Being such a popular mobile application for personal finance because of the opportunity to send and receive money quickly and easily, it is quite normal for many to wonder if Cash App allows you to have more than one account.

There are even those who want to know what Cash App Plus is, How to know when Cash App payment is completed, or why you can’t log in on another device with Cash App.

Indeed, this is a great platform. Whether to separate personal finances from business finances or simply to keep track of expenses, having a second account can certainly be a differential point in your economy.

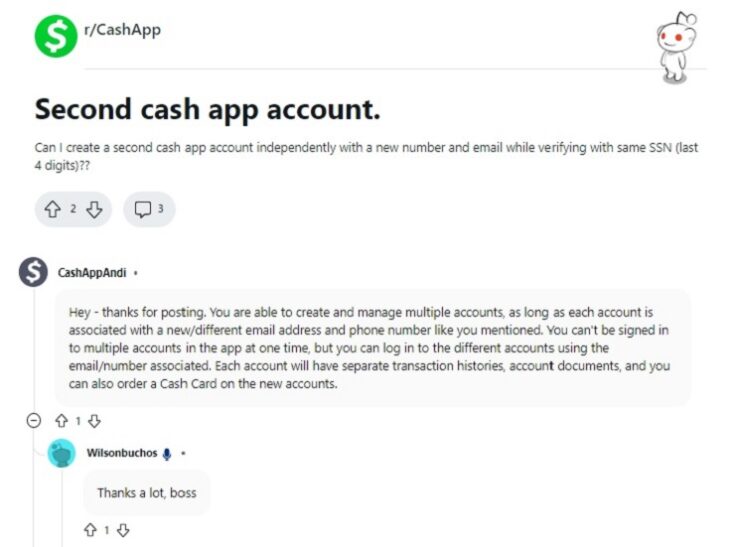

Thus, the Mobile application does allow you to have more than one account, although certain limitations and considerations must be considered. You cannot just create an account, you must follow a set of rules established by the company. This is to differentiate each of these accounts internally.

Can I have more than one Cash App account with the same phone number?

The main limitation to having a second Cash App account is that it must be associated with a unique phone number and email address. Following this, even though you may have multiple Cash App accounts, you cannot have more than one associated with each mobile phone number you have.

Undoubtedly, this limitation may seem annoying to some, but it is a solution that the company proposes to those who may intend to violate the terms of service of the application, thus putting a line that must be maintained to have a second account, which is, of course, to have a second phone number for the new Cash App account they seek to have.

What other limitations should I be aware of when creating multiple Cash App accounts?

First, each Cash App account must be associated with a single debit card or bank account. This means that if you wish to have multiple Cash App accounts, you must also have multiple debit cards or bank accounts to link to those accounts, regardless of whether you are referring to a personal or business account.

In the same way, you should keep in mind that Cash App charges a fee for each transaction made on each account.

So having multiple accounts created and using them frequently could exponentially increase what you pay in fees. This is even more than what you would pay on a single active account with several transactions.

Finally, you should keep in mind that having multiple Cash App accounts can complicate the tracking of your expenses and personal finances. If you decide to have multiple accounts, you must keep a detailed record of your transactions to avoid confusion or errors. However, this is something that will be entirely up to you depending on how you manage your personal finances.

If I have more than one Cash App account, will I be able to make more transactions?

A common question regarding Cash App accounts is whether having more than one account allows you to make more daily transactions. Well, the answer is a resounding no; having more than one account open on your mobile device will still line you up to the same amount of total daily transactions that you would have with a single account open.

This is because Cash App sets daily and weekly limits for transactions that can be made in the app, and these limits apply to each account individually. Therefore, if you have multiple Cash App accounts, each will be subject to the same transaction limits. In other words, you could further complicate how you use the account.

Instead of creating multiple Cash App accounts to make more transactions, it is recommended that you seek to increase the transaction limits on your existing account.

This is possible as long as you verify your identity and provide additional information to Cash App. Likewise, in case you make enough daily transactions, Cash App may provide you with an increase in the number of daily transactions.

Advantages of having more than one Cash App account

Although having more than one Cash App account could be detrimental, considering purely financial and transactional issues, There are several features that you could take advantage of by having more than one account, especially in aspects of order when managing your personal finances. Some of these advantages are:

- If you are an entrepreneur or have your own business, it can be useful to have a separate Cash App account for your business transactions. This way, you can keep your personal and business finances separate and organized

- If you share expenses with another person, such as a roommate or family member, having a separate Cash App account for those expenses can be helpful in keeping a clear record of who made what payment.

- If you prefer to keep your financial transactions separate for privacy reasons, having multiple Cash App accounts can be beneficial. This can be especially useful if you share an account with someone else and want to keep your personal transactions private.

- If you are an active investor, having multiple Cash App accounts can allow you to diversify your investments across different accounts and have greater control over your investments.

Are there any restrictions on the number of accounts I can have?

Cash App does not specify a limit on the number of accounts a user can have as long as the user complies with the established limitations, especially in the case of identity verification methods such as email and phone number, which can only be associated with one account.

Furthermore, kindly note that Cash App prohibits the use of multiple accounts for fraudulent or illegal activities and may close your accounts if you are found to be in violation of these rules. Regardless of whether any of these activities are related to a specific account, they will all be closed.

References

-

mrhackio. Multiple Cash App Accounts – Is It Allowed? YouTube, https://www.youtube.com/watch?v=Q-TLblDggVc.

María Laura Landino is a journalist who graduated from Boston University with more than four years of experience in the financial sector. He has been responsible for several research papers published by major universities.

Content Manager of allaboutgroup company. You will find me in job and Finance sections.