apply, so it is recommended that you check all the transactions you make and, if you receive the form, fill it out so that Cash App reports it to the IRS.

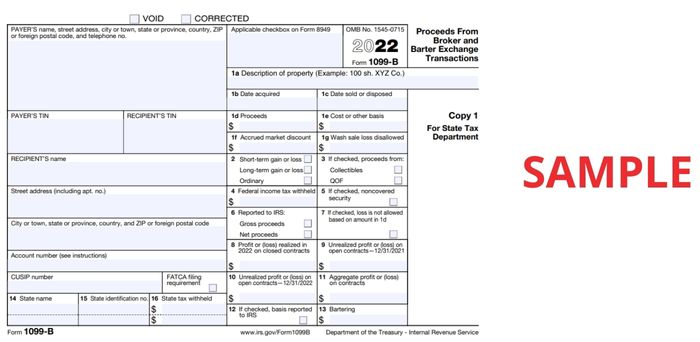

Does Cash App also report Stocks and Cryptocurrency to the IRS?

As a matter of fact, yes. Since Cash App allows you to buy stocks and cryptocurrency, the app must also report these to the IRS. However, you will receive the 1099-B form instead by February 15th of the following year of the cryptocurrency sale, reflecting any transactions regarding stocks and bitcoin transactions.

You can also find this form on your dashboard online. Since this market changes with the passing of time, your gains and losses also change. If you are having a rough time determining these, go to Transactions CSV in Cash App.

Cash App will not support you on any tax advice. You should seek a tax advisor before you start filling out this form. Here is a preview of the document that Cash App will report to the IRS:

New adjustments do not imply a new tax

We must clarify that you do not have to pay a new tax on Cash App. In other words, the new regulations (mentioned above regarding the American Rescue Plan Act of 2021) specify if you qualify to fill this form and only apply to transactions made from business accounts.

If you are given money as a reward or a gift from someone else, then it is not required to report it on the 1099-K. Everything that is not business related is non-taxable.

After Cash App releases the report to the IRS, you will have to keep track of any new transactions for the next year. We recommend keeping track of these transactions digitally, but you can also do it manually. The former is better when working with crypto assets and stocks.

We hope you are all set and prepared for your income tax return with this information.

If you have a personal account, you do not have to worry about anything. But if it is a business account, then prepare to fill out the form and wait for Cash App to report to the IRS. While it is tiresome to calculate the total taxable income, you must not skip this to avoid any trouble in the future.