Financial necessities can surface unexpectedly, making it crucial to have dependable and cost-effective loan options at hand. For instance, Viva Payday Loans is a swift and streamlined financial solution for individuals needing to manage unforeseen expenses or emergencies.

Viva Payday Loans are distinguished by their speed and accessibility. In contrast to traditional loans, which typically involve a plethora of documentation and bureaucratic hurdles, Viva Payday Loans provide a simplified, hassle-free process. This enables applicants to secure the funds they require within mere hours, eliminating the need for prolonged waiting periods that span days or weeks.

What is Viva Payday Loans and how does it work?

Viva Payday Loans is an online service that acts as a middleman between borrowers and payday loan lenders. Its primary function is to simplify finding short-term payday loans by connecting borrowers with potential lenders.

To get started, borrowers complete an online application. If they meet the eligibility criteria, Viva Payday Loans matches them with a lender from its network. The lender then evaluates the application and decides whether to offer a loan. If the borrower agrees to the terms, the funds are deposited directly into their bank account.

Once the loan is received, the borrower assumes the responsibility of repaying it according to the agreed-upon terms. This streamlined process saves borrowers time and effort by eliminating the need for individual searches, as multiple lenders can be accessed through a single application.

Types of online Viva Payday Loans

Viva Payday Loans offers diverse payday loan options to cater to various financial needs. Here are the different types of payday loans available through Viva Payday Loans:

Instant Online Payday Loans Bad Credit

These loans are specifically tailored for individuals with bad credit or no credit history. Viva Payday Loans understands that past financial difficulties should not hinder access to loans. They work with lenders who consider the borrower’s ability to repay rather than solely relying on credit scores.

Loans with No Job (Quick Online Payday Loans Unemployed)

Viva Payday Loans recognizes that not having a traditional job should not prevent individuals from accessing loans. They offer payday loans for unemployed individuals who can demonstrate alternative sources of income, such as rental income, dividends, social security benefits, or freelance earnings. The loan amount can vary from $100 to $5,000, with up to 24 months of repayment terms.

Quick Cash Loans No Credit Check

Viva Payday Loans provides payday loans without requiring a credit check. This option is suitable for individuals who may not have a credit history or have faced challenges in the past. These loans are typically smaller in amount, ranging from $100 to $2,000.

Fast Payday Loans on Welfare – Temporary Assistance for Needy Families (TANF)

Viva Payday Loans provides loans to individuals who receive TANF benefits. These loans are designed to assist families in need during financial emergencies or unexpected expenses. The loan amounts range from $100 to $2,000, and the application process is quick and convenient.

Guaranteed Payday Loans on Supplemental Security Income (SSI)

Individuals who receive Supplemental Security Income (SSI) can also access payday loans through Viva Payday Loans. These loans are available to adults and children with disabilities or low income. Lenders are willing to extend loan offers based on the borrower’s SSI payments, and the loan amounts are typically small and affordable.

REMEMBER: The specific terms and conditions, loan amounts, and repayment periods may vary depending on the lender and the borrower’s circumstances.

Viva Payday Loans eligibility

To determine if you are eligible to borrow money at Viva Payday Loans, you need to meet only five essential requirements:

- Valid ID: You must possess a valid identification document that verifies your identity and age. This can be a driver’s license, passport, or government-issued ID.

- Age Requirement: You must be 18 years of age or older. This ensures that you are legally allowed to enter into a loan agreement.

- Active Bank Account: You need to have an active bank account. This is necessary for the loan funds to be deposited into and for repayment purposes.

- Proof of Regular Income: You must provide evidence of your regular income. This can be in the form of pay stubs, bank statements, or any other documentation that shows you earn at least $1,000 per month. This requirement ensures that you have the means to repay the loan.

- Proof of Residential Address: You must provide proof of your address. This can be a utility bill, lease agreement, or any official document that displays your name and current address.

How to Apply for a Viva Payday Loan: Step-by-step

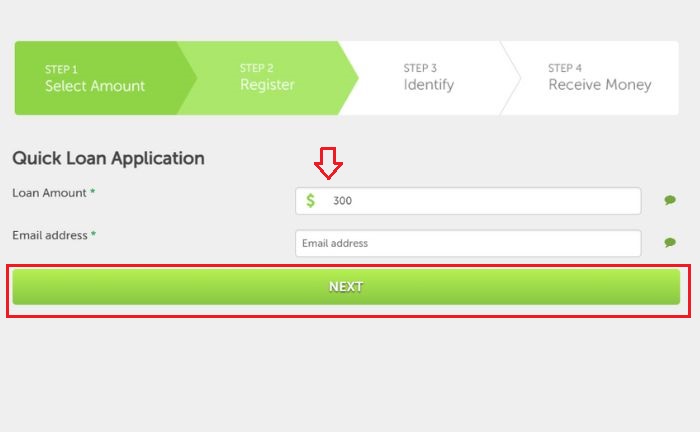

If you are considering applying for a payday loan with Viva Payday Loans, the process is simple and can be completed in only three easy steps.

