In a role that came onto the scene in the 1990s, the hedge fund manager is a position that is entirely viable today if you’re thinking about your future. Like any career, it requires a certain degree of education and experience, so not just anyone can achieve the position.

It is essential to emphasize the importance of preparation for this position since the person who fulfills this function will be managing funds. Not only their own but also those of many investors who seek optimal results by investing them in a safe portfolio with low risks. All this follows different investment models and market trends.

What should I study to become a hedge fund manager?

Becoming a hedge fund manager requires a bachelor’s degree as well as a basic study of the investment environment. This is undoubtedly one of the most challenging job fields, so it is common for prospective students to wonder if it is difficult to become a hedge fund manager. Still, preparation is necessary to succeed in this market.

In the same way, a hedge fund manager is directly responsible for high-risk and high-reward investments. So making the leap into this field of work is not something that can be done overnight. It also requires a certain degree of critical thinking and good decision-making, something that can be gained through experience or study.

Most of the top hedge fund managers have master’s degrees in finance, economics, mathematics, marketing, or business administration. In many cases they even have PhDs. Therefore, a lack of a university degree will undoubtedly be a limiting factor if you want to make the leap into this world. In the same way, courses to verify your knowledge and skills will always be available.

Best universities to become a hedge fund manager

According to studies conducted by eFinnancialcareers.com, these are some of the universities from which most hedge fund managers graduate:

- Columbia University

- New York University

- University of Pennsylvania

- University of California

- Harvard University

- University of Michigan

- Princeton University

- Yale University

Would it be possible to become a hedge fund manager without a college degree?

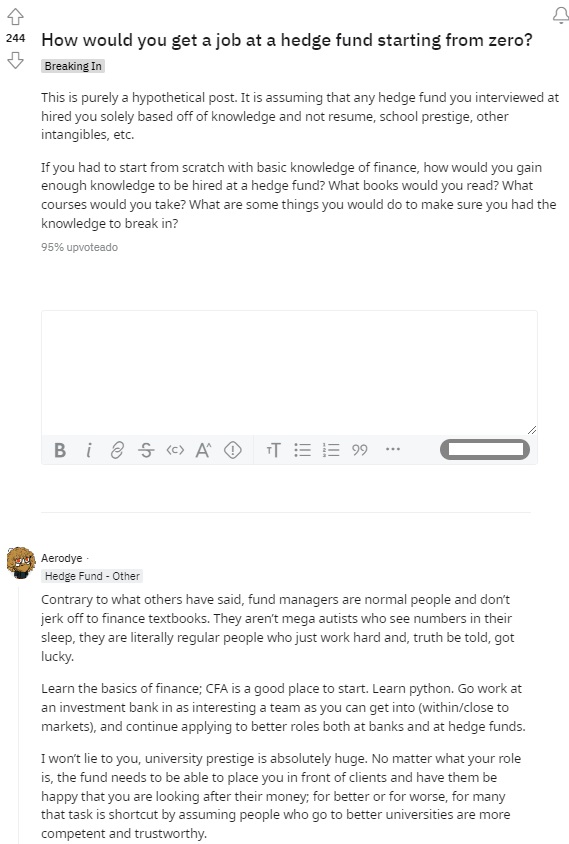

If one thing is clear, it is that in today’s society, many fields no longer place such a high value on a university degree. Although it is worth noting that in the world of fund managers, this is still considered.

It is also becoming increasingly common to find individuals pursuing a chartered financial analyst certification credential, also known as a CFA hedge fund manager. This is a highly valued credential that is earned after passing tests on fund management, ethics, and work leadership.

How to become a hedge fund manager – Step by Step

If you are wondering if becoming a hedge fund manager is easy, let us tell you that it is not. We’ve already talked about education, but just having it doesn’t guarantee anything.

This is a highly coveted position, plus it’s a high-risk market where you’ll always have to adapt.

Get a degree or certification

As mentioned above, the amount of education required for a fund management position will depend on the company you work for. At least one certificate will be necessary if you want to venture into this field. Especially if the city where you live has a lot of competition, as this is what will set you apart from the rest.

Gain experience

Beginning as an intern is the ideal start in this business world. It is recommended to do so in a company where you feel you have the possibility to grow as a fund financial advisor. Although the positions to which you should aspire are those of traders or financial analysts.

If the resumes of hedge fund managers coincide in one thing, it is that almost all of them went through one of these positions. This is because you will gain the necessary experience in these positions to be a true manager.

A hedge fund manager needs key experience in decision-making, trading decisions under pressure, and relationships with investors themselves. So it is advisable to take at least 10 years of experience in different positions related to the investment world before making the leap to a senior position.

Apply for the job

Applying for a job as a hedge fund manager is not something that usually happens as soon as you get your degree. As we have mentioned, on average, to reach this position, a person has to have at least 10 years of experience in the business world.

How much does a hedge fund manager charge in the United States?

In the United States, a hedge fund manager is paid around $62.45 per hour of work. While this is a figure that can vary, your salary is directly related to how you manage your investments. If your investment funds do well, you will do well, and if they don’t, you will struggle.

We are estimating $2498 per week in 40-hour shifts. Although with it being such a demanding job, you might be wondering how many hours hedge fund managers work; well, some managers can do up to 70 hours of work a week. So the number of hours hedge fund managers work will depend on what the job itself is like.

It is very common to directly relate this job to economic power or to ask if hedge fund managers are rich directly. This is due to the movements in the stock market recently. It should be clarified that, although this is not always the case, this is one of the jobs with the highest number of wealthy people.

References

-

“Hedge Fund Managers: Requirements.” Firsthand | The Career-Building Platform, https://firsthand.co/professions/hedge-fund-managers/requirements.

-

Meyer, Jack. “How to Become a Hedge Fund Manager – TheStreet.” TheStreet, TheStreet, https://www.thestreet.com/how-to/how-to-become-a-hedge-fund-manager-15053771.

-

Schweser, Kaplan. “How to Become a Fund Manager: Career Path – Schweser.Com.” CFA, CAIA & FRM Study Materials – Kaplan Schweser, https://www.schweser.com/cfa/blog/career-information/how-to-become-a-fund-manager.

-

“News, Analysis & Comment | Financial Services & Banking Sectors.” Finance Jobs, Banking and Tech Jobs – USA – EFinancialCareers, https://www.efinancialcareers.com/news.