Car loans can be your best friend or become your worst enemy; keep in mind that some car loan terms can be longer than others. It is critical to make sure you can make the full payment on the vehicle before you end up paying more than you thought you would for the car you borrowed. In these situations, you are vulnerable to falling for less-than-sincere offers from dealers.

When you’ve been paying for your car for a long time and it starts to break down or simply no longer meets your needs, it’s normal to seek alternatives to buy a new one. Before trusting that the dealer will take care of the entire debt, be sure to read the fine print in the contract. You should also consider insurance for your new car.

Will a dealer pay for my purchase no matter what I owe?

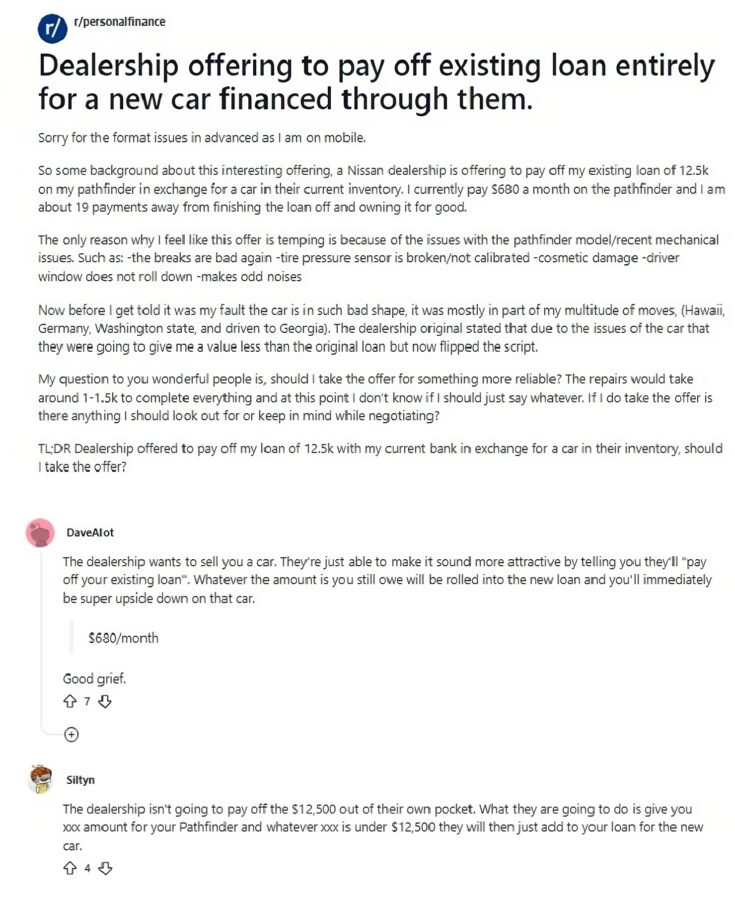

In dealer terms, this is called “reverse lending” and refers to the fact that the credit on your vehicle is now greater than the current value of the vehicle. This tells them that you have negative equity and the common solution is that they will include a difference between the value of your current vehicle that you want to trade in and the loan balance of the new car.

It may seem complex and this is where many customers decide to trust the dealership completely by assuring them that they will pay off the debt. However, it doesn’t work that way. What happens in these cases is that the dealer will add the negative equity to your next car loan.

When you think about it, this can be a problem considering you have negative equity, and eventually, you will have more debt and a new vehicle. In other words, you end up paying off the old debt along with the new debt.

Which dealers will pay for my purchase no matter what I owe?

Once you understand how these “offers” work, it doesn’t seem unreasonable for dealers to offer them to their customers. It can be a good alternative to trade in your old vehicle, although you should design a good payment plan to avoid continuing to collect debts.

[wpdatatable id=438]Of course, there are some dealerships willing to offer this alternative. There are even Car Dealerships that accept Bad Credit and Repos.

Imperial Cars

One of the dealerships that can become your ally for this is Imperial Cars, you can find them in Providence RI, Worcester MA, Framingham, Franklin, Milford, MA, and Mendon, MA. You can choose from their three dealerships and their six brands, Imperial Chrysler, Dodge Jeep Ram, Imperial Chevrolet, and Imperial Ford.

It is one of the alternatives for those who want to buy a new vehicle, but have bad credit or to trade in a car even with negative equity. Through the website, you will find the steps to follow and can contact an agent to find out the trade-in rates.

Suburban

Suburban buys new vehicles, accepts trade-ins even if your debt is more than the value of the car, and will finance even if you haven’t paid off the loan in full. You can go to any of their locations or contact them at 248 – 230 – 2223 to learn more about the procedure.

Auto Outlet of PA

The process with Auto Outlet of PA is simple because you can do it online, once you enter their online page go to the “Sell Your Car” option and fill out the form. In the end, they will tell you the requirements that you must give to the dealer the day you take your car.

Premier GMC

In this case, we’re talking about a local General Motors company based in Rittman, Ohio, although it also covers Wooster, Medina, and Wadsworth. It is a company with an interesting catalog of different new and used vehicles available for sale. At the dealership, you also find excellent professionals willing to help you fix your current vehicle.

Within the service options, they have vehicle exchange: when you need auto financing, the professionals work together to offer you the best payment plan, adjusting to your possibilities. They will always be willing to pay for your operation regardless of the debt that exists.

Think twice before you choose this option

The desire to buy a new car is common when the one you have no longer meets your needs, however, if you have outstanding debts and negative equity, you should take some considerations before taking the risk. Making a study of the dealership you will choose is essential for your decision to be the right one.

- Evaluate the financing you will have, how much money you will have to pay for the remainder of the loan, and how much you can afford. You should also evaluate if there is any down payment and the total amount

- Compare prices from different dealerships to decide the one that best fits your current needs. This comparison can be done through the online pages of the dealerships you have chosen

- Make an evaluation of your credit score and know how much the new purchase will affect you. If you don’t have good credit, it may not be the right time to trade in

- Know the trade-in price of your vehicle, you need to have a rough estimate of the value of the car you will trade in

- Be clear about the type of vehicle you want to purchase and whether it will meet all of your current needs

As you can see, the process of choosing is not as easy as deciding to do it, you need to consider all the factors that will be in play to avoid eventual financial inconvenience. You must forget about the idea that the old debt will be suspended; on the contrary, you will add it to the new one. Are you prepared to pay for it? Ask yourself all the necessary questions before starting the process of change.

References

-

Cars, Imperial. “Upside Down on Your Trade – We Can Help Get You Out of Your Trade and Into a New Vehicle.” New & Used Car Dealer Mendon | Imperial Cars, https://www.imperialcars.com/LP/upside-down-sales-event.htm

-

“Reddit – Dive into Anything.” Reddit – Dive into Anything, https://www.reddit.com/r/personalfinance/comments/aty6ow/dealership_offering_to_pay_off_existing_loan/

-

“Sell Cars.” Auto Outlet of PA, https://www.autooutletofpa.com/used.cfm/page/sell-your-car/

-

Troy, Suburban Ford. “Bad Credit Auto Financing | Suburban Ford of Troy.” New Ford and Used Car Dealer Serving Troy | Suburban Ford Of Troy, https://www.suburbanfordoftroy.com/financing/bad-credit-auto-financing.htm