- Determine the loan amount you require and the repayment term that best suits your financial situation. This will allow you to clearly understand the loan terms before proceeding.

- Provide the necessary information to meet the requirements. This includes your details, such as your name, address, and contact information. You must also provide employment information, such as your employer’s name, contact details, and income. Additionally, you will be asked to provide your bank account information, as this is where the approved funds will be deposited.

- Once you have submitted your application, you must wait for a decision. The good news is that Viva Payday Loans typically provides a decision within 2 minutes, allowing you to determine whether your loan has been approved quickly.

If your loan application is approved, the funds will be available in your bank account next business day. This means you can access the money you need quickly and conveniently.

How much money can I borrow from Viva Payday Loans?

With Viva Payday Loans, you can borrow from $100 to $5000. One of the advantages of Viva Payday Loans is that you can borrow different amounts of money, which are as follows:

- $100

- $200

- $300

- $400

- $500

- $600

- $700

- $800

- $900

- $1,000

- $1,100

- $1,200

- $1,300

- $1,400

- $1,500

- $1,600

- $1,700

- $1,800

- $1,900

- $2,000

- $2,500

- $3,000

- $3,500

- $4,000

- $4,500

- $5,000

How long can Viva Payday Loans be repaid?

You can pay the loan amount in different installments, depending on the amount. For example, as they explain on the Viva Payday Loans website, if you borrow between $100 and $2,000, you can pay in installments of 3 to 12 months. If you apply for between 2,500 and 5,000, you can pay the total in installments of 13 to 24 months.

When considering taking out a loan, you must carefully review and understand the APR (Annual Percentage Rate), which will significantly impact the total cost. The APR represents the annualized interest rate, including the interest charged on the loan and any additional fees or expenses.

Regarding loans, the APR can range from 5.99% to 35.99%. However, the specific APR you receive will depend on various factors, including your creditworthiness, the loan amount, and the repayment term.

Pros and cons of Viva Payday Loans

When considering online payday loans, balancing the benefits and drawbacks is imperative. These are a few of the critical items to take into account:

Pros of Payday Loans USA

- Borrowing within minutes: Unlike traditional loan applications that can take days or several weeks for a loan decision, online payday loans provide near-instant outcomes. Within a few minutes of submitting your application, you’ll know if you are approved and can get the required funds.

- No matter your FICO score: Online payday loan lenders are known for being more flexible regarding credit scores. Some lenders will work with you even if your credit score is low or zero.

- Gain access to lenders most likely to get your application approved: By networking with a well-reputed panel of lenders, online payday loan platforms can match you with lenders most likely to support and provide the loan you need.

Disadvantages of instant online loans

Online payday loans often come with high-interest rates. This is because they are frequently requested by people with low incomes or poor credit scores who may not qualify for loans from mainstream banks. High-interest rates make these loans less affordable than other loan options.

Viva Payday Loans Reviews

There are several sources where people give their opinions and reviews about Viva Payday Loans. For example, on Reddit, there are several threads where some users report high fees and interest rates, while others find the platform helpful in getting quick cash. The same happens with The Chronicle of Southern Maryland. This news source provides information on loan-seeking platforms, which describes Viva Payday Loans as a legitimate option for borrowers with good and bad credit.

However, some users have reported high fees and interest rates, consistent with other websites that provide information on lending platforms, such as Trustpilot, Northwestern Financial Review, or Forty Reviews. Overall, Viva Payday Loans reviews are positive, rating it as a good option for quick loans with 100% transparency.

RECOMMENDATION: Check multiple sources and carefully consider the terms and conditions (of any loan) before accepting it.

References

- “Frequently Asked Questions – Viva Payday Loans.” Viva Payday Loans, https://www.vivapaydayloans.com/faq/.

- “How To Apply For a Payday Loan | Learn How In 3 Easy Steps! (2022).” Viva Payday Loans, https://www.vivapaydayloans.com/how-to-apply/.

She has a degree in Social Communication (graduated in 2010). Arianna has experience in research and writing about universities, credit cards, procedures and insurance, among other topics related to finance in general.

With more than ten years of experience, she has worked in different local and digital media, writing on various issues related to the economy and international politics. She has also coordinated teams of editors, gaining experience in managing groups.

She was born in Merida, Venezuela. She lived in Wausau, Wisconsin, for 5 years, allowing her to learn English. Being bilingual, she also does research and writing in Spanish.

She has taken TOEFL exams and English proficiency tests (passed), so she is qualified to write texts in English.