In the United States, and in the United Kingdom, it is very common to find that the “mobile payment” method offered by platforms such as CashApp is accepted in more and more places. It is becoming a quick and easy way to move your money from one place to another.

When you manage to register and verify all your personal, domiciliary, and financial data in the database, you automatically get an unlimited virtual account. This way you can exchange personal and business funds and even invest in stocks or cryptocurrencies.

Can I send money to my account on this app?

Since this application was launched in October 2013, it has gained almost 80 million users in both the United States and the United Kingdom, users to which it has guaranteed a secure and convenient means of transferring and receiving monetary funds.

Of course, there are two types of accounts with which you can participate and make use of the tools and mobilization methods provided by CashApp. Those are verified and unverified accounts. Although they are not perceptibly different, they have clear and marked differences.

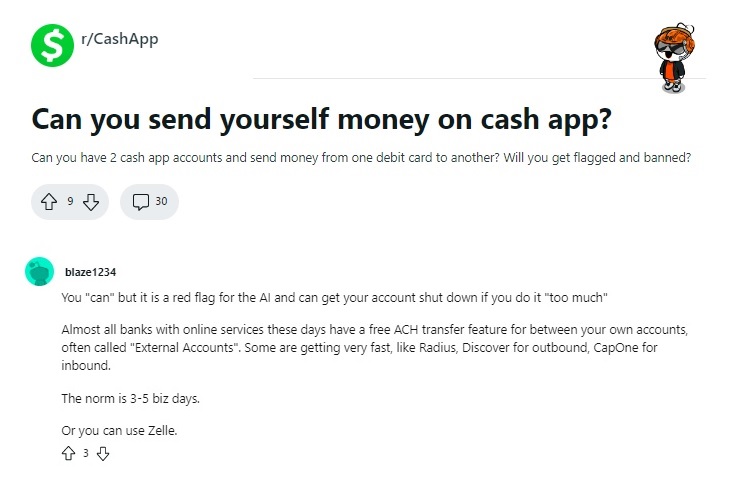

That is precisely where the answer we are referring to in this opportunity comes from since to be able to transfer money to another account you own, you should have 2 users registered in the CashApp database. This is possible, but the alternate account would end up being unverified.

Basically, it is totally possible to affiliate another CashApp account to your name and send money to it in real-time without any inconvenience. You just need to log in to the app, access the “$” option, and enter the amount to transfer along with the email and phone number intended.

You can proceed to choose a reason or motive for the payment and finally select the “pay” option. All you have to do is verify that the balance was correctly debited from your account and that it has been received without any inconvenience from the other side.

Of course, you must consider the limitations that an unverified account may have, specifically regarding the maximum amount it can send and receive. In the case of unverified accounts, they can only move up to $250 per week without being blocked or held.

Can I affiliate my bank account to my CashApp account to transfer funds?

Similarly, if what you are looking for is not precisely to move money from your CashApp account to another account in the same application, but to your bank, it is also possible. In fact, it is one of the main settings that you can find in the options menu in the mobile application:

- Log in to the CashApp website or app on your phone or tablet

- Access your account using your registration data: username and password

- When you get to the main sale you must click on your profile picture or on the bubble that takes you to the profile settings

- Select the second option displayed in the menu, which has the name “linked banks”, this is where you can add your bank accounts or credit or debit cards

- When you click “Continue” you will be shown a brief set of terms and conditions that we strongly recommend you read

- Choose the bank or card you have and want to affiliate with your CashApp account and proceed to enter the access data

- Subsequently, they will request a verification code that will reach the phone number or email to confirm your identity

- If you have complied with the security parameters, CashApp will allow you to confirm the affiliation of your bank account

- Click the “continue” option and you will have completed the account linking process

Automatically after linking both accounts, you will be able to send and receive money easily between both accounts. Remember that to have the option to link your bank accounts to your CashApp, your user or profile on the platform must be fully verified.

If I send money from CashApp to my bank, will it be received immediately?

This question may be a common one among new users of this application since the CashApp financial platform handles two types of payment methods. Specifically, we are talking about “standard” and “instant” sending.

Both are perfectly visible when you want to pay and both fulfill the same function of moving the money to where you want it. However, they are the determining factor in how long it will take for the transferred amount to reach its destination: your bank account.

[wpdatatable id=336]The standard transfer is usually the default option, in which the processed money will take between 2 and 3 business days to reach the bank affiliated with the account. This is clearly stated in the terms and conditions of the application when you first register your account.

On the other hand, we find instant remittance, which, as its name suggests, bases its activity on payments being processed immediately. Contrary to standard shipping, when you select this payment method, you will not have to wait the established 3 days.

However, because it is not a regular channel, an interest fee is required for using the instant payment method. This typically requires a fee of 1.5 or 2% of the amount to be mobilized or transferred in case you have made a transaction to a bank account.

In case you have made a balance transfer from CashApp to a debit card and you have selected the instant method, the fee will be 3%. The interest amounts will be displayed at the time of the transaction.

What happens if after 3 days the money does not land in my bank account?

It is rare for this type of case to happen. However, in case you do not see the sent balance in your bank account, you should call the CashApp customer service number. Which is 1- 800-969-1940, remember that operators work from 9 am to 7 pm Monday through Friday.

References

-

“Add Cash.” Cash App – Do More with Your Money, https://cash.app/help/us/en-us/1106-add-cash.

-

“Can I Send Myself Money On Cash App? Here Is An Explanation.” All-in-One Solution At One Place | Support, https://www.contact-customerservice.co/blog/can-i-send-myself-money-on-cash-app/.

-

Langdon, Amy. “Can I Use Cash App To Transfer Money To Myself?” Money Task Force | The Ultimate Personal Finance Blog, Money Task Force, https://www.moneytaskforce.com/money/can-i-use-cash-app-to-transfer-money-to-myself/.

-

Norris, Andrea. “How To Transfer Money From Your Cash App To Your Bank Account | GOBankingRates.” GOBankingRates, GOBankingRates, https://www.gobankingrates.com/banking/technology/how-to-transfer-money-from-cash-app-to-bank-account/.

-

“Reddit – Dive into Anything.” Reddit – Dive into Anything, https://www.reddit.com/r/CashApp/comments/l12idv/can_you_send_yourself_money_on_cash_app/.

-

support. “Can I Send Myself Money on Cash App? What Research Reveals?” What Is Cash App Customer Service? Solve Your Issues, https://www.square-cash-app.com/blog/can-i-send-myself-money-on-cash-app/.

María Laura Landino is a journalist who graduated from Boston University with more than four years of experience in the financial sector. He has been responsible for several research papers published by major universities.

Content Manager of allaboutgroup company. You will find me in job and Finance sections.