When retirement arrives or the time is near, it is common to doubt how long your savings will last accurately prepare you. Knowing this information is not as simple as you might think; there are many factors at play that will determine the outcome.

Situations such as inflation, investment performance, unforeseen expenses, and other situations can affect the longevity of your savings. The most efficient option you have to know the approximate is to use a retirement savings calculator.

Keys to Extending Retirement Savings

For many people, retirement living is not an alternative; it’s simply not enough money for their lifestyle. A useful guide is a calculator designed to calculate how long your savings will last, considering all the variables.

However, you have a lot of responsibility in making the money stretch as far as possible to enjoy it for many years. To that end, some general rules of thumb have been developed to explain how to withdraw savings and make them yield longer wisely.

4% Rule

It is an alternative taken from research by William Bengen, who found that investing 50% of your money in stocks and the rest in bonds gives you a better chance of withdrawing a 4% adjusted annual savings for 30 years.

You can extend this time depending on the performance of your investment. In short, during each year, you will withdraw only 4% of your savings. In each year, you will also start an adjustment depending on inflation at the time.

The 4% rule has been proven in some of the most complex financial markets in the United States. It was even applied during the Great Depression, with 4% being the safe withdrawal rate. It is one of the alternatives where the probability of success is higher.

Income floor strategy

It is an option to ensure you don’t have to sell your stocks when the market is down. It also helps you to maintain your retirement savings in the long term.

Its operation is simple; to begin with, you must calculate the total dollar amount you need for your basic expenses, i.e., food and housing. You must be sure that these expenses are covered by steady income such as Social Security with an annuity or bonds.

Having the security of such income means you can leave your savings invested in taking care of discretionary expenses.

Dynamic Withdrawals

Although the 4% rule is successful, it is also one of the most rigid options. That’s why financial experts are constantly looking for new methods to increase the chances of success, especially when you require the money to have an extended duration.

With the dynamic withdrawal strategy, you can adjust to the investment returns by reducing withdrawals in the years when the investment returns go down. When the market returns increase, you can withdraw more money.

To implement this strategy, you may need the help and advice of a financial agent to understand when it is time to withdraw funds and when to wait.

How does a retirement savings calculator work?

It is impossible to know what will happen in the future. However, the mission is to have the best possible vision. When you get your retirement, it is common for you to want to know the approximate time in which you will be able to enjoy the savings obtained during so many years.

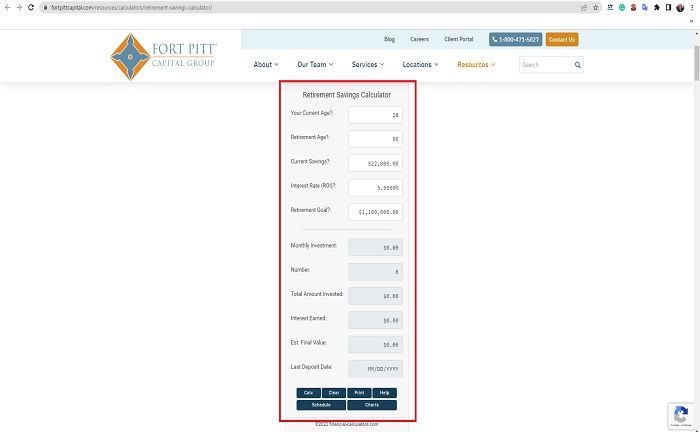

For this, there are different calculators on the internet, such as Fort Pitt Capital Group. You must enter basic information such as the age at which you retired, the amount of savings, and the approximate total amount you need for your monthly expenses, among other details.

Based on this, the calculator will do the corresponding operations and indicate the approximate years you can live on these savings. It is a planning tool to determine the measures you will use once you leave your job.

These calculators usually make assumptions about information that is complicated to know exactly. They might take approximate data such as:

- The increase in inflation over the next few years

- The increase in income if you are not yet of retirement age. They will estimate when it might increase

- The rate of return

What should you consider in your savings duration calculations?

From the moment you retire, many facts can change over time. Some of the most common are monthly medical expenses, rent increases if you don’t own a home, unforeseen needs, and additional sources of income.

Experts recommend that you adjust to your needs. You should know what your basic mandatory expenses are each month, and based on that information; you will be able to evaluate if it can be adjusted or should be kept that way for a longer period.

María Laura Landino is a journalist who graduated from Boston University with more than four years of experience in the financial sector. He has been responsible for several research papers published by major universities.

Content Manager of allaboutgroup company. You will find me in job and Finance sections.