Insurance companies play an essential role in a person’s life or well-being. That is why so many people seek information about the price of contractor insurance, the price of cleaning company insurance, or even how to reduce car insurance and save a little more.

So, having difficulties or knowing that the insurance company is giving you the runaround can waste your time. There are several steps we need to follow or keep in mind in order to avoid this.

Since claims are part of the service, if the service is not well established, you need a secure line to resolve them and accelerate the process if necessary.

Here’s what you can do if your insurer is stalling!

Many times the insurer’s customer service department isn’t capable of or gets confused when making a claim. There are several ways to proceed if this happens regularly:

- Ask your insurer if they need related documents or paperwork to expedite the claim

- Make sure you don’t lose any evidence to support what you are saying in the waiting period for the claim to be resolved

- Get estimates and seek qualified second opinions in case your contractor wants to lower settlement payments in the event of a problem or handling

- Always be aware of how your claim is going, ask for management information, and ask questions of interest about settlement and damage review times (if we are talking about automobile or medical issues)

- If you do not receive a response within the established time frame, you can file a lawsuit and have a lawyer handle the claim for you

Signs to recognize this stagnation

There are some signs that can lead us to recognize when an insurance company tries to stop the claim and in some cases does not give us the money for the insurance.

To recognize this mode of operation, they will first ask you for the documents one by one, without the need to do this as you could present all of them at the same time. Then, on other occasions, they can deny the valid claim that we have.

Likewise, to delay the process, they ask for more unnecessary documents, or in some cases they tell you that they are about to solve the problem when they are not.

They often seek additional statements from service providers related to your medical treatment or property damage claim. On certain occasions, they will not answer your phone calls.

One way they also operate is by providing false information or laws that do not exist to delay the matter in question. It is necessary to check and make sure that the attitudes are correct for the insurer, as recognizing these mistakes will help you save operation time.

Why do insurers delay or engage in anti-consumer tactics?

This is usually done by insurers to pay less money than the amount agreed on in the policy, looking for excuses and delaying the payment process. Some negative measures that insurers can possibly take are:

- Deny or omit all claims from the beginning. This is done as a measure to make them forget about the situation and consider the case as lost

- Delaying the claim as long as possible to settle for a much lower payment than expected, since they know you need the money quickly. Time and patience are critical factors in these cases

- In certain cases, an adjuster or handler did not understand the client’s needs, or even the laws that were clearly applicable to their case.

- Waiting for extended periods of time can sometimes help insurance corporations because evidence can be lost or reduced over time. This often happens in accidents where evidence, photos, or important documents are lost.

- Even after the original claim, another accident may occur and the case may stall due to sabotage. The amount of time it takes can work in favor of the insurance companies

- Allowing time to pass from the date of the incident may give the insurer the right to not have to pay your claim at all. This is why it is essential not to lose evidence and to be informed of the resolution deadlines.

