Pay scheduling is crucial for employees as it directly impacts their financial management. Traditionally, employees had to wait for their scheduled payday to receive their wages, which could lead to financial difficulties if unexpected expenses arose before payday.

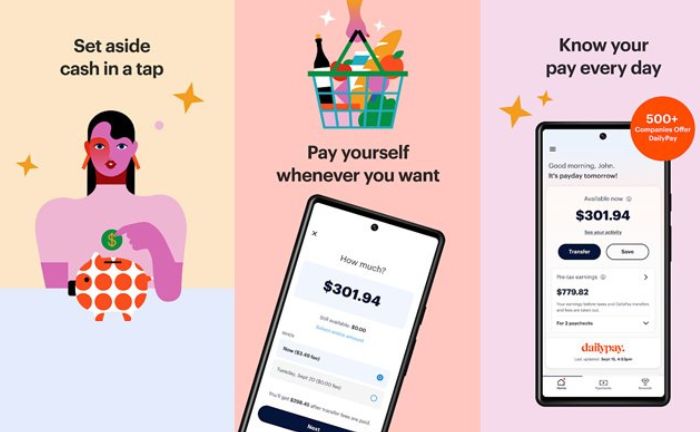

DailyPay allows employees to access their earned wages before their scheduled payday. This means that if an employee has already worked for a certain number of days in their pay cycle, they can access that portion of their salary immediately rather than waiting for payday. It can be particularly beneficial for employees living paycheck to paycheck, allowing them to access funds when needed.

What is DailyPay and how does it work?

DailyPay is an innovative pay service that allows employees to access some of their earned wages before their scheduled payday. This service mainly benefits employees who rely on each paycheck and may need funds before their next payday.

To avail of DailyPay, employees need to register via their employer. Once enrolled, they can receive a portion of their earned but unpaid wages at any time using the DailyPay mobile app. The app facilitates the transfer of the requested funds to the employee’s bank account or prepaid card, typically within a 15-minute window.

Each transaction incurs a nominal fee deducted from the employee’s paycheck. The withdrawal limit for an employee is determined by the number of hours worked and the salary earned but not yet paid.

On the arrival of the next scheduled payday, the employee receives the balance of their salary minus the funds already withdrawn through DailyPay.

Advantages and disadvantages of DailyPay

Like all services, DailyPay has pros and cons that should be carefully evaluated before using this application. By doing so, you can ensure that the app meets your needs and avoid any potential dissatisfaction.

Pros

- Access to wages already earned but not paid out can help cover unforeseen bills or expenses before an employee’s regular payday.

- The fees charged per transaction tend to be lower than what one would pay for an overdraft or payday loan.

- Funds are transferred electronically to the employee’s bank account or card quickly once a withdrawal is requested through the app.

- The service provides employees more control over when and how much of their pay they receive.

Cons

- The fees charged add up over time, especially for frequent users.

- Employees risk withdrawing more than earned, which could cause issues when their entire paycheck arrives.

- The app requires a smartphone and bank account, which not all employees have.

- Implementing the service involves integrating it with employers’ payroll systems.

- Withdrawing wages early can interfere with budgeting and saving goals.

What is the difference between DailyPay Pay Balance and Reported Earnings?

Reported earnings refer to your gross pay that your employer has reported to DailyPay for the current pay period. This is the total amount of money you’ve earned before any deductions.

On the other hand, your Pay Balance is a portion of your reported earnings after subtracting taxes, deductions, and any other withholdings such as garnishments. This amount is available for you to transfer to your debit card, payroll card, or bank account.

What does “Transferred early” means?

The “Transferred early” amount refers to the money you have already transferred from your Pay Balance, which has been deposited into your debit card, payroll card, or bank account.

What time does DailyPay send money?

DailyPay provides two convenient methods for accessing your money: Instant transfers for immediate access to your earnings and Next Business Day transfers for those who can afford to wait a bit longer. The choice between these two methods depends on your individual needs and situation.

Instant transfer

With the Instant transfer feature, you can immediately access your earnings at any time of the day. This service is available around the clock, every day of the year, including weekends and holidays.

That means you can instantly transfer your earnings from your Pay Balance to your bank account whenever needed.

Next Business Day

the Next Business Day transfer feature lets you receive your funds on the next business day. The timing of your transfer request is critical in determining when you’ll receive your money.

If you initiate a transfer before 5:30 p.m. Eastern Time (ET), your money will be transferred to your bank account on the next business day. However, if you make the transfer request after 5:30 p.m. ET, the transfer will be completed on the subsequent business day.

How to transfer from DailyPay to an employee’s account

Following this step-by-step process, employees can conveniently access their earned wages when needed, empowering them with greater financial control and flexibility through DailyPay’s secure and efficient fund transfer system.

- Employees enroll in DailyPay through their employer and securely link their bank account or prepaid card to the DailyPay app.

- When employees want to access a portion of their earned but unpaid wages, they log into the DailyPay app and specify the desired deposit amount.

- DailyPay verifies the requested amount by cross-referencing it with the employee’s worked hours and pay rate.

- Once the requested amount is verified, DailyPay initiates an electronic funds transfer from their bank to the employee’s linked account or card using the Automated Clearing House (ACH) network.

- A transaction fee, a percentage of the deposit amount, is deducted by DailyPay from the employee’s remaining pay.

- The funds are deposited directly into the employee’s bank account or card within 15 minutes. However, the deposit time may vary depending on the employee’s bank.

- On the scheduled payday, the employee receives their entire paycheck, which is reduced by any funds accessed through DailyPay deposits.

What are the DailyPay transfer limits?

Employees can transfer up to 100% of their pay balance, with a daily limit of $1,000, and receive the money quickly.

How do DailyPay transfers work in Nevada?

Recent changes to regulations in Nevada have led to modifications in the transfer process for DailyPay users in the state. Now, Nevada customers can make one instant, fee-free weekly transfer, allowing immediate access to earnings. All transfers that take 1-3 business days are also free and unlimited.

These changes, implemented in response to new state regulations, are part of DailyPay’s commitment to keeping its customers informed and updated about any alterations affecting how and when they can access their earnings. Your reported earnings and Pay Balance are different because they represent various aspects of your income.

References

- “Frequently Asked Questions – DailyPay.” DailyPay, https://www.facebook.com/dailypay, https://www.dailypay.com/frequently-asked-questions/#:~:text=Our%20software%20uses%20an%20algorithm,other%20withholdings%20such%20as%20garnishments.

- “On Demand Pay Solution to Recruit, Engage, Motivate and Retain Employees.” DailyPay, https://www.facebook.com/dailypay, https://www.dailypay.com/dailypay-solution/.