Saving money can be difficult, especially for young people, but with financial apps, this will no longer be a problem because you can control all your expenses and keep track of what you buy, the money you pay, receive, and much more.

The use of financial apps is straightforward. You have to be of legal age to use some of these platforms, which are not allowed to be used by minors, although some, such as Cash App, do have the option to teach finance to children.

In 2020, with the arrival of the pandemic, digital finance platforms became an effective and necessary tool to pay for different expenses. Among them are 5 financial apps you should have on your cell phone to keep track of your finances.

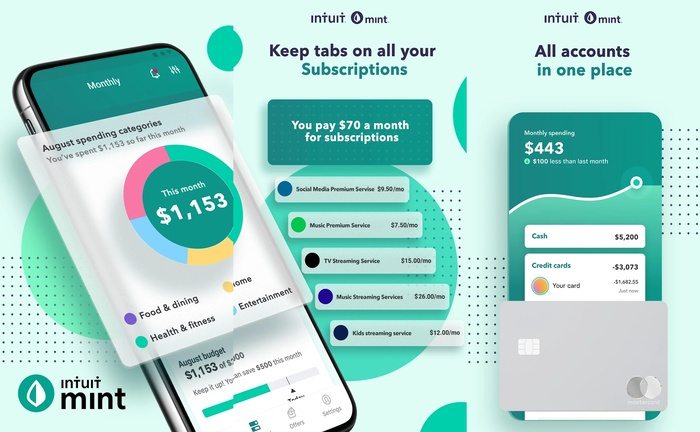

1. Mint

With over 30 million downloads, this digital payment app is top-rated among Android and iOS users with bank accounts since it links directly to the Mint user. Thanks to its tracking capabilities, credit, and debit card movements can be monitored, and the user can keep track of their spending and thus improve their finances. In addition, there is no cost to download, and it has a function that allows you to access your credit profile, so you can know what you need to change to improve your finances.

2. Everydollar

This budget app is one of the most popular and has been chosen by Android and iOS users due to its practicality and ease of use when organizing personal finances. More than 10 million people have downloaded this app that allows you to control your expenses thanks to the budget functions that help you manage your finances. Everydollar will tell you exactly how to achieve your financial goals after you set them. In addition, you will receive encouraging messages to help you achieve your short-term goals and learn how to save and manage your money.

Your income is your most important wealth-building tool. As long as your money is tied up in monthly debt payments, you can’t build wealth.

It's time to ditch the payments—because the sooner you're debt-free, the sooner you can start investing and the more wealth you can build.

— EveryDollar (@EveryDollar) October 17, 2022

3. PocketGuard

Control your personal finances to keep track of every move you make. The ideal finance app to control budgets and keep track of monthly, weekly, and daily expenses. PocketGuard takes care of your pocket with a special meter that calculates the difference between earnings and expenses. If it is positive, you are on the right track, and if it is negative, the money control platform will help you improve your finances. That will help you balance your transactions so that you don’t spend more than you earn.

4. You Need a Budget

Also known by its acronym “YNAB“, this financial system offers 4 essential rules for its users to save and improve your financial future and keep track of all your expenses. On the one hand, it allows you to give a value to every dollar you earn to divide your expenses rationally, for example, Christmas shopping or monthly utility payments. On the other hand, it encourages you not to feel bad if something doesn’t go as expected since it is entirely possible. Finally, they will help you grow your money and achieve your goals.

@ynabofficial The top 3 best budgeting apps for 2023. #budgeting #budgetingapps #budgetingtips #budgetingtiktok #ynab #youneedabudget

5. Personal Capital

With this online financial advisor, you can access professional help that follows each case individually so that the user can plan a personal financial strategy and achieve the proposed goals. In addition, users can access different tax portfolios, monitored by specialists, who will be aware of the transactions and the possibilities of increasing and making the most of every dollar in the account.

She has a degree in Social Communication (graduated in 2010). Arianna has experience in research and writing about universities, credit cards, procedures and insurance, among other topics related to finance in general.

With more than ten years of experience, she has worked in different local and digital media, writing on various issues related to the economy and international politics. She has also coordinated teams of editors, gaining experience in managing groups.

She was born in Merida, Venezuela. She lived in Wausau, Wisconsin, for 5 years, allowing her to learn English. Being bilingual, she also does research and writing in Spanish.

She has taken TOEFL exams and English proficiency tests (passed), so she is qualified to write texts in English.