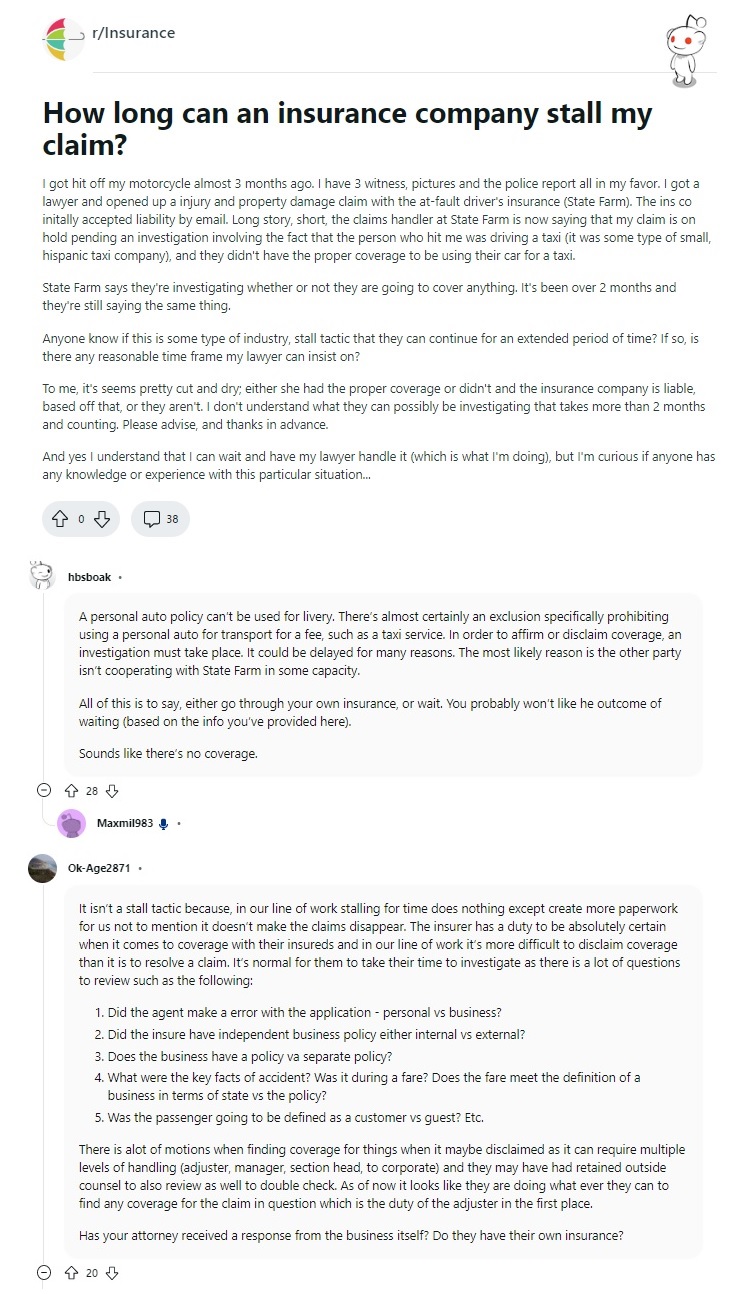

How long can an insurance claim be delayed?

Once you notify your insurance company about a claim, it is their obligation to resolve the problem or find out what is happening.

Variables are always an external factor in these processes. As claimants, we must inform ourselves on how to proceed, considering the nature of the accident, the amount of damage, whether the injured person had a pre-existing condition, and even the amount of insurance coverage available.

Types of Claims Commonly Arising

There are several reasons why a person exercises their claim against the insurer. These insurance companies are known to stall claims no matter what type of problem they are facing, and the claims that may exist are:

- Homeowners’ insurance claims

- Commercial property owners’ insurance claims

- Auto, truck, and motorcycle accident claims

- Hail and storm damage claims

- Personal injury claims

If these claims are valid, the adjusters check and report back to figure out how to proceed. There are so many fraudulent claims that it is common for insurance companies to investigate even the smallest claims to make sure they are only paying settlements for valid cases.

For that reason, evidence of these cases is important and many times the time of availability is exercised by the insurer waiting for police evidence or still trying to locate the people who were at fault in your case.

These are concrete reasons for the stalling of an insurance company in particular cases, and if you do not follow this series of requirements or processes, you could be scammed or misled in the process of payment of your insurance.

References

-

Megna, Michelle. “How To File A Complaint About Your Insurance Company – Forbes Advisor.” Forbes Advisor, https://www.forbes.com/advisor/life-insurance/how-to-file-insurance-company-complaint/.

-

Show, Commercial Claims. What to Do If the Homeowners’ Insurance Company Is Stalling – Insurance Claims Training. YouTube, https://www.youtube.com/watch?v=D0JqVY2KNfI.

María Laura Landino is a journalist who graduated from Boston University with more than four years of experience in the financial sector. He has been responsible for several research papers published by major universities.

Content Manager of allaboutgroup company. You will find me in job and Finance sections.