In today’s digital age, mobile applications have revolutionized the way we manage our finances. One such app that has gained widespread popularity is Cash App.

With state-of-the-art encryption technology and advanced security measures, you can be confident that your personal information and transactions are protected while using the app. One of the most prominent features of Cash App is the option to set up direct deposit, which allows you to receive your payments directly into your Cash App account.

Whether you’re expecting a salary, government benefits or client payments, Cash App gives you the convenience of receiving funds quickly and securely, eliminating the need for physical checks or traditional wire transfers.

How do I set up direct deposit?

- Start the Cash App on your mobile device. If you don’t have the app, you can download it from your app store and create an account.

- Tap the profile icon located in the upper-left corner of the app interface. This will open the Menu options.

- From the menu options, choose the “Cash” tab. Here you will find several options related to your Cash App balance.

- Scroll down and look for the “Direct Deposit” option. Tap on it to start the process.

- Cash App will provide you with a form to complete. Fill in the required information accurately, including your employer’s information and your account number.

- Submit the form after completing the required information, and review the form for accuracy. Once satisfied, submit the form to initiate the direct deposit setup.

What bank does Cash App use for direct deposit?

Cash App uses the Federal Deposit Insurance Corporation (FDIC) bank: Lincoln Savings Bank. That way they make it easy to manage your direct deposits.

When you set up direct deposit with Cash App, your funds are routed through this bank. This ensures that your money is safe and protected by federal deposit insurance.

How long does a direct deposit take with Cash App?

Once you have successfully set up direct deposit with Cash App, you may wonder how long it takes for the funds to appear in your account. In general, Cash App strives to make your direct deposit available the same business day it is received.

However, there may be slight delays depending on factors such as your employer’s processing time or any unforeseen issues. In most cases, you can expect to see the funds in your Cash App account within one to three business days.

Having problems with direct deposit?

Although Cash App strives to provide a smooth direct deposit experience, occasionally problems can occur. Below, I’ll mention some common problems you may encounter and some troubleshooting steps to resolve them:

- Delayed Deposits: If you don’t see your direct deposit into your Cash App account within the expected timeframe, make sure you entered the account information correctly during the setup process.

- Incorrect account information: If you entered incorrect account information during the direct deposit setup, contact Cash App support immediately.

- Employer-related issues: In some cases, delays may occur due to your employer’s internal processing procedures.

- Cash App Support: If you have exhausted all other troubleshooting options and the problem persists, contact Cash App support directly. They have a dedicated customer service team available to address your concerns.

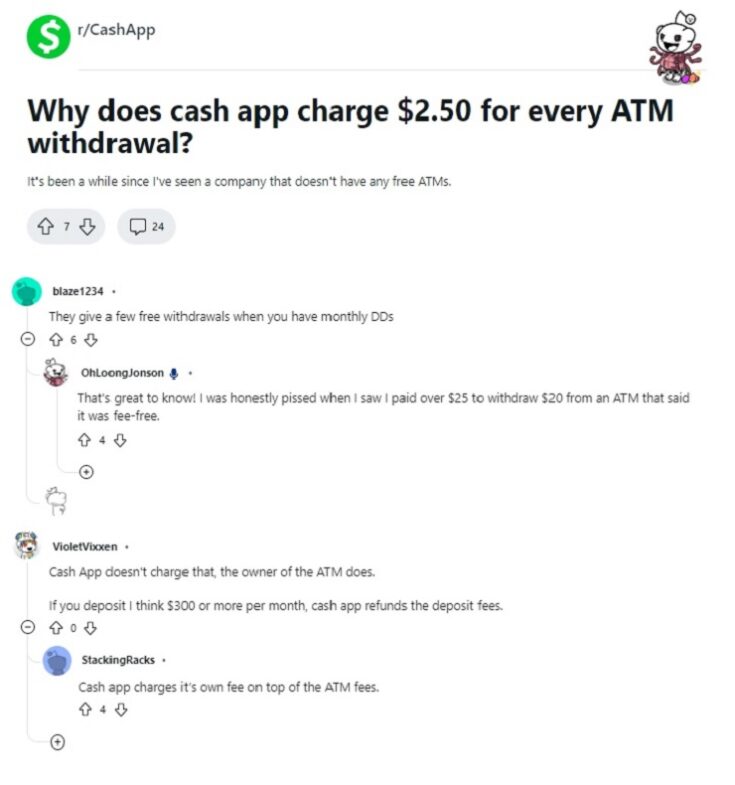

How much does Cash App charge for withdrawing money?

Cash App generally charges a fee of $2.50 for withdrawing money at any ATM. However, some ATMs may charge their fees for withdrawing cash using the Cash App debit card.

These fees are determined by the ATM operator and not by Cash App. Before making a withdrawal, it is advisable to check if the ATM has additional fees and decide whether you wish to proceed with the transaction.

It is important to note that Cash App may apply certain limitations on the amount of cash you can withdraw in a given period of time.

Security and Privacy in Cash App Direct Deposit

Security and privacy are key issues when setting up Cash App Direct Deposit. Cash App uses end-to-end encryption technology to protect your financial data during transactions.

It also offers the option to enable two-factor authentication as an additional security measure. This means that, in addition to your password, a unique verification code sent to your mobile device will be required to access your account. In addition, there are some accounts that require the Cash App PIN for added security.

Cash App constantly monitors account activity to detect any suspicious or unauthorized activity. If any unusual activity is detected, steps will be taken to protect your funds and you will be notified immediately.

References

-

“Cash Cards Work at Any ATM, with Just a $2.50 Fee Charged by Cash App.” Cash App – Do More with Your Money, https://cash.app/help/us/3087-cash-card-atm-fees#.

-

“Direct Deposit.” Cash App – Do More with Your Money, https://cash.app/help/us/1113-direct-deposit.

-

TruFinancials. Cash App Tutorial: How to Set Up Direct Deposit. YouTube, ttps://www.youtube.com/watch?v=-rUFpv50i-w.

María Laura Landino is a journalist who graduated from Boston University with more than four years of experience in the financial sector. He has been responsible for several research papers published by major universities.

Content Manager of allaboutgroup company. You will find me in job and Finance sections.