Many Cash App users have experienced a CashApp error message when attempting to view their account balance on the app, resulting in confusion and frustration, and Cash App is investigating a problem that has led to users being debited twice for transactions made with their Cash card.

Cash App has announced its commitment to refund all duplicate charges and provide relief to those affected. The Cash Card, a no-cost debit card, is linked to users’ Cash App balance, and several users have taken to social media to express their frustration over the duplicate charges. Some business owners have even urged Cash App to address the issue immediately. Cash App has promised to refund the double charges on both occasions.

hey @CashApp I work at a hotel and have had two guests call because the charge they show withdrawn from their account is double what I charged them. I have confirmed thru CC Processor that I charged correct amount. Please assist.

— Liz Muck (@lizardmuck) June 26, 2023

What is the CashApp glitch about

In the last few days, Cash App experienced a series of technical glitches that caused significant problems for its users. One of the glitches resulted in some users being double-charged for transactions made using Cash Card. This error led to many users being left out of pocket, causing incredible frustration and inconvenience.

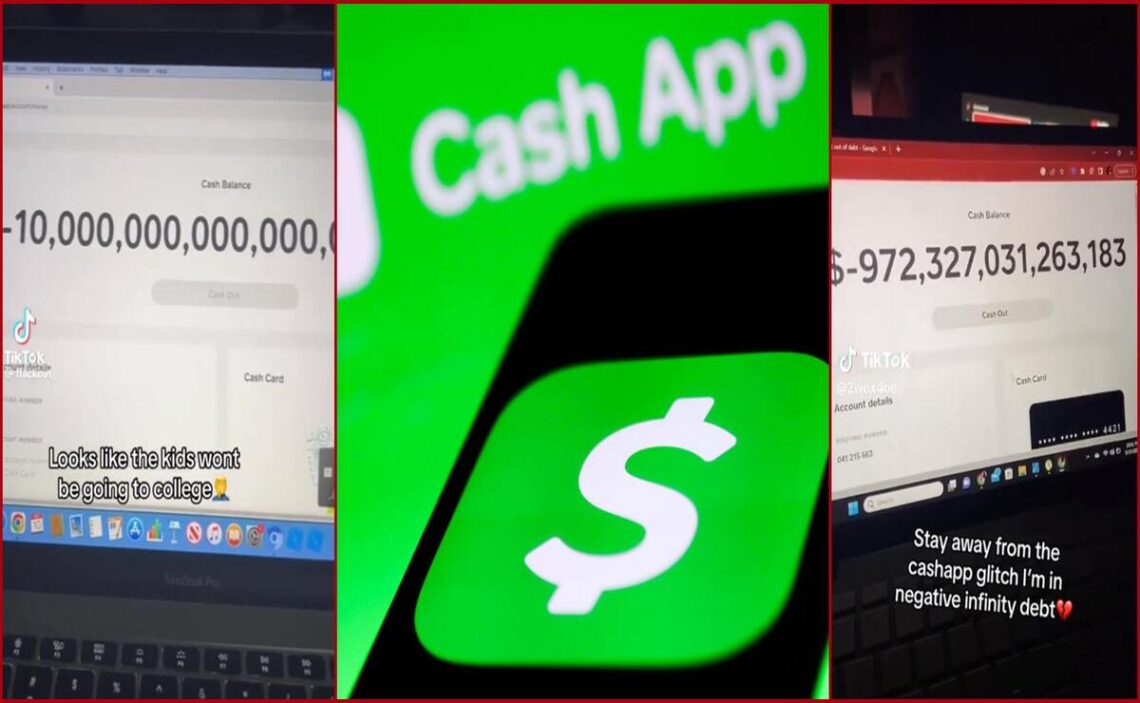

Another glitch allowed users to add large sums of money to their Cash App balance without affecting their bank accounts. This led to some users having negative balances and debt, further compounding their problems. Many users could not access their accounts due to service disruptions and outages, which led to further inconvenience and frustration.

There were also concerns about the safety of user’s personal information and money, which caused many users to question the app’s security. Despite these issues, some users exploited the glitches to earn free money. However, Cash App has confirmed that there is no way to get free money on the app through a glitch.

“We’ve identified the connection issue. It was caused by a third-party service provider, resulting in delays across Cash App. We’re coordinating with them to fully implement a fix to restore services as soon as possible. Please do not reattempt transactions at this time. Thank you for your patience.”

Some customers may be experiencing issues sending payments, purchasing Cash Card, and accessing other features. Our team is actively working on a fix.

If you encountered an error in app, please don't reattempt the action. We're working to resolve everything as quickly as…

— Cash App (@CashApp) September 8, 2023

CashApp glitches in September 2024

In September 2024, a technical issue occurred on Cash App, impacting users’ transactions and purchases, including payment transfers, Cash Card acquisitions, and Bitcoin purchases. This incident enabled certain Cash App users to allocate significant sums into their accounts without bank withdrawals.

Consequently, these users could transfer the added funds to their bank account and purchase products from online stores like Amazon or order take-out from McDonald’s. Some users of this finance app claimed to have withdrawn up to $40,000 during the exploit. Yet once the bug was resolved and Cash App became aware of these illicit hacks, these users encountered a negative balance in their accounts.

Now, numerous Cash App users are burdened with thousands of dollars in debt . By Cash App’s terms of service, if an account remains overdrawn for 45 days, Cash App will initiate measures to recover the funds, which could entail withdrawing amounts from associated accounts like credit cards, debit cards, and bank accounts. Furthermore, Cash App reserves the right to pursue legal action to retrieve any amount owed.

This will happen to people who took advantage of the Cash App glitch

In conclusion, many people have lost thousands of dollars in debt because they did not follow CashApp’s rules and tried to defraud the company. This is clearly stated in the Cash App terms and conditions. Now, the funds deposited in their accounts are automatically used to pay the overdrawn balance, which cannot exceed 45 days.

In other words, from the day the overdrawn balance was initiated until 45 days later, you have time to pay what is owed. Otherwise, the mobile payment service can withdraw the overdrawn funds from any account linked to the financial app. This also means the company may cancel or suspend the subscription and overdraft fee coverage.

The terms and conditions of the app launched in 2013 state that its users cannot cancel the payment of a transaction made with a cash card. On the other hand, as we mentioned recently, Cash App has the right to use the funds credited to your account (by Cash App or any other company associated with your account, be it a bank, credit, or debit card) to pay off the debt. It will keep taking money from you as you add money to your account until it completes paying off what you owe.

@eastoakland_1100 #fyp cashapp glitch went wrong

The worst thing that can happen is that if you have committed this illegal act, the peer-to-peer money transfer app will contact you to take legal action and bring the case to court for fraud or illegal activity. As a result, the company could agree to tax liens and notices for those who have taken advantage of this system crash to their benefit.

In this context, the wisest advice we can give you is to return all the money and admit what happened. If you bought anything with the money you received, the best thing to do is to cancel the order as soon as possible, as your credit profile could be damaged.

She has a degree in Social Communication (graduated in 2010). Arianna has experience in research and writing about universities, credit cards, procedures and insurance, among other topics related to finance in general.

With more than ten years of experience, she has worked in different local and digital media, writing on various issues related to the economy and international politics. She has also coordinated teams of editors, gaining experience in managing groups.

She was born in Merida, Venezuela. She lived in Wausau, Wisconsin, for 5 years, allowing her to learn English. Being bilingual, she also does research and writing in Spanish.

She has taken TOEFL exams and English proficiency tests (passed), so she is qualified to write texts in English.