The rise of virtual payment methods such as Venmo or Cash App has revolutionized how we transfer money. Still, it has also given rise to a new threat – virtual fraudsters. The fear of falling prey to such scams is real and has become even more pronounced after the pandemic.

While these “new” forms of payment have made financial transactions more accessible, they have also opened up new avenues for criminals to defraud unsuspecting users. It is, therefore, imperative to exercise caution and stay alert when using digital payment methods.

Users are attracted to these payment platforms due to their simplicity and convenience, but they come with a price. Fraudsters are always on the lookout for opportunities to steal your money.

They know how to exploit the vulnerabilities of these financial applications and lure you into their traps. It is essential to be aware of the risks involved and take appropriate measures to safeguard your finances.

Most common Venmo scams

Apart from familiarizing yourself with the policies and features of Venmo, it is also essential to learn how to protect yourself from scammers. You should be on the lookout for any suspicious transaction, request for money, or message you receive on your account.

It is advisable to set up additional security measures such as two-factor authentication and keep your login credentials safe. By being vigilant and taking appropriate precautions, you can enjoy the benefits of digital payments without falling prey to fraudsters. Among the most common scams, of which Venmo is aware and warns its users on its website, we can distinguish the following:

1. Fake prize or cash reward

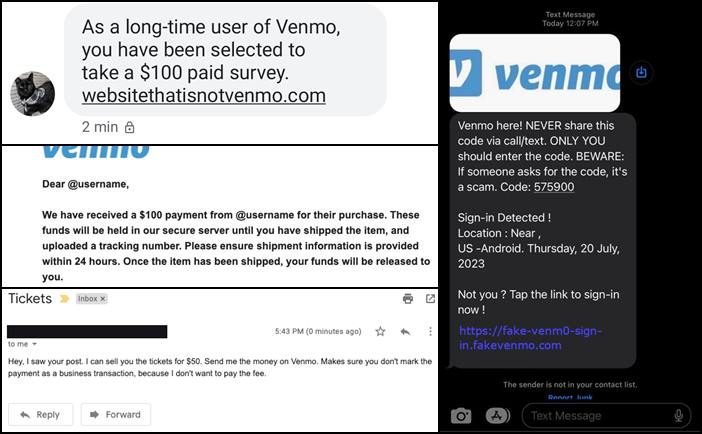

A fake prize or cash reward refers to a scam where scammers send messages or emails claiming that you have won money from Venmo. They may provide a link that asks you to log in to your Venmo account or provide information about your Venmo account. However, these links are usually fake and designed to steal personal information.

To avoid falling for this scam, never enter your Venmo login information outside of the official Venmo website or app. Also, be cautious about providing your Venmo account information on social media, except for official and verified Venmo accounts (@venmo on social media or @venmosupport on Twitter). Venmo will only send emails from an email address ending in “venmo.com.”

2. Call from Venmo

Scammers may pretend to be Venmo support or claim there is an issue with the victim’s account. If you receive suspicious calls, contact Venmo directly to verify the caller’s credibility. They may also ask for access to devices, request verification codes, or ask to make payments to other Venmo accounts.

REMINDER: Venmo will never ask for verification codes, remote device access, or payments to other accounts.

3. Text messages impersonating Venmo

Venmo impersonation scams involve fraudsters who pretend to be Venmo and try to deceive you into revealing personal information or login credentials. Scammers aim to obtain sensitive information or unauthorized access to your Venmo account through these scams.

They might send you a fake Venmo two-factor authentication message asking you to enter a code you received on your phone. Alternatively, they could send you a text message claiming you have won a cash prize on Venmo and request you click a link to log in or provide account information. Remain vigilant and do not disclose any personal information or login credentials to anyone.

4. Prepayment of Goods and Services

Prepaid goods and services scams are a fraudulent tactic used by scammers to trick people into paying for goods or services they will never receive. These scams usually involve an unknown or unfamiliar seller asking for payment before the product or service is delivered. The scammer may use various strategies to convince you to send the money, such as assuring you that the product or service is in high demand or offering discounts.

However, after you make the payment, the scammer disappears without keeping their word. To avoid falling victim to these scams, use caution and only pre-pay with reputable sellers or when following the guidelines outlined in Venmo’s Terms of Use.

