Has your business ever had trouble applying for a loan? Or do you need assistance in making a big deposit? Then someone working in commercial banking could give you a hand.

But let’s not mix up the terms here. If you are an individual or a small business, you must go to retail banking. On the other hand, commercial banking serves more prominent entities, like large companies, institutions, organizations, and even the government.

If you do not want to be the client but rather an employee in this work branch, then be ready for some significant challenges. Commercial banking has an ongoing workflow, so you have to show your best performance in these demanding job positions.

What Does a Commercial Banking Worker Do?

In a commercial banking job, you would offer a range of services, such as accepting deposits where businesses can safely store their funds in checking or savings accounts or providing loans and credit facilities to help companies finance their operations, expansion, or projects.

You will also facilitate international trade by offering trade financing services like letters of credit. Commercial banks assist businesses with treasury management, including cash flow management and risk mitigation.

On top of that, providing merchant services enables businesses to accept various forms of payments from customers, which is an essential job task.

So the product that you are “selling” is, overall, your service. The way you and the bank generate profits is through interest income and fees charged for the services while supporting economic growth and business activities in the commercial sector.

Not only do you need to have a good relationship with your clients and coworkers, but keeping abreast of changes in the financial industry, including regulatory updates, market trends, and emerging risks that could impact commercial clients, is also essential.

With that said, these jobs do not allow lots of mistakes. It is a demanding career path, so one error can cost you your job, and for commercial banks, it is easy to find someone new.

Benefits of Becoming a Commercial Banking Professional

- Job stability. Commercial banking is a vital part of the financial industry and is generally considered a stable career choice. As we said before, commercial banks need personnel who can provide excellent financial services to businesses.

- Competitive salary and benefits. The payment you receive for working in commercial banks is good and valuable, but you can also obtain benefits such as health insurance, retirement plans, and paid time off.

- Career advancement opportunities. These jobs offer a clear career progression path, with options to move up the ranks within the organization. Employees can advance to positions with greater responsibilities, higher salaries, and more leadership roles.

- Exposure to diverse industries. You will get to meet and interact with multiple businesses across various industries. This exposure provides valuable insights into different sectors of the economy and helps develop a broad understanding of business operations.

- Impact on local businesses. As an employee, you have the opportunity to make a positive impact on local businesses by helping them access capital, manage their finances effectively, and support their growth plans.

List of Jobs in the Commercial Banking Area

You can find yourself in different sectors from a commercial bank, but depending on your abilities and skills, you will be more suitable for specific positions. Some of these are:

- Relationship Manager. One of the primordial roles in commercial banking. It establishes and maintains relationships with commercial banking clients, providing financial advice, managing their accounts, and identifying opportunities for business growth.

- Credit Analyst. This, on the other hand, is the most required. It evaluates the creditworthiness of potential borrowers by analyzing financial statements, which leads to making decisions such as approving loans.

- Loan Officer. Speaking of which, loan officers assess loan applications, negotiate terms and conditions, and manage the loan process from application to disbursement.

- Branch Managers. They oversee the operations of commercial banking branches, including managing staff, customer service, sales targets and ensuring compliance with banking regulations.

- Risk Manager. Whether inside or outside the bank, risk managers are essential to identifying and assessing potential risks associated with commercial banking activities, developing risk management strategies, and implementing controls to mitigate risks.

- Treasury Management Specialist. It Advises commercial banking clients on cash management solutions.

- Portfolio Manager. There needs to be an organization in the bank, and this position allows the employee to manage a portfolio of commercial banking clients, monitor their financial performance, provide ongoing support, and identify cross-selling opportunities.

What Are the Requirements to Work in this Field?

It largely depends on the position you are applying for in a commercial bank. If you want insight into where you can place yourself in the industry, look no further: the U.S. Occupational Outlook Handbook is here to assist you.

You can find this publication on the Bureau of Labor Statistics website. Once in, look for the career or job position you are interested in and receive information regarding the occupation, such as salary, requirements, and job outlook.

Only some occupations are listed on the website, but you can find some similar in the Business and Financial category. If you want to become a professional in this field, you must have:

- Education. Most positions only require a bachelor’s degree in business, finance, or economics, but getting a master’s degree can raise your chances of getting the job.

- Certification. While certification is essential and valuable for improving your job opportunities, it will vary depending on the job. For example, the Chartered Financial Analyst (CFA) certification is helpful for financial analysts.

- Licensing. Some positions may require individuals to hold relevant licenses, such as Series 7 (General Securities Representative) and Series 63 (Uniform Securities Agent State Law).

- Experience. While entry-level positions may not require prior experience, having internships or relevant work experience in banking, finance, or related fields can be advantageous. You can start working in retail banking and keep learning until you feel confident enough to rise for commercial banking.

