Capital One is a bank holding company that helps make it easier to manage loans or bank accounts, facilitating the economic life of Americans. However, there is a possibility that the beneficiary may want to cancel their account for the credit card service; but how does one cancel the Capital One card?

A credit card helps customers pay for a product with money they may not have on hand at the time. A credit account consists of the bank lending credit to the customer, who agrees to make monthly payments. However, a credit account can lead to future debts due to overdraft funds, so it should be handled cautiously.

Things to consider about Capital One before closing to cancel your card

When setting up a checking or savings account, you can research the banks that best suit your needs. Capital One is the tenth-largest bank in the United States today.

Capital One is one of the few banks that provide the ability to set up checking or savings accounts without charging beneficiaries any fees or credits for making transfers or banking online.

All Capital One accounts are currently managed online, which means that customers can control them via the website or app and thus manage banking operations more conveniently. However, there are still branches where one can ask for help from the bank and operate their bank accounts.

Capital One accounts do not require any minimum balance to open them and offer high profitability and no commissions. Interest rates exceed the average of the banking entities, offering savings or checking accounts the opportunity to multiply the usual profitability.

With the ability to generate an account online, comes the option of reimbursing the balance with the online card; these debit cards are free, as well as being able to withdraw cash at any Capital One ATM for free.

Capital One credit card

A credit card account allows you to pay back the money spent on the card after some time. The interest on the credit card is 13.24%, 18.24%, or 23.24%, depending on the customer’s creditworthiness. The date for paying the card is 25 days after the close of the billing cycle.

No interest is charged on new purchases as long as the previous balance is paid in full before the credit expiration date of the month. If a credit advance is desired, interest will be charged from the date of the transaction, which usually amounts to 3% on advances.

There is also a late payment fee; this interest can be as high as $35. Capital One credit cards are used to pay bills, write checks, or send and receive money by Zelle. It can be managed through the app with the virtual card to make purchases without using the physical card.

Rewards are also accumulated, which can be redeemed from the app by searching the rewards history. A card can be canceled from the mobile app or the website.

Canceling the Capital One card

The Capital One account can be canceled online on the website but cannot be closed from the application. What you can do is block the credit card from the app.

Canceling the card from the app

From the application, you can see a tab in the menu that says “I want to”; you will see an option that says “lock card” with the symbol of a padlock; tap it.

A tab will appear on the screen where you must verify that you want to lock the card. When you confirm it, it will be automatically blocked, and you will not be able to use it.

Canceling the card online

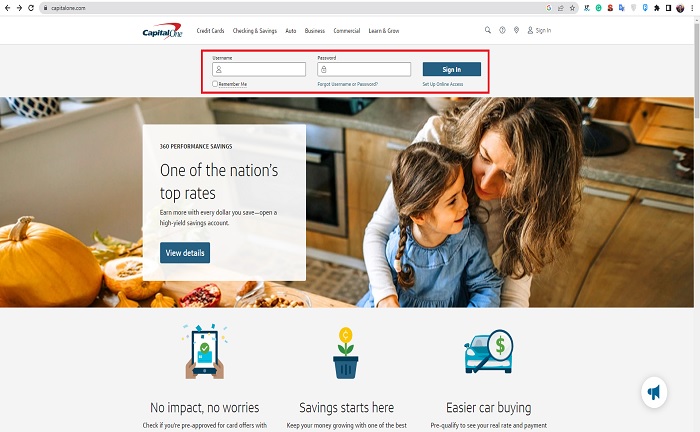

Enter your username and password to block the card from the Capital One website.

Look for the option “Services and account settings,” there, look for the tab that says “Manage credit card,” and then the option “block your card” will appear; follow the steps provided by the bank, and it will be blocked automatically.

Canceling the account

If you cancel the card, it does not mean you are canceling the credit account; it simply means you cannot use it. Now, canceling an account does mean terminating the relationship with the bank. There are three different ways to close a credit account.

From the Web

You must access the website and enter your username to cancel the account.

When the account you want to close appears, click on the option “I want to…” and the option “close account” will appear; then follow the steps requested by the bank, and you are done.

From the telephone

Another way to cancel the account is to call the bank, specifically 1-800-227-4825. The Capital One service agent will ask you to answer a series of questions to verify that you own the account and guide you through some steps to close the account.

Some of the questions you will most likely be asked are the last four digits of your social security number, account number, and credit card number. If the customer is not in the United States, you can call +1-804-934-2001.

Via email

The other way to close the account and thus cancel the credit card is by email. You need to write a letter to Capital One explaining that you want to close the account; in the mail, you must attach the pertinent data such as the account number, card number, social security number, and digital signature.

Capital One must reply to the mail verifying that the account is closed.

References

-

“How to Close a Credit Card Account | Capital One Help Center.” Capital One, https://www.capitalone.com/help-center/credit-cards/close-your-account/.

María Laura Landino is a journalist who graduated from Boston University with more than four years of experience in the financial sector. He has been responsible for several research papers published by major universities.

Content Manager of allaboutgroup company. You will find me in job and Finance sections.