Have you ever bought a ticket online and been scammed? If this is not your case, congratulations, as there are thousands of victims due to the sale of tickets through digital platforms or virtual payment methods, such as PayPal or Venmo.

Unfortunately, it is difficult to trust someone unknown to make a purchase or sale online, as scams are just around the corner, and you never know when they may knock on your door (or smartphone). This is why the PayPal and Venmo teams decided to improve the virtual platforms’ security measures (as they did by celebrating Cybersecurity Month) since many have complained about having been scammed through these digital wallets.

As a result of this situation, the online payment system keeps abreast of the mishaps of its users and intends to prevent this type of scam from happening again.

Most frequent PayPal frauds

When purchasing online, several scenarios could leave you feeling dissatisfied and cheated. For instance, you may have made a credit purchase for your favorite video game but never been credited, leaving you without access to the game.

📢 PSA: Concert ticket scam alert. PayPal and @venmo send money features can help you stay safe. #TrustTheWayYouPay @Humphreytalks pic.twitter.com/6hGLbmAy5J

— PayPal (@PayPal) October 19, 2023

Alternatively, you may have received a receipt confirming your purchase, but the item you paid for never arrived. Sometimes, you may have ordered a book but received a CD instead, which is not what you wanted. Similarly, you may have bought an item described as “new” but received a used item instead, which is not what you expected.

Another common scenario is purchasing three items on this electronic payment method but only receiving two, which is a clear case of incomplete delivery. On the other hand, your item may have suffered significant damage during shipping, making it unusable or unsightly.

In some cases, you may find that the item is missing parts, and the seller did not inform you about it, which can be a frustrating experience. Lastly, you may have purchased an item described as authentic but received an imitation, which is not only dishonest but can also be dangerous in some instances.

Transactions that PayPal does not cover

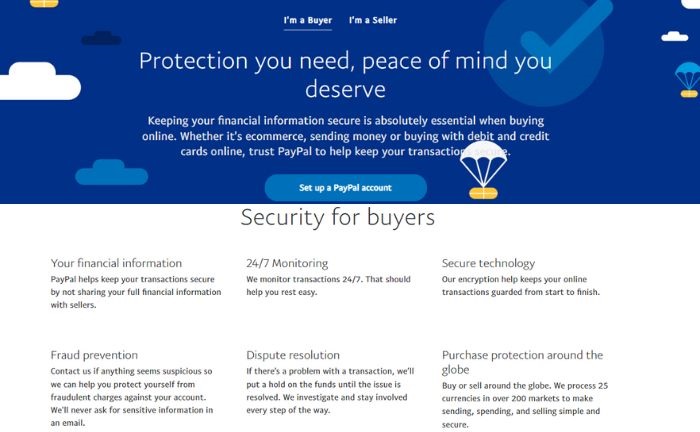

PayPal offers (like Venmo) a Buyer Protection Policy to ensure the confidence and security of its users when making online purchases. However, certain transactions are not covered by this policy. PayPal’s protection applies primarily to online purchases. Therefore, in-person transactions, such as in physical stores, are not protected.

PayPal does not cover transactions related to the purchase of vehicles or real estate, industrial machinery, travel tickets, or items such as gift cards or prepaid cards, as PayPal cannot guarantee the security of the transfer of these items.

The same is true for items that violate PayPal’s policies because if it occurs with transactions such as selling prohibited or illegal items, it will not be covered by the Buyer Protection Policy.

If the seller provides an accurate and detailed description of the item and the item matches what has been advertised, PayPal will not offer Buyer Protection coverage.

What if the PayPal merchant is a scammer? 5 tips to avoid fraud

If the PayPal merchant is a scammer, you must be cautious and take appropriate steps to protect yourself.

- Research the merchant: Research the merchant thoroughly before engaging in any transaction. Check their reputation, reviews, and ratings from other buyers. Look for any red flags or negative feedback.

- Verify their PayPal account: Make sure the merchant has a verified PayPal account. This can provide some level of assurance that they are a legitimate seller.

- Use secure payment methods: Use secure payment methods offered by PayPal, such as PayPal Buyer Protection. This can help protect you from fraudulent transactions. Also, be cautious when sharing personal information. Provide only personal data on secure websites with an HTTPS connection. Avoid sharing sensitive information over public Wi-Fi networks.

- Be cautious of overpayment requests: If the merchant asks you to send them the difference in payment because they claim to have overpaid, be wary. This could be a common scam tactic. Do not proceed with any refund or wire transfer without verifying the legitimacy of the situation.

- Report suspicious activity: If you suspect that the PayPal merchant is a scammer or engaging in fraudulent activities, report the incident to PayPal immediately. They have measures in place to investigate and take action against fraudulent accounts.

@exotiqickssneaker Why I use PayPal goods and services for my sneaker business. . . . . . #shoes #shoegame #reseller #sneakerhead #content #fyp #viral #shoereel #tips #sneakerbot #hustle #freegame #explore #explorepage #learn #hustle #hustler #exotiqicks

If you suspect that someone has accessed your account without your permission, it is crucial to promptly notify PayPal so that they can take the necessary steps to safeguard your interests. If you come across a questionable charge, mistake, or any unauthorized activity on your account, you can report it within 180 days from the date it appears on your statement.

You will not be held responsible for these unauthorized transactions if you meet the eligibility criteria. You have the choice to report such incidents via the Resolution Center or by getting in touch with PayPal Customer Service. Once a claim is initiated, they will thoroughly investigate the transaction and try to resolve the issue satisfactorily.

Reimbursement will be processed if it is determined that the transaction was indeed unauthorized or erroneous. Before making a report, you must verify that the transaction is not something you may have overlooked, such as a Venmo recurring payment or a subscription to a magazine.