PayPal prides itself on providing users with robust security and protection 24/7. The company founded in 1998 has invested heavily in advanced fraud detection systems that constantly monitor activity on the platform. Sophisticated algorithms and machine learning models allow the PayPal application to detect even the most subtle anomalies or early signs of fraudulent behavior in real time.

The platform created by Ken Howery requires strong passwords to log into an account and implements multi-factor authentication features to verify users’ identities. Computerized login attempts are examined for irregularities that could indicate a compromised account. Meanwhile, customer service representatives can assist users with trouble logging in.

Once a purchase is made, PayPal’s tracking features allow users to track shipments anytime. Sellers are also monitored to ensure that items are shipped on time and as described. If there are delays or discrepancies, PayPal works quickly to resolve disputes. Customers can rest easy knowing that PayPal has their back when problems arise with orders.

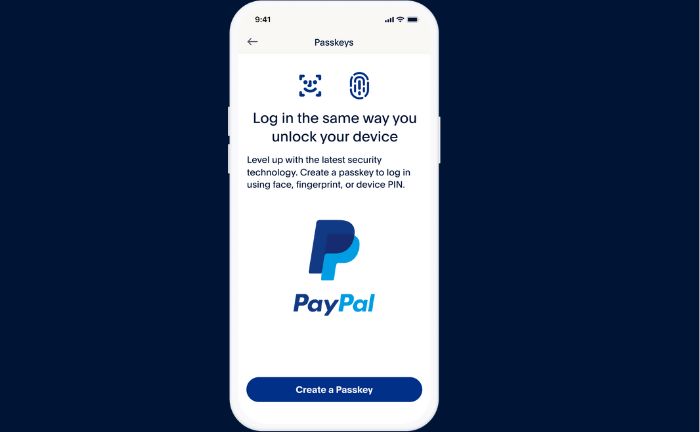

Passkeys: A new security measure

Security is a top priority for the money transfer platform. Financial transactions are fraught with risk, but the economical strives to mitigate it as much as possible through diligent fraud protection, login security, and shipment visibility.

The goal is to make the checkout process seamless and worry-free for users. The electronic payments system is committed to staying at the forefront of security science to maintain the trust of hundreds of millions of account holders worldwide.

https://www.tiktok.com/@paypal_uganda/video/7277500119912680709?q=paypal%20passkey&t=1695488095097

One of their new security methods is PayPal Passkeys, a new passwordless authentication method developed by the financial company. It allows PayPal users to log in without entering a traditional password. Instead, Passkeys uses biometric data such as fingerprints or facial recognition to unlock devices securely.

Each Passkey is linked to the user’s biometric identity and device. They are stored securely on the user’s own device and are never shared with websites or applications. This ensures that each Passkey can only be used by its rightful owner.

By eliminating the need to memorize or manage passwords, PayPal Passkeys streamline the login process for users. At the same time, its biometric and device binding provides enhanced security compared to traditional passwords. In case of a lost or stolen device, no one else can access accounts, even if the device is unlocked.

With Passkeys, PayPal aims to provide its users with frictionless access and increased protection against identity theft and online fraud. As the first central platform to adopt passwordless authentication on a large scale, PayPal hopes to set a new industry standard that offers convenience and security for digital payments and online accounts.

Pay it Safe

Under the hashtag “#PayItSafe,” the financial entity shared that “151 million Americans have been victims of fraud, but that shouldn’t stop you from shopping online!” as they said on the official PayPal Twitter account, encouraging people not to stop shopping online due to the amount of fraud millions of people have suffered at the hands of scammers.

In fact, as embarrassed as he was to admit it, one man was encouraged to say that he had once been scammed online. However, after two weeks, he recovered the money after the multinational financial technology company returned it to him.

However, many people claim that there is no way to recover that money if a transaction is done wrong through this virtual wallet. In fact, you can read comments on social networks or review sites, such as Reddit. On this website, you can find a wealth of opinions and experiences about the security and usefulness of PayPal as a financial application.

The threat of financial scams is always there – but so is PayPal. #PayItSafe pic.twitter.com/P67z0x5z5A

— PayPal (@PayPal) September 16, 2023

Some users have shared positive experiences, praising PayPal for its effectiveness in preventing fraudulent transactions and acting as a middleman between online merchants and bank accounts. However, other users have expressed concerns about account limits, document requests, and the potential for legal action from the financial app.

To get better currency conversion and customer service, some users suggest using alternative platforms like Revolut, Stripe, TransferWise, or virtual debit cards. The platform’s high fees, difficulty in reaching customer service, and inaccessible deposited funds have also been reported. In general, opinions on the safety of PayPal vary and depend on each user’s specific needs and preferences.