Having an American Express credit card with a lower credit limit does not mean you will not be able to change it in the future. Many users choose to ask American Express to increase their current credit by up to 25%.

However, there is the option to upgrade your card. That is, changing the card entirely into a better version with added benefits and a different points system.

Upgrading to a better card is not just about having a higher credit limit; each card has its own benefits, enrollment, and rewards system, according to AmEx. The user could either ask American Express for a new card and keep the current one or upgrade the current one to another category; both options are valid.

How do I upgrade my Amex credit card?

There is a process to follow to upgrade your credit card, but it is not complicated. You must call the number on the back of the card; then when customer service answers your call, inform the agent about your request to change the card or purchase a new one.

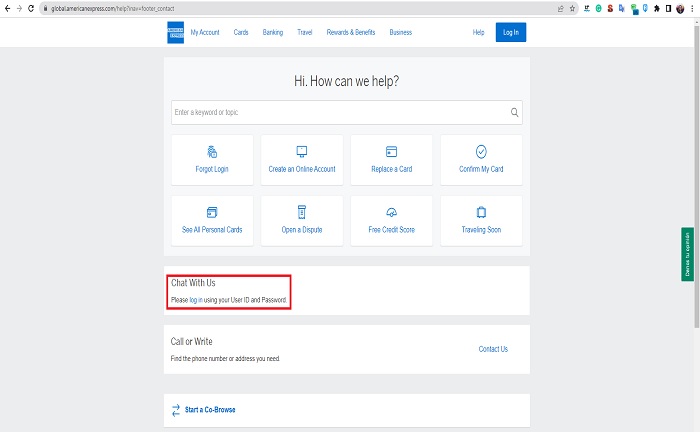

Another option available to make the request is through the web page using the Live Chat tool, where you can send messages to an agent, and they will answer you that way. However, you must first log in with your username and password.

American Express may email the user when it deems appropriate to assign a higher category card, even without the user making the request beforehand.

The email may be answered with questions or the customer’s decision about whether they are interested. Similarly, the user may receive a phone call from AmEx offering to switch cards.

Does upgrading My AmEx card affect my credit score?

No. When you upgrade your card to a better card, the points system that was available on the old card is also transferred.

The bank needs to perform the approval of the previous credit, so it needs to review all funds, including the point systems obtained. Therefore, the credit score is not affected when changing the card.

If the current credit card account is in good standing, American Express will automatically transfer the old credit line to the new card.

Why is upgrading my AmEx credit card a good decision?

When you want to obtain another credit card, there are two options: apply for a new one or ask to upgrade your existing one to a better one. Each option has several benefits; the choice will depend on the person’s wants. Here are some of the benefits of switching cards.

You don’t have to give another credit check

When changing the existing card for a higher category, there is no need to open a new account, the current one is enough, so there is no need to make a formal application for the process.

Because of this, the user does not need to perform the existing credit check, i.e., American Express will not ask for the bank status, the amount of monthly salary earned, and other relevant bank details.

It’s easier to be approved when you are already an AmEx user

Since the user is already an AmEx customer, they are more likely to be approved than if they apply for the same card from scratch.

This happens because the customer gains credibility and generates more security for the bank. Of course, it is essential that the user pay on time and be responsible for the secure approval of the new card.

Your annual percentage rate won’t change

An open account allows the user to keep their current credit limit and annual percentage rate. However, if the user wishes to obtain a higher credit limit than the existing card, this can also be requested from American Express when requesting the card change.

Recommendations

Requesting a card upgrade to a higher category is simple. It is recommended to read beforehand and be informed at the time of the request, so as not to run the risk of being denied by American Express.

Review your responsibility and punctuality of payment in the last months

Your credit account must be in the best possible state at the time of your application; the bank will see your current status and payment history.

Therefore, if you want to make an upgrade, it is advisable to review your history with the existing card or perhaps postpone the application to be aware of the following month’s payments.

Combining both annual tuition payments

It is advisable to make the card change with the card’s annual fee payment; if the application is made 1 or 2 months before the next card’s yearly fee charge, it’s likely that the system will automatically combine the two fees, and you will not have to pay twice (for the old card and the new one).

Review your Membership Rewards Program status

Another suggestion is to keep track of the Membership Rewards Program system and the Cashback so that the points earned on the old card are transferred to the new credit card.

Be an AmEx user for at least one year before requesting a change

Another tip is that it is pertinent to wait at least one year of card use before requesting a change of category.

This is because American Express may reject the request if there is not a solid history that can be studied so that they can decide if the person can change their card for a better category. Perhaps the user is qualified, but the application may be rejected simply because there is insufficient data.

References

-

Crail, Chauncey. “Should You Upgrade Your Amex Card? – Forbes Advisor.” Forbes Advisor, https://www.forbes.com/advisor/credit-cards/upgrade-amex-card/.

-

“Upgrade | Business Platinum Card | American Express CA.” American Express Credit Cards, Rewards & Banking, https://www.americanexpress.com/en-ca/business/credit-cards/business-platinum-card/upgrade/.