The U.S. supermarket chain Food Lion was one of the first businesses to accept Apple Pay. This company decided to install Nier Field Communication (NFC) payments when different phone technology companies embarked on this new payment method.

Chiefs on the path of excellence

One of the most important aspects to be considered by company directors is keeping up with what is new in their market, the competition, and checking out the latest trends. We could add listening to customers and identifying what they need to achieve to improve their market share and customer loyalty.

As Greg Finchum, vice president of retail operations, commented at a press conference, “Customers asked us to make grocery shopping easier and more convenient, and this new payment process is another way we are helping our customers speed through the checkout line.”

After paying close attention to their customers´ opinions, Lion Food’s management decided to invest in helping solve the payment problem, so they set out by installing Near Field Communication or NFC.

Apple Pay and other NFC

Certainly, the Apple Pay system needs an iOS 11.2 processor to activate on Apple equipment. However, an investment in NFC equipment is necessary to accommodate customers such as legal businesses or companies since they would not simply receive a confirmation iMessage for their transactions as a natural person would on their phone.

What are NFCs, and how do they impact Apple Pay transactions? Simply put, near-facilities communication is the technology used to achieve wireless communication to send or receive data from devices that are within a short range.

The Apple Pay payment method for businesses works by exchanging data, such as wireless cash. The customer places the cell phone on top of the store’s point of sale, reads the final bill, deducts the money from the customer through NFC payment, and sends the exact amount to the store’s payment system.

Always thinking about costume service first.

Due to the comments and feedback from customers, Finchum shares that “We’re excited to introduce mobile payment options for our customers at local Food Lion stores” by installing the new payment methods in its 1,100 U.S. stores.

Benefits of Lion Foods taking Apple Pay

As a developing technology, some businesses are cautious before incorporating this payment method. However, Food Lion studied the benefits of using this payment system for the company and its clientele.

Security

The feeling of security and comfort is key for the customer, thanks to the fact that the Apple Pay Cash system does not need any card or identification, only the cell phone or Apple Watch, creating convenience at the time of payment and also decreasing the possibility of theft of bank-owned payment instruments.

In addition, it is directly linked to an iCloud, so it automatically verifies that the money belongs to the person who is paying, helping to reduce fraudulent transactions.

Market competition strategy

Market competition is important to follow up, to constantly discover alternatives that position the business as a more attractive option to the potential market.

The more comfortable and satisfied the customer feels, the easier it will be to create a bond with the brand, ensuring loyalty when choosing where they want to buy their food.

Allowing customers a wide range of payment methods, which not all businesses use, makes Lion Foods more attractive. It is important to remember that the customer experience is everything.

Apple Pay is a convenient and simple option that can create the customer-business link that sets it apart from other supermarket chains.

Fee

Businesses must charge an extra fee per transaction upon using some payment platforms and methods, such as paying by credit or debit card, which the bank requires. Thus, there will be a slightly higher expenditure per product.

Apple Pay Cash does not charge this bank fee. Therefore, no additional money will be deducted besides the products’ worth.

Reduce possible contagious of COVID-19

The COVID-19 pandemic has made us more cautious about physical contact, and a store’s hygiene strategies can make or break a smooth customer experience.

Because of Apple Pay´s contactless technology, the customer does not have to hand over or receive anything; it eliminates physical contact and the risk of contamination for the customers and the cashier personnel.

Other payments at Food Lion

Food Lion is committed to the integration of mobile and digital technology in its stores, so not only has it added Apple Pay to its system, but also Android Pay and Samsung Pay options so that customers can pay from the comfort of their homes or experience an improved checkout process in the stores.

Additionally, Food Lion has integrated chip and pin cards in all its stores to provide another alternative to NFC and classic payments, achieving more convenience and a wider range of options for its current and potential customers.

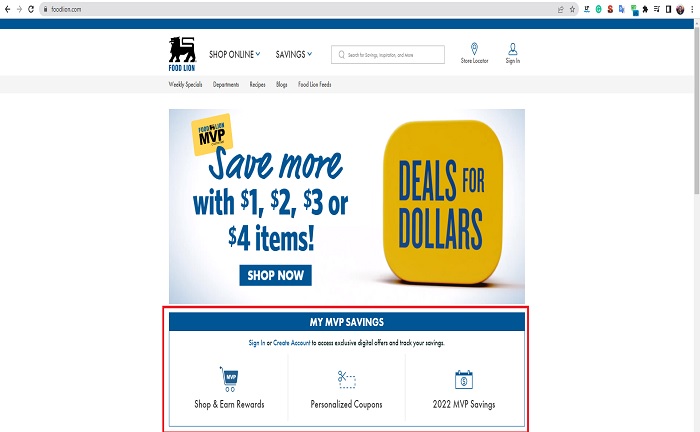

They have also created a partnership with Instacard; customers can use it online and in stores and earn discount coupons deposited on Instacard and used on their website.

As we can see, Food Lion is committed to improving the experience in their online and physical stores and helping their clientele find the most convenient method tailored to their financial habits.