Wanting to study in a college for some may be an unattainable goal, but what if you know what the final amount is when you subtract the economic benefits that don’t require COA payback? The amount to invest is reduced, and it doesn’t seem so tireless, right?

So don’t get discouraged; just do your homework and do a thorough research. This allows you to explore all the economic possibilities. Furthermore, every college has different policies, so don’t sit on your hands if a college education is one of your big goals.

What is the net price for college?

Do you already know how much your next few years of college will cost? In case you don’t have an idea, many students pay less than the actual cost that colleges publish on their official websites. This is because that amount is the total amount without deductions for scholarships and grants.

But if you already know all that and you don’t know the term used to designate the amount that remains after you subtract those benefits from the college’s cost of attendance in a year, you should know that it is called net price.

This amount varies according to the particular case of each student since the amounts designated by grants and Scholarships are different based on their conditions. This is because, for the awarding of financial aid, they take into consideration characteristics such as:

- GPA

- Special talents

- Annual family income

Keep in mind that the net price is the result of the deductions of all those economic supports that you receive and that you should not repay or cover with some work. Therefore, loans are not taken into consideration in this calculation.

NET COLLEGE COST:

15 Cheapest vs. Priciest FBS Schools

(Avg. Net Price Paid)College costs are skyrocketing, but in a world with lots of financial aid, what is the average real price paid?

Here are the 15 CHEAPEST and the 15 MOST EXPENSIVE schools (among FBS) in terms of… pic.twitter.com/82Ln9sZPSx

— Tony Altimore (@TJAltimore) July 17, 2023

How do you know your net price?

You don’t have to crack your head calculating your net price. Fortunately, most universities have a calculator that allows you to know this amount. While it will not always be 100% accurate, it will be a great help in managing an estimated amount.

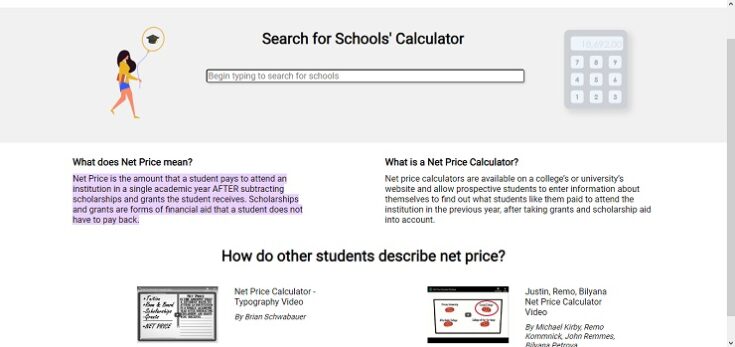

If you have not decided on a particular college, on the official website of the U.S. Department of Education, in the Net Price Calculator Center section, you will be able to access the tools of all the universities in the country.

Some websites will offer you a counseling service to make your estimate more accurate, but basically, all of them handle a similar questionnaire:

- Whether you intend to apply to a financial aid program

- Location

- Type of residence needed

- The financial situation of the parents or person making the payment

Depending on the college, you will have to provide less or more information, but all of them are estimates and based on the accuracy and consistency of the data you share. Here, you can review three different tools that will help you get an idea of what the approximate amount of your future net price will be:

- Harvard Net Price Calculator

- American College of Healthcare & Technology Net Price Calculator

- American Academy McAllister Institute Net Price Calculator

Are net price and total cost of attendance the same (COA)?

No; although it can be confusing, they are not the same. The net price is simply the amount between the subtraction of the cost of attendance and all the financial aid for which you don’t have to pay back.

On the other hand, the COA has to do with all the expenses that you must cover when you enter college, such as fees, supplies, and insurance. This also includes the cost of the possible residence where you will live, as well as your personal expenses, such as:

- Transportation

- Leisure time

- Books and the like

Another difference with the net price is that the COA does include student loan fees, as well as miscellaneous expenses.

Something that you should consider is that several universities mention the term “net cost” on their website, and it can be even more confusing. However, this is the final result of subtracting all the expenses you have to pay, including loans.

How do you calculate the net price?

As I said, there are many virtual calculators that will help you calculate this amount, but all from an approximation. Besides, the amounts will vary according to the college you want to enter since not all of them have the same annual fees and tuition.

If you would like to know if there is a specific formula, the reality is that each university takes into consideration different aspects of the financial information you provide.

Although some use the same system. However, the reality is that it will help you not to get discouraged since you will see that what you have to pay is not so much.

How much is a COA?

First, it is crucial for you to know that federal law requires all schools to publish their estimated costs for a one-year period. So, even then, the amount is not exorbitant, even if it is only an approximation.

In addition, it is necessary that you know that this amount includes direct expenses such as the payment of the credits that you are going to enroll in the academic period. This will also be influenced by whether you will study part-time or full-time.

Another direct expense is the fees for the use of certain facilities within the university campus. Similarly, there are the room and board fees, which have to do with the costs of accommodation and meal plans. Of course, in this case, if you live off campus, these amounts are not included in the COA.

Now, you must also consider indirect expenses such as transportation costs. It has to do with parking and transportation to and from the college, but not long-distance trips unless they are organized by the institution.

Similarly, the COA includes expenses for laundry and leisure time, known as living expenses. This includes the payment of your cell phone bill and other minor expenses that you incur regularly.

Finally, so that you know what the annual COA of the college of your dreams is, you should know that indirect expenses for the purchase of books and the use of other campus tools essential for your career are also added.

References

-

“College Affordability and Transparency Explanation Form.” College Affordability and Transparency Explanation Form, https://collegecost.ed.gov/net-price#:~:text=Net%20Price%20is%20the%20amount,not%20have%20to%20pay%20back

-

“Cost of Attendance Explained | College Ave.” College Ave, https://www.collegeavestudentloans.com/blog/what-is-the-cost-of-attendanceKagan, Julia. “Cost of Attendance (COA): Meaning, Overview and FAQ.” Investopedia, Investopedia, https://www.investopedia.com/terms/c/cost-of-attendance.asp

-

“Net Price Calculator.” Net Price Calculator, https://npc.collegeboard.org/app/funeraleducation/start

-

“—.” American College of Healthcare and Technology, https://www.ach.edu/getting-started/financial-aid/net-price-calculator/

-

“Net Price Calculator | Harvard.” Harvard College, https://college.harvard.edu/financial-aid/net-price-calculator

-

“Net Price Calculator – AATI-USA.” AATI-USA, https://www.aati.edu/net-price-calculator/

-

Schaffer, Kristine. “What Is Net Price? The True Cost of College – Savingforcollege.Com.” Savingforcollege.Com, Savingforcollege.com, https://www.savingforcollege.com/article/what-is-the-net-price#:~:text=Net%20price%20is%20the%20college%27s,repay%20or%20earn%20through%20work

-

“What Is Cost of Attendance? – NerdWallet.” NerdWallet, https://www.nerdwallet.com/article/loans/student-loans/what-is-college-cost-of-attendance