5. Romance scams

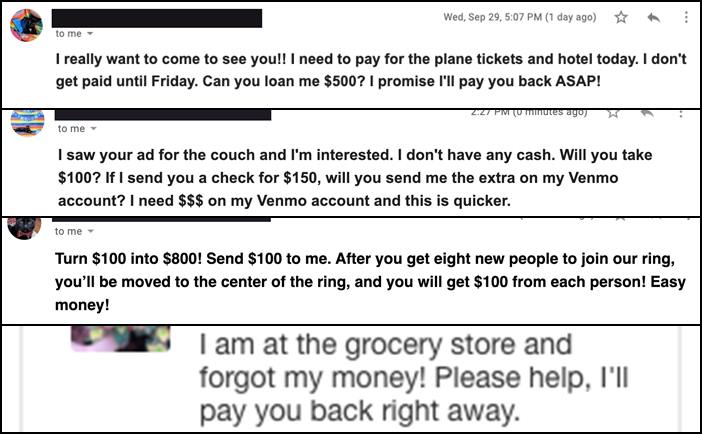

Romance scams are a type of fraud where scammers try to trick people into giving them money or personal information by pretending to be romantically interested in them. They do this by creating fake profiles on dating websites or social media platforms and using counterfeit photos and stories to gain the victim’s trust.

Once they have established a bond, the scammer may ask for money for medical emergencies, legal troubles, or financial difficulties. They may also ask for sensitive information like bank account details or credit card numbers. To avoid falling for a romance scam, it is essential to be careful and take a few safety measures:

- Don’t share personal or financial information with someone you don’t know well.

- Be cautious of people on dating or social media sites who seem suspicious or too good to be true.

- Never send money (like in Cash App) to someone you meet online, especially if they ask for it quickly.

- Do a little research on the person before getting too emotionally or financially invested.

Look out for common warning signs like requests for money, sad stories, or contradictions in their account. Remember, it’s essential to stay safe and protect your personal and financial information. If you think you’ve been the victim of a romance scam, report it to the authorities immediately.

6. Technical support call

Scammers nowadays use a variety of tactics to steal money from unsuspecting victims. One of these tactics is technical support call scams. This type of scam involves imposters posing as representatives of reputable companies’ IT support teams. They may contact potential victims and claim to offer technical assistance. Instead, they aim to deceive and trick people into paying them for their fraudulent services by asking victims to send money to a particular user via Venmo. This type of scam can be challenging to detect, and many people fall victim to it.

To avoid being scammed, contact the official support team of the company directly through their website or search for their official phone number on the internet. This will help avoid any misunderstandings and ensure that you are dealing with genuine representatives of the company.

7. Fake payment confirmation or request for tracking details

Scammers often try to trick people into giving them money or sensitive information by pretending to be from Venmo. They might send you an email or message saying they received a payment through Venmo and ask you to log in or give them details about your Venmo account.

Sometimes, they might even pretend to work for Venmo and ask for a code sent to your phone for verification. These are all fake and dangerous scams! Don’t give out your personal or financial information to anyone claiming to be from Venmo outside of official Venmo channels.

Other fraudsters’ methods to steal your Venmo money

Here are some other examples of possible situations that could be scams:

- Pressure is put on you to wire them money by generating a crisis or event that requires you to make a quick decision.

- Someone else’s new job offer requires that you pay in advance to incorporate or transfer someone else’s money by using your Venmo account or bank account.

- The new property owner wants you to pay a rental deposit for a property with no documentation, keys, etc.

- Scammers impersonate your friends on Venmo, request money like on Cash App, and disappear. They create accounts similar to those of people you know and send you friends or payment requests.

- Paper check scams entail sending you authentic-looking checks and asking for a refund through Venmo. When the check bounces or is fake, you become responsible for the funds, so be careful with unfamiliar checks and verify payments to avoid this scam.

- Watch out for scammers promising quick money through Venmo or social media; be cautious with unsolicited offers, and consult a financial advisor before committing to any opportunities that sound too good to prevent losing money.

@yourrichbff Don’t get duped!!! #money #venmo #scam #lifehack #smart #greenscreen

Social payment apps like Venmo are great for dividing restaurant bills or refunding a friend for a split cost, but they also are targets for consumer scams with messages like:

Hey! I’m at the store but I left my wallet at home. Can you Venmo me like $3.50?

Be careful and protect yourself from Venmo scammers!