Whoever has a large or small business looking for a fast and efficient way to insure it against any damage will surely come across the name Next Insurance in their search.

Next Insurance was only formed in 2016 and had been making waves ever since. However, before you run to set up a commercial policy with this insurer, it is essential to know whether it is considered good or bad.

What is Next Insurance’s score?

One of the best ways to define whether a company or insurer is good or bad is by checking its score on various sites and its services. If you are looking for an honest opinion, that is one of the most natural ways to find out.

There are a few bad things to say about Next Insurance. Most popular radio sites about insurance reviews and various insurance companies rate it with a good score.

More specifically, if you average the scores of these pages mentioned above, you get a score of 4.5. Pretty close to perfect service.

On its Facebook social network, where it has more than 79,000 likes and almost 84 thousand followers, it has a nearly perfect score of 4.6 stars, based on the reviews of 485 people.

Its app on Google Play is rated 4.1 stars, where it also has more than 10 thousand downloads, and most of its base scores are five stars.

The next highest, being the amount of about a quarter of those mentioned, are 1 star. The remaining scores are those with lower amounts, ranging between 2,3, and 4. The App Store has given it 4.6 stars, with the highest being five stars and the others being divided between 4, 3, and 1 star.

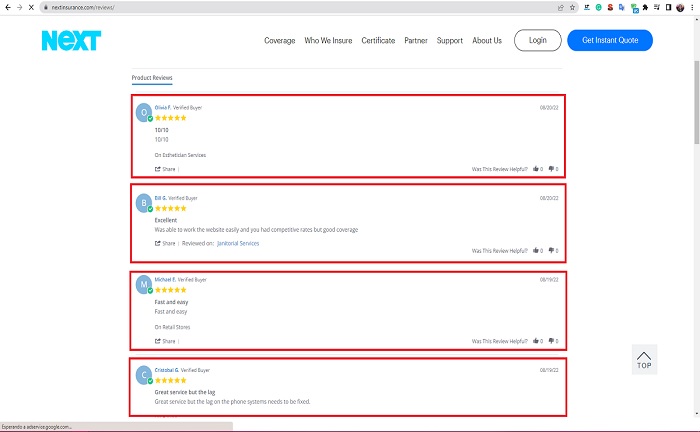

On their page, in the reviews section, they have an almost perfect score of 4.8 stars with over 3600 reviews.

Although you can find a few negative comments in the reviews, they are irrelevant when compared to the positive ones.

Can Next Insurance be considered a good insurer?

It can be considered a very responsible company that complies with all its services offered, considering all the ratings mentioned in the previous section and the comments of its customers.

Therefore, it is safe to qualify it as a good insurance company. So far, there are very few complaints about Next Insurance. In general, the customers seem happy with all their packages and products.

One of the reasons why they have positioned themselves in the market is because of the ease of registration and affiliation to any of their services. You only need to go to their home page to see how much they have to offer to their clients and interested parties.

On their home page, it is possible to get an immediate quote according to each company’s unique needs. Although you must fill out a slightly tedious form, it is the only way to give an accurate quote.

If satisfied with the quote obtained, the interested party can choose to make the purchase immediately and start enjoying their coverage without the need to leave their home or go through a lengthy process.

The estimation of the length of the aforementioned process to acquire the Insurance and not have any more worries about the risks that the interested party’s company runs, including the filling out forms, is calculated to be approximately 10 minutes.

Is it a perfect company?

Defining any company as “perfect” is an almost impossible thing to do. No matter how many years of experience an insurance company has or how well organized they are, there are always several flaws.

Next Insurance is no exception. For its customers, the telephone claims process can be slightly tedious. While decent, one would expect a more efficient one from a company of such magnitude.

On the other hand, its digitalization process is among the best in the market. Although one would expect the positioning of this advantage in a more positive section, for some people who have not quite adapted to it yet, it results in a disadvantage.

Next Insurance makes an interface and applications available to its users and quite intuitive and easy to handle; still, for those who prefer to handle the procedures in a personal way, it is a not-so-positive aspect.

In addition, despite having a catalog with more than 1300 types of companies available for Insurance, some important types are still not included in their list, such as key person insurance.

What other advantages does Next Insurance offer?

Next Insurance’s forte is supporting small businesses. That’s why the enrollment process is so simple. The idea is to offer them Insurance that makes all their growth easier and not more complicated.

Generally, small or new companies find it difficult to get an insurer who wants to cover them because of the higher risk of accidents due to the lack of experience and the small number of workers within them.

Where other insurers refuse to enroll, Next Insurance acts and allows small companies to insure their capital, investments, structure, and workers.

One of its most attractive advantages is obtaining a 10% discount when combining more than one policy. Something not very common in insurance companies, where generally, the more they can charge, the better.

Of course, just like any other insurance company, Next Insurance offers its clients the possibility of obtaining a certificate to corroborate their affiliation with an insurance company.

To obtain it, you must download the application in any of the operating systems available (iOS and Android) and request the download of the certificate. It is obtained immediately even if the affiliation process has just been carried out.