- Ethical Standards. Working in commercial banking requires integrity and compliance with ethical standards. Banks often conduct background checks and may need candidates to have a clean financial record and follow work ethics, especially in this service-focused job.

- Set of skills. Practical written and verbal communication skills are crucial for interacting with clients and work colleagues. They also must have computer skills to manage software to analyze financial data and trends, create portfolios, and make forecasts.

Job Outlook and Payment

Commercial banking positions are rapidly growing, more so than other occupations. From 2022 to 2032, it is projected for business and financial occupations to have about 911,400 openings each year on average.

You can also expect to receive a reasonable payment from your well-received job; it has presented a median annual wage of $76,850 as of May 2022. So, for example, if you land a job as a loan officer, you can expect to get a median annual wage of around $65,740 (according to the Occupational Outlook Handbook).

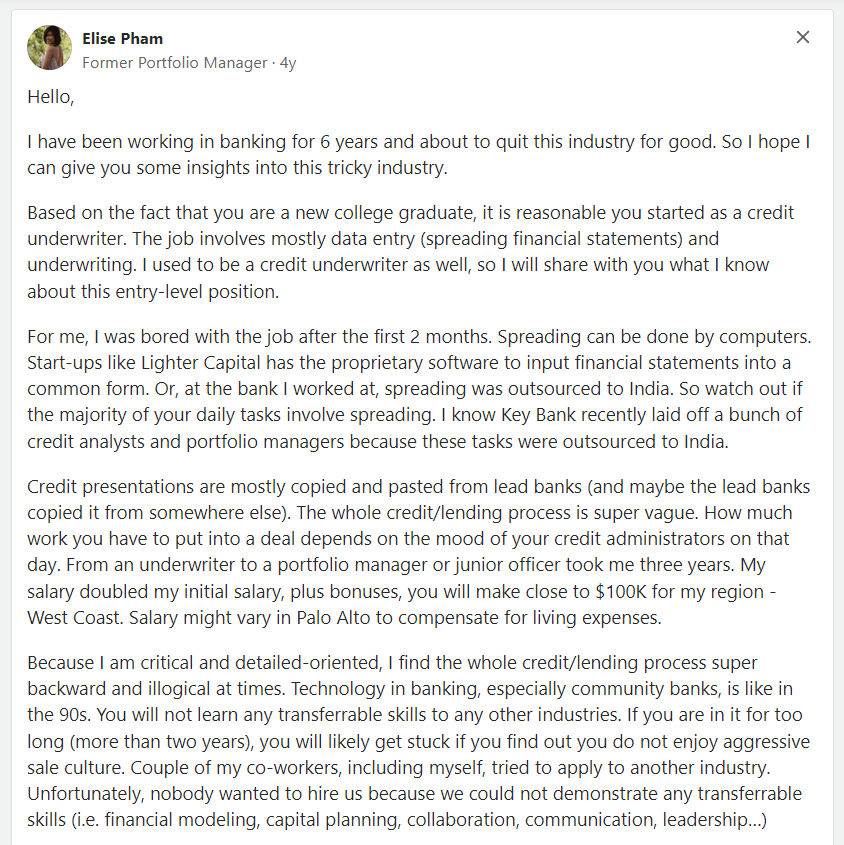

Insights and Experiences from People About this Career

Even though there can be multiple opinions or testimonies of how commercial banking works in the industry, this is an objective statement from someone who has already experienced working in this field and talks about what you will expect when you get into their commercial banking position:

We agree with what she’s saying because commercial banking has heavy and prolonged duties that, with time, can be tiresome. If you like your position, then you will not have any trouble developing and standing out as one of the best.

There are more opinions in that thread, and you can click here (link: https://www.quora.com/Is-commercial-banking-a-good-career-choice-Im-a-recent-college-graduate-and-now-working-as-a-credit-underwriter-for-a-community-bank-in-Palo-Alto-What-can-I-expect-my-salary-growth-to-look-like) to know how people that have worked in this industry have managed themselves.

Start Helping businesses’ Problems as a Commercial Banking Expert

Commercial banking can be a rewarding and promising career path for individuals with the necessary qualifications and skills. But aside from getting a great salary and rising the industry ranks, let’s not forget what is essential: serving businesses and organizations.

You will have the chance to work with a diverse range of clients and contribute to their financial success. You will be satisfied by knowing your clients thrive because of your service.

However, it is essential to note that the banking industry is highly regulated and requires individuals to uphold ethical standards and comply with legal requirements. But if you are interested in finance, have a passion for numbers, and enjoy working with clients, commercial banking is your